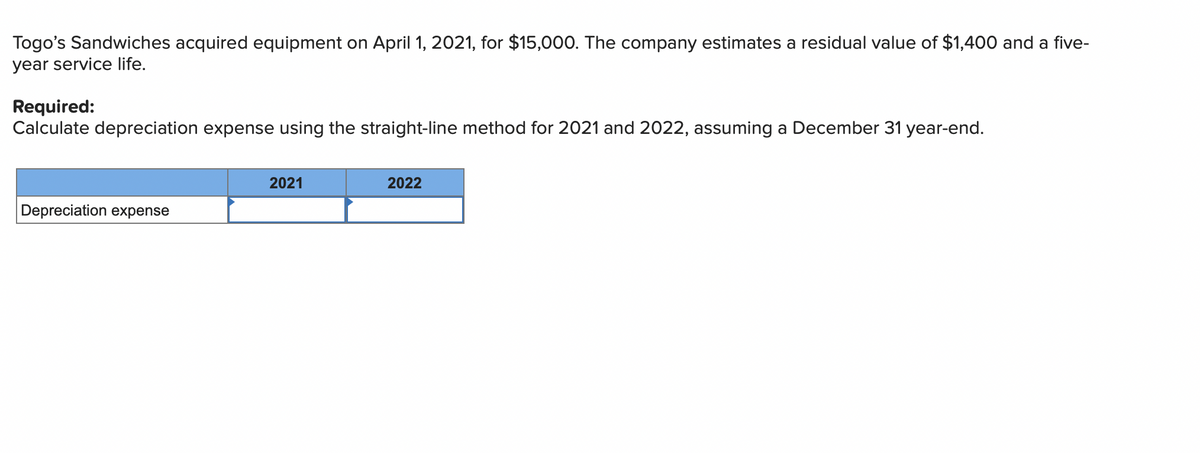

Togo's Sandwiches acquired equipment on April 1, 2021, for $15,000. The company estimates a residual value of $1,400 and a five- year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a December 31 year-end. 2021 2022 Depreciation expense

Q: Cutter Enterprises purchased equipment for $93,000 on January 1, 2021. The equipment is expected to…

A: Depreciation expense refers to the fall in the value of the asset due to passage of time, wear and…

Q: Citi Company purchased factory equipment on March 10, 2019. The company accountant revealed the…

A: Depreciation is a demunition [reduction] in the value of an asset on account…

Q: ABC Company purchased equipment on January 1, 2018 for ₱9,000,000. The equipment had a useful life…

A: Working Note;

Q: Alteran Corporation purchased office equipment for $1.5 million at the beginning of 2019. The…

A: Double Declining Method of Depreciation: 2* Straight Line depreciation rate* Book Value Straight…

Q: Togo’s Sandwiches acquired equipment on April 1, 2021, for $18,000. The company estimates a residual…

A: For the year 2021: 9 months is computed from April to December

Q: Togo's Sandwiches acquired equipment on April 1, 2021, for $16,500. The company estimates a residual…

A: Definition: Straight-line depreciation method: The depreciation method which assumes that the…

Q: Sorter Company purchased equipment for $380,000 on January 2, 2019. The equipment has an estimated…

A: Depreciation on an asset can be calculated using different methods: Straigh line method Sum of years…

Q: El Tapitio purchased restaurant furniture on September 1, 2021, for $45,000. Residual value at the…

A: Depreciable costs = Cost of asset - Residual value = $45,000 - $6,000 = $39,000.

Q: On September 30, 2018, Bricker Enterprises purchased a machine for OMR 11,000. The estimated service…

A: Depreciation is the decrease in value of an asset due to various reasons like wear and tear,…

Q: Muggsy Bogues Company purchased equipment for $212,000 on October 1, 2020. It is estimated that the…

A: Depreciation: Depreciation is a method of reducing the capitalized cost of long-lived operating…

Q: Steele Company purchased on January 1, 2020, a new machine for $2,100,000. The new machine has an…

A: Sum-of-the-years'-digits = 1+2+3+4+5+6+7+8+9 = 45 years

Q: Kansas Enterprises purchased equipment for $77,000 on January 1, 2021. The equipment is expected to…

A: Formula:

Q: Tasty Subs acquired a delivery truck on October 1, 2021, for $25,800. The company estimates a…

A: Depreciation using straight line method = (Cost of the asset - salvage value) / Asset useful life…

Q: Winsey Company purchased equipment on January 2, 2019, for $700,000. The equipment has the following…

A: Depreciation is an accounting technique for distributing a tangible or fixed asset's cost over its…

Q: Birkey Company purchased equipment on January 1, 2020, at a total cost of $99,000. The machinery’s…

A: 1- Calculation of Depreciation for the year 2020 using double declining method Depreciation as per…

Q: A machine was purchased at a cost of $9,600,000 on June 30, 2020. The machine’s estimated salvage…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: Kansas Enterprises purchased equipment for $75,000 on January 1, 2021. The equipment is expected to…

A: Solution: Depreciation rate - SLM = 1/5 = 20% Depreciation rate - Double declining balance method =…

Q: Cutter Enterprises purchased equipment for $99,000 on January 1, 2021. The equipment is expected to…

A: An accelerated depreciation method of calculation is called the double-declining balance (DDB)…

Q: On January 2, 2021, Oriole Enterprises reports balances in the Equipment account of $34,100 and…

A: Given: Purchase cost as stated in equipment account=$34,100 Accumulated Depreciation=$8,660 Book…

Q: On January 1, 2020, JJ Company purchased factory equipment for P3,000,000. Estimated useful life of…

A: Cost of equipment (C) = P3000,000 Useful life = 5 Years Depreciation rate (d) = (1/5)*1.50…

Q: Nash Company purchased equipment for $199,200 on October 1, 2020. It is estimated that the equipment…

A: Sum of years digit method is method of computation of depreciation for fixed assets. It is totalled…

Q: On March 31, 2021, Canseco Plumbing Fixtures purchased equipment for $38,000. Residual value at the…

A:

Q: Sorter Company purchased equipment for $320,000 on January 2, 2019. The equipment has an estimated…

A: The computation of depreciation expense for 2019 varies from each of the given methods which is…

Q: On January 1, 2021, Canseco Plumbing Fixtures purchased equipment for $30,000. Residual value at the…

A: 1. Annual depreciation = (Cost of the equipment - Residual value) / Total life of the assets =…

Q: Skysong Company purchased equipment for $199,200 on October 1, 2020. It is estimated that the…

A: Hi Student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: A company purchased machinery for $10,800,000 on January 1, 2019. The machinery has a useful life of…

A: Answer Sheet: Formula Sheet:

Q: rple Company acquires an office building at a cost of $1,000 on January 1, 2021. The building…

A: Step 1 Any upward increases in the value of capital assets are held in a revaluation surplus, which…

Q: Foster Corporation purchased a new machine for its assembly process on August 1, 2020. The cost of…

A: Compute straight-line depreciation rate.

Q: On April 1, 2021, Robert Sporting Goods Company purchased some new machinery for $3 300 000 to…

A: LUnder this method, depreciation is calculated consideringh the remaining life of asset.

Q: Pier Exports purchased equipment on January 1, 2018, at a cost of $600,000. The company estimates…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets. The…

Q: Cutter Enterprises purchased equipment for $72,000 on January 1, 2021. The equipment is expected to…

A: "Since you have asked multiple questions, we will solve one question for you. If you want any…

Q: On January 1, 2015, Indians Corporation bought a factory equipment for 924,000 salvage value was…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: A company purchased factory equipment on April 1, 2021 for $128,000. It is estimated that the…

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: On January 1, 2021 the Hogan Manufacturing Company purchased a machine for $250,000. The company…

A: Depreciation is an expense charged against the income for the wear and tear of the equipment .…

Q: On April 1, 2020, an entity purchased machinery for P3,300,000. The machinery has an estimated…

A: Fixed assets that are used in a business will undergo certain wear and tear due to continuous…

Q: Rehearsal Corporation purchased equipment on Jan 1, 2020, for $250,000. The equipment was expected…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Kansas Enterprises purchased equipment for $80,500 on January 1, 2021. The equipment is expected to…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On July 1, 2020, E. Cristobal Corp. acquired a service vehicle or P200,000. It is to be depreciated…

A: The initial cost of the asset is capitalised in the books rather than expensing it in the period of…

Q: Skysong Company purchased equipment for $199,200 on October 1, 2020. It is estimated that the…

A: Depreciation is the value of all fixed assets reduce gradually over time due to Wearing out,…

Q: Bonita Company purchased a new plant asset on April 1, 2020, at a cost of $738,000. It was estimated…

A: Double declining depreciation rate = Straight line depreciation rate x 2 = (100/20 years) x 2 = 10%…

Q: Tasty Subs acquired a delivery truck on October 1, 2021, for $25,800. The company estimates a…

A: Depreciation is the allocation of cost of asset over the useful life of the asset. There are several…

Q: Citi Company purchased factory equipment on March 10, 2019. The company accountant revealed the…

A: Double declining depreciation rate = Straight line depreciation rate x 2 = (100/8 years) x 2 = 25%

Q: On January 1, 2020, ABC Company purchased factory equipment for 3,000,000. Estimated useful life of…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage ,…

Q: Nash Company purchased equipment for $199,200 on October 1, 2020. It is estimated that the equipment…

A: ''Since you have posted a question with multiple parts, we will solve the first three sub-parts for…

Q: Freedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $48,000. The…

A: The question is related to the Depreciation Accounting. In the given question Depreciation is…

Q: Tasty Subs acquired a delivery truck on October 1, 2021, for $21,600. The company estimates a…

A: Depreciable cost = Cost - Residual value = $21,600 - $1,200 = $20,400

Q: Kansas Enterprises purchased equipment for $74,500 on January 1, 2021. The equipment is expected to…

A: Solution: Annual depreciation using SLM = (Cost - Residual value) / Useful life

Q: Tasty Subs acquired a delivery truck on October 1, 2021, for $21,500. The company estimates a…

A: Depreciation: It refers to a gradual decrease in the fixed asset’s value because of obsolescence,…

Q: A Company purchased equipment on January 1, 2019 for AED 70,000. It is estimated that the equipment…

A: Depreciation is an expense for consuming the fixed assets of the entity. The depreciation method…

Q: Coronado Company purchased equipment for $222,800 on October 1, 2020. It is estimated that the…

A: a.

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.

- Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.Depreciation Methods On January 1, 2019, Loeffler Company acquired a machine at a cost of $200,000. Loeffler estimates that it will use the machine for 4 years or 8,000 machine hours. It estimates that after 4 years the machine can be sold for $20,000. Loeffler uses the machine for 2,100 and 1,800 machine hours in 2019 and 2020, respectively. Required: Compute depreciation expense for 2019 and 2020 using the (1) straight-line, (2) double-declining-balance, and (3) units-of-production methods of depreciation.