To raise revenues during the recent recession, the governor of your state proposed the following taxation formula. T() = 0.0010.5, where i represents total annual income earned by an individual in dollars and T(i) is the income tax rate as a fraction of total annual income. (Thus, for example, an income of $50,000 per year would be taxed at about 22%, while an income of double that amount would be taxed at about 32%.)t (a) Calculate the after-tax (net) income N(i) an individual can expect to earn as a function of income i. N(i) = (b) Calculate an individual's marginal after-tax income at income levels of $300,000 and $500,000. (Round your answer to four decimal places.) N'(300,000) = $ per dollar income N'(500,000) = $ x per dollar income (c) At what income does an individual's marginal after-tax income become negative? (Round your answer to two decimal places.) 2$ What is the after-tax income at that level? (Round your answer to two decimal places.) $ What happens at higher income levels? (Round your answer to two decimal places.) At any income level above , an individual begins to pay back more than $1 for each additional $1 earned, so his or her net income begins to drop. (d) What do you suspect is the most anyone can earn after taxes?t (Round your answer to two decimal places.) N = $

To raise revenues during the recent recession, the governor of your state proposed the following taxation formula. T() = 0.0010.5, where i represents total annual income earned by an individual in dollars and T(i) is the income tax rate as a fraction of total annual income. (Thus, for example, an income of $50,000 per year would be taxed at about 22%, while an income of double that amount would be taxed at about 32%.)t (a) Calculate the after-tax (net) income N(i) an individual can expect to earn as a function of income i. N(i) = (b) Calculate an individual's marginal after-tax income at income levels of $300,000 and $500,000. (Round your answer to four decimal places.) N'(300,000) = $ per dollar income N'(500,000) = $ x per dollar income (c) At what income does an individual's marginal after-tax income become negative? (Round your answer to two decimal places.) 2$ What is the after-tax income at that level? (Round your answer to two decimal places.) $ What happens at higher income levels? (Round your answer to two decimal places.) At any income level above , an individual begins to pay back more than $1 for each additional $1 earned, so his or her net income begins to drop. (d) What do you suspect is the most anyone can earn after taxes?t (Round your answer to two decimal places.) N = $

Chapter12: The Partial Equilibrium Competitive Model

Section: Chapter Questions

Problem 12.10P

Related questions

Question

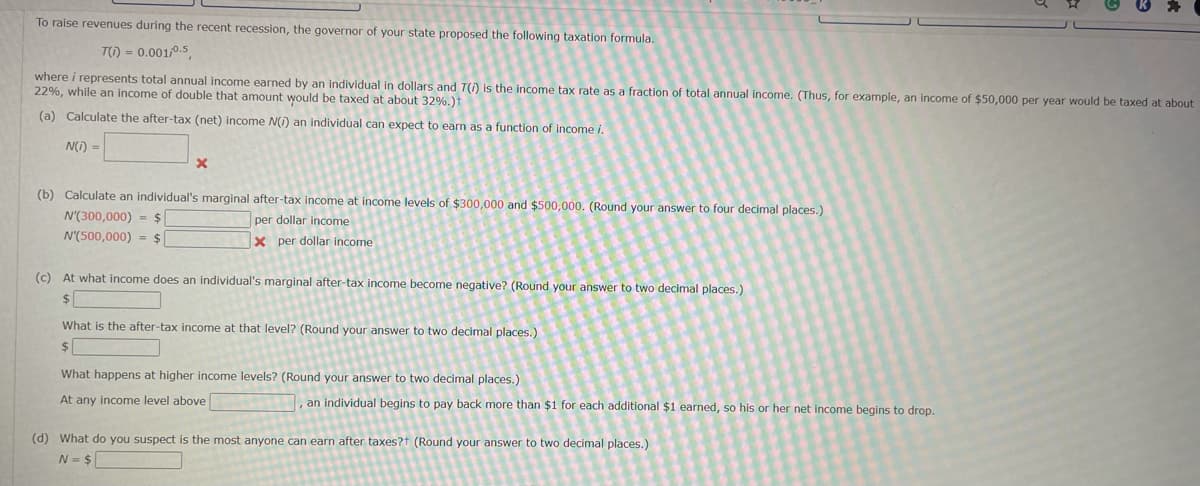

Transcribed Image Text:To raise revenues during the recent recession, the governor of your state proposed the following taxation formula.

T() = 0.001/0.5,

where i represents total annual income earned by an individual in dollars and T(i) is the income tax rate as a fraction of total annual income. (Thus, for example, an income of $50,000 per year would be taxed at about

22%, while an income of double that amount would be taxed at about 32%.)t

(a) Calculate the after-tax (net) income N(i) an individual can expect to earn as a function of income i.

N(i) =

(b) Calculate an individual's marginal after-tax income at income levels of $300,000 and $500,000. (Round your answer to four decimal places.)

N'(300,000) = $

per dollar income

N'(500,000) = $

X per dollar income

(c) At what income does an individual's marginal after-tax income become negative? (Round your answer to two decimal places.)

$

What is the after-tax income at that level? (Round your answer to two decimal places.)

$4

What happens at higher income levels? (Round your answer to two decimal places.)

At any income level above

, an individual begins to pay back more than $1 for each additional $1 earned, so his or her net income begins to drop.

(d) What do you suspect is the most anyone can earn after taxes?t (Round your answer to two decimal places.)

N = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you