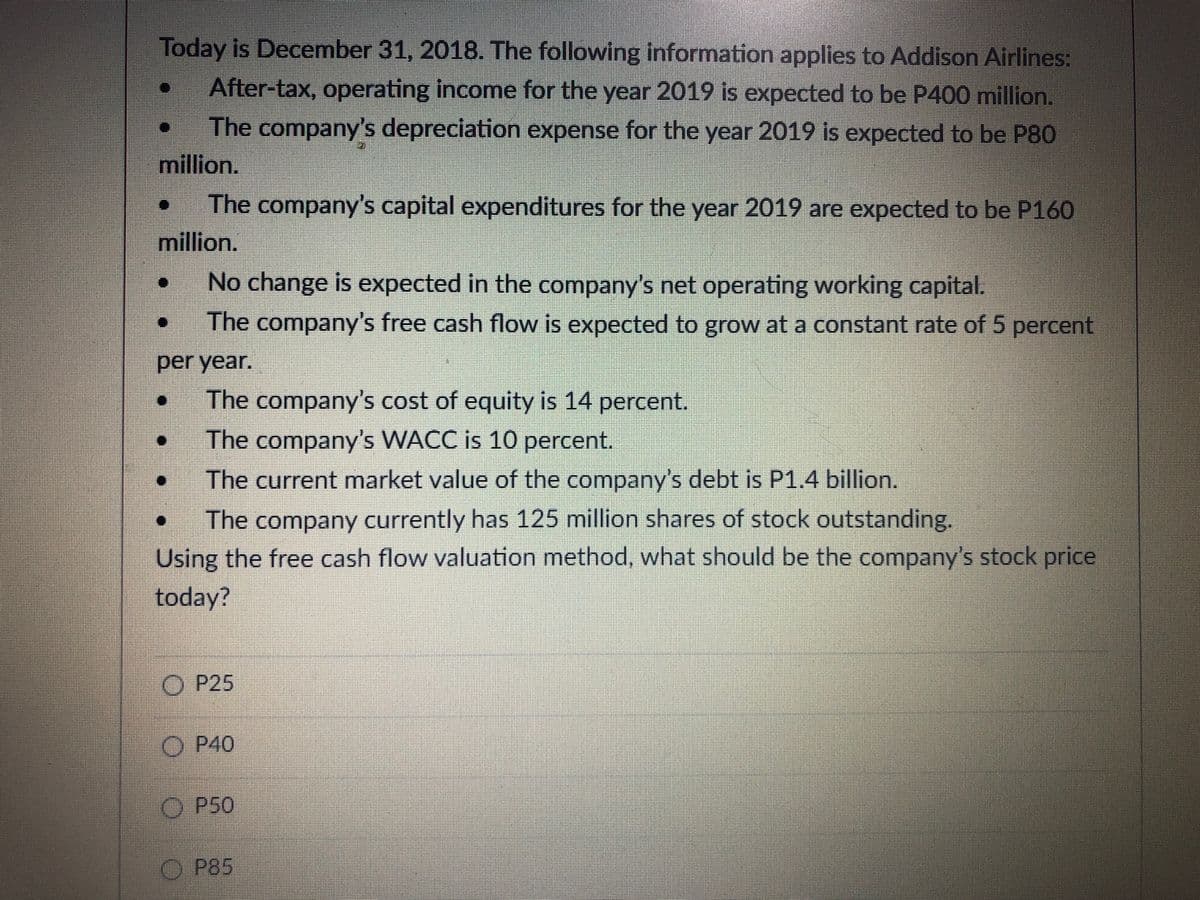

Today is December 31, 2018. The following information applies to Addison Airlines: After-tax, operating income for the year 2019 is expected to be P400 million. The company's depreciation expense for the year 2019 is expected to be P80 million. The company's capital expenditures for the year 2019 are expected to be P160 million. No change is expected in the company's net operating working capital. The company's free cash flow is expected to grow at a constant rate of 5 percent per year. The company's cost of equity is 14 percent. The company's WACC is 10 percent. The current market value of the company's debt is P1.4 billion. The company currently has 125 million shares of stock outstanding. Using the free cash flow valuation method, what should be the company's stock price today? P25 P40 P50 P85

Today is December 31, 2018. The following information applies to Addison Airlines: After-tax, operating income for the year 2019 is expected to be P400 million. The company's depreciation expense for the year 2019 is expected to be P80 million. The company's capital expenditures for the year 2019 are expected to be P160 million. No change is expected in the company's net operating working capital. The company's free cash flow is expected to grow at a constant rate of 5 percent per year. The company's cost of equity is 14 percent. The company's WACC is 10 percent. The current market value of the company's debt is P1.4 billion. The company currently has 125 million shares of stock outstanding. Using the free cash flow valuation method, what should be the company's stock price today? P25 P40 P50 P85

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Today is December 31, 2018. The following information applies to Addison Airlines:

After-tax, operating income for the year 2019 is expected to be P400 million.

The company's depreciation expense for the year 2019 is expected to be P80

million.

The company's capital expenditures for the year 2019 are expected to be P160

million.

No change is expected in the company's net operating working capital.

The company's free cash flow is expected to grow at a constant rate of 5 percent

per year.

The company's cost of equity is 14 percent.

The company's WACC is 10 percent.

The current market value of the company's debt is P1.4 billion.

The company currently has 125 million shares of stock outstanding.

Using the free cash flow valuation method, what should be the company's stock price

today?

O P25

O P40

O P50

O P85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning