To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Daun purchased the stereo systems for $190,000 and sold them for $300,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 2 percent of sales. During the year, she paid $3,320 cash to replace a defective tuner. Required Prepare an income statement and statement of cash flows for Daun's first year of operation. (Statement of Cash Flows only, items to be deducted must be indicated with a negative amount.)

To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Daun purchased the stereo systems for $190,000 and sold them for $300,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 2 percent of sales. During the year, she paid $3,320 cash to replace a defective tuner. Required Prepare an income statement and statement of cash flows for Daun's first year of operation. (Statement of Cash Flows only, items to be deducted must be indicated with a negative amount.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 79BPSB

Related questions

Question

Answer full question.

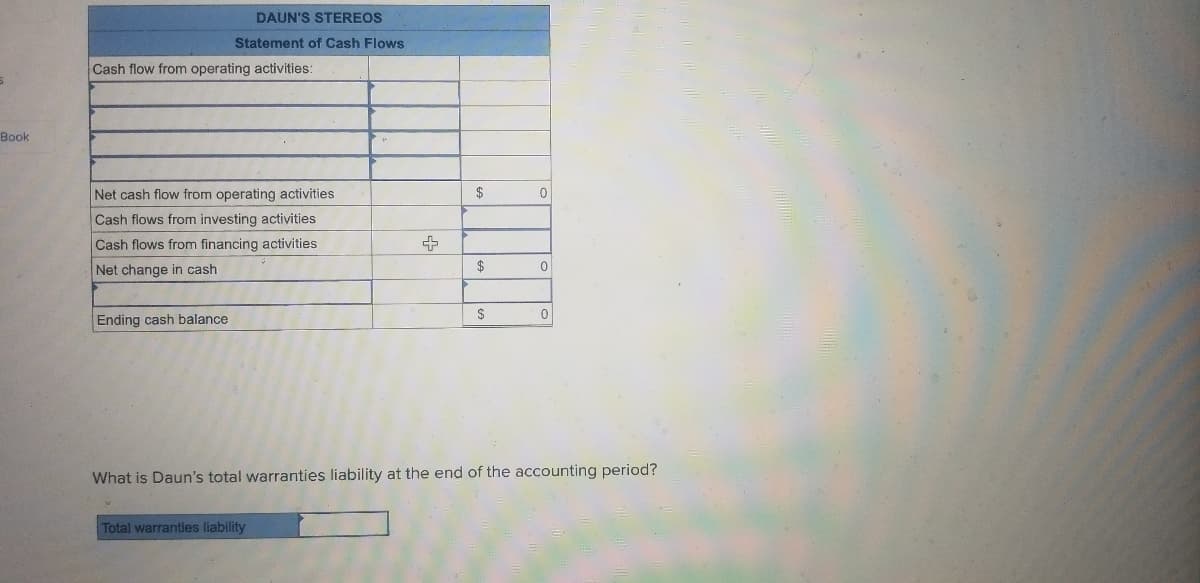

Transcribed Image Text:DAUN'S STEREOS

Statement of Cash Flows

Cash flow from operating activities:

Book

Net cash flow from operating activities

$

Cash flows from investing activities

Cash flows from financing activities

Net change in cash

$

Ending cash balance

What is Daun's total warranties liability at the end of the accounting period?

Total warranties liability

Transcribed Image Text:Saved

Help

Save & Exit

Submit

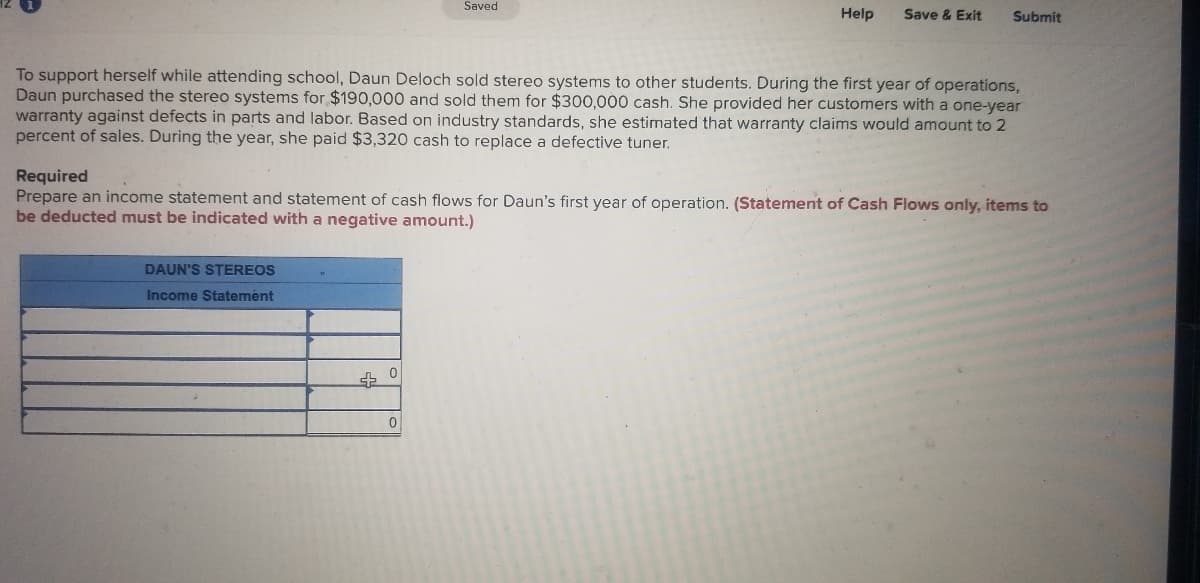

To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations,

Daun purchased the stereo systems for $190,000 and sold them for $300,000 cash. She provided her customers with a one-year

warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 2

percent of sales. During the year, she paid $3,320 cash to replace a defective tuner.

Required

Prepare an income statement and statement of cash flows for Daun's first year of operation. (Statement of Cash Flows only, items to

be deducted must be indicated with a negative amount.)

DAUN'S STEREOS

Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning