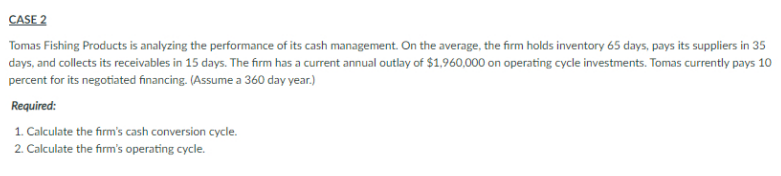

Tomas Fishing Products is analyzing the performance of its cash management. On the average, the firm holds inventory 65 days, pays its suppliers in 35 days, and collects its receivables in 15 days. The firm has a current annual outlay of $1,960,000 on operating cycle investments. Tomas currently pays 10 percent for its negotiated financing. (Assume a 360 day year.) Required: 1. Calculate the firm's cash conversion cycle. 2. Calculate the firm's operating cycle.

Tomas Fishing Products is analyzing the performance of its cash management. On the average, the firm holds inventory 65 days, pays its suppliers in 35 days, and collects its receivables in 15 days. The firm has a current annual outlay of $1,960,000 on operating cycle investments. Tomas currently pays 10 percent for its negotiated financing. (Assume a 360 day year.) Required: 1. Calculate the firm's cash conversion cycle. 2. Calculate the firm's operating cycle.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 22E: Future Value of a Single Cash Flow Jenkins Products has just been paid $25,000 by Shirley...

Related questions

Question

I. Provide an answer with solution

Transcribed Image Text:CASE 2

Tomas Fishing Products is analyzing the performance of its cash management. On the average, the firm holds inventory 65 days, pays its suppliers in 35

days, and collects its receivables in 15 days. The firm has a current annual outlay of $1,960,000 on operating cycle investments. Tomas currently pays 10

percent for its negotiated financing. (Assume a 360 day year.)

Required:

1. Calculate the firm's cash conversion cycle.

2. Calculate the firm's operating cycle.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT