Tony, Mary, and Tegan are partners with capital balances of $200,000, $120,000, and $120,000, respectively. Profits and losses are shared in a 3:1:1 ratio. Tegan decided to withdraw and the partnership revalued its assets. The value of inventory was decreased by $40,000 and the value of land was increased by $80,000. Tony and Mary then agreed to pay Tegan $180,000 for her withdrawal from the partnership. Required: Prepare a schedule to identify capital account balances of Tony and Mary after Tegan's withdrawal under the: A. B. bonus method. goodwill method. 3

Tony, Mary, and Tegan are partners with capital balances of $200,000, $120,000, and $120,000, respectively. Profits and losses are shared in a 3:1:1 ratio. Tegan decided to withdraw and the partnership revalued its assets. The value of inventory was decreased by $40,000 and the value of land was increased by $80,000. Tony and Mary then agreed to pay Tegan $180,000 for her withdrawal from the partnership. Required: Prepare a schedule to identify capital account balances of Tony and Mary after Tegan's withdrawal under the: A. B. bonus method. goodwill method. 3

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1EB: The partnership of Michelle, Amal, and Maureen has done well. The three partners have shared profits...

Related questions

Question

Transcribed Image Text:Question #4:

to pay $910,666.67

h

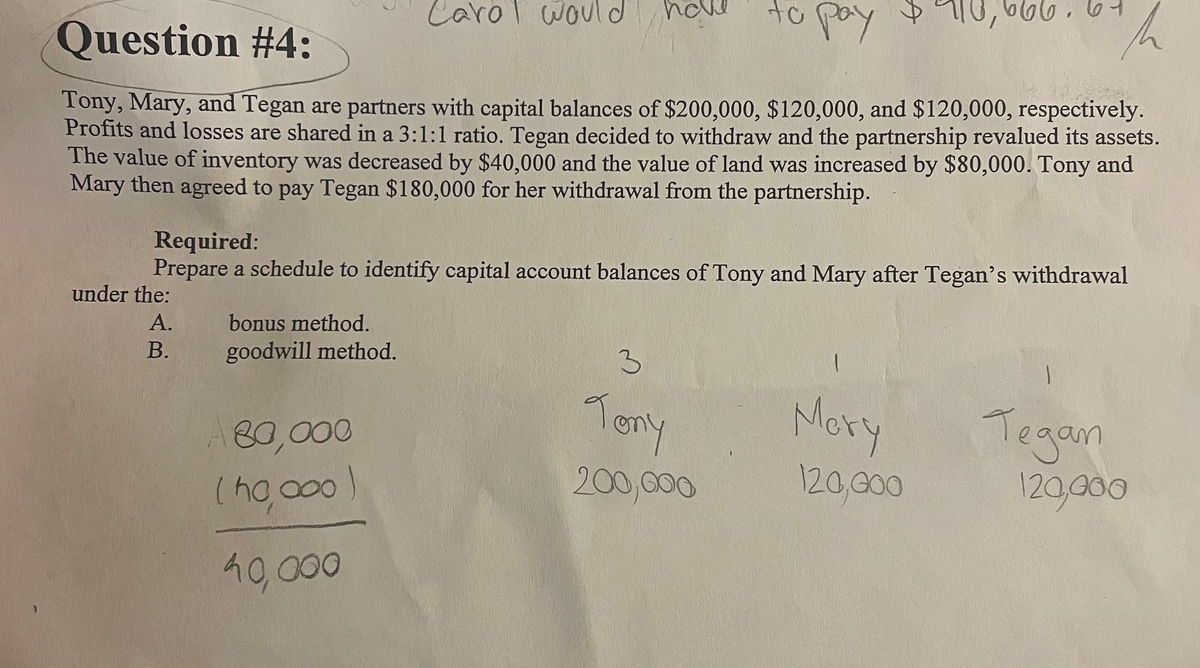

Tony, Mary, and Tegan are partners with capital balances of $200,000, $120,000, and $120,000, respectively.

Profits and losses are shared in a 3:1:1 ratio. Tegan decided to withdraw and the partnership revalued its assets.

The value of inventory was decreased by $40,000 and the value of land was increased by $80,000. Tony and

Mary then agreed to pay Tegan $180,000 for her withdrawal from the partnership.

Required:

Prepare a schedule to identify capital account balances of Tony and Mary after Tegan's withdrawal

under the:

A.

B.

bonus method.

goodwill method.

Carol would

80,000

(ho,000)

40,000

3

Tony

200,000

Mery

120,000

Tegan

120,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,