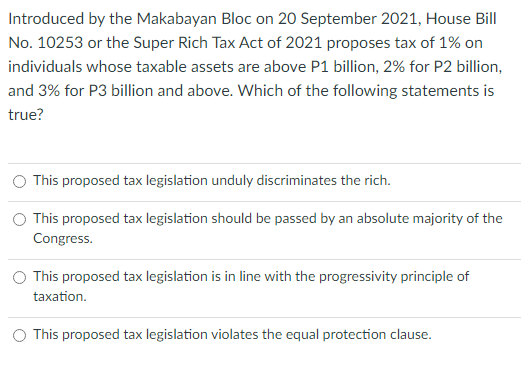

Introduced by the Makabayan Bloc on 20 September 2021, House Bill No. 10253 or the Super Rich Tax Act of 2021 proposes tax of 1% on individuals whose taxable assets are above P1 billion, 2% for P2 billion, and 3% for P3 billion and above. Which of the following statements is true? This proposed tax legislation unduly discriminates the rich. This proposed tax legislation should be passed by an absolute majority of the Congress. This proposed tax legislation is in line with the progressivity principle of taxation. O This proposed tax legislation violates the equal protection clause.

Introduced by the Makabayan Bloc on 20 September 2021, House Bill No. 10253 or the Super Rich Tax Act of 2021 proposes tax of 1% on individuals whose taxable assets are above P1 billion, 2% for P2 billion, and 3% for P3 billion and above. Which of the following statements is true? This proposed tax legislation unduly discriminates the rich. This proposed tax legislation should be passed by an absolute majority of the Congress. This proposed tax legislation is in line with the progressivity principle of taxation. O This proposed tax legislation violates the equal protection clause.

Chapter3: Economic Decision Makers

Section: Chapter Questions

Problem 3.10P

Related questions

Question

Transcribed Image Text:Introduced by the Makabayan Bloc on 20 September 2021, House Bill

No. 10253 or the Super Rich Tax Act of 2021 proposes tax of 1% on

individuals whose taxable assets are above P1 billion, 2% for P2 billion,

and 3% for P3 billion and above. Which of the following statements is

true?

This proposed tax legislation unduly discriminates the rich.

O This proposed tax legislation should be passed by an absolute majority of the

Congress.

This proposed tax legislation is in line with the progressivity principle of

taxation.

O This proposed tax legislation violates the equal protection clause.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning