Tools manufactures wide variety of tools and accessories. One of its more popular items is a cordless power mandisaw. Each handisaw sells for $42. Wesley expects the following unit sales: January February March April May 3,400 3,600 4,100 3,900 3,300 Wesley's ending finished goods inventory policy is 20 percent of the next month's sales Suppose each handisaw takes approximately 0.75 hour to manufacture, and Wesley pays an average labor wage of $18 per hour. D Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.50 each. The company has ending direct materials Inventory policy of 25 percent of the following month's production requirements. Materials other than the plastic components total $4.50 per handisaw. Manufacturing overhead for this product includes $75,000 annual fixed overhead (based on production of 27,000 units) and $1.20 unit variable manufacturing overhead. Wesley's selling expenses are 7 percent of sales dollars, and administrative expenses are fixe at $18,000 per month.

Tools manufactures wide variety of tools and accessories. One of its more popular items is a cordless power mandisaw. Each handisaw sells for $42. Wesley expects the following unit sales: January February March April May 3,400 3,600 4,100 3,900 3,300 Wesley's ending finished goods inventory policy is 20 percent of the next month's sales Suppose each handisaw takes approximately 0.75 hour to manufacture, and Wesley pays an average labor wage of $18 per hour. D Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.50 each. The company has ending direct materials Inventory policy of 25 percent of the following month's production requirements. Materials other than the plastic components total $4.50 per handisaw. Manufacturing overhead for this product includes $75,000 annual fixed overhead (based on production of 27,000 units) and $1.20 unit variable manufacturing overhead. Wesley's selling expenses are 7 percent of sales dollars, and administrative expenses are fixe at $18,000 per month.

Chapter7: Budgeting

Section: Chapter Questions

Problem 14PA: Total Pops data show the following information: New machinery will be added in April. This machine...

Related questions

Question

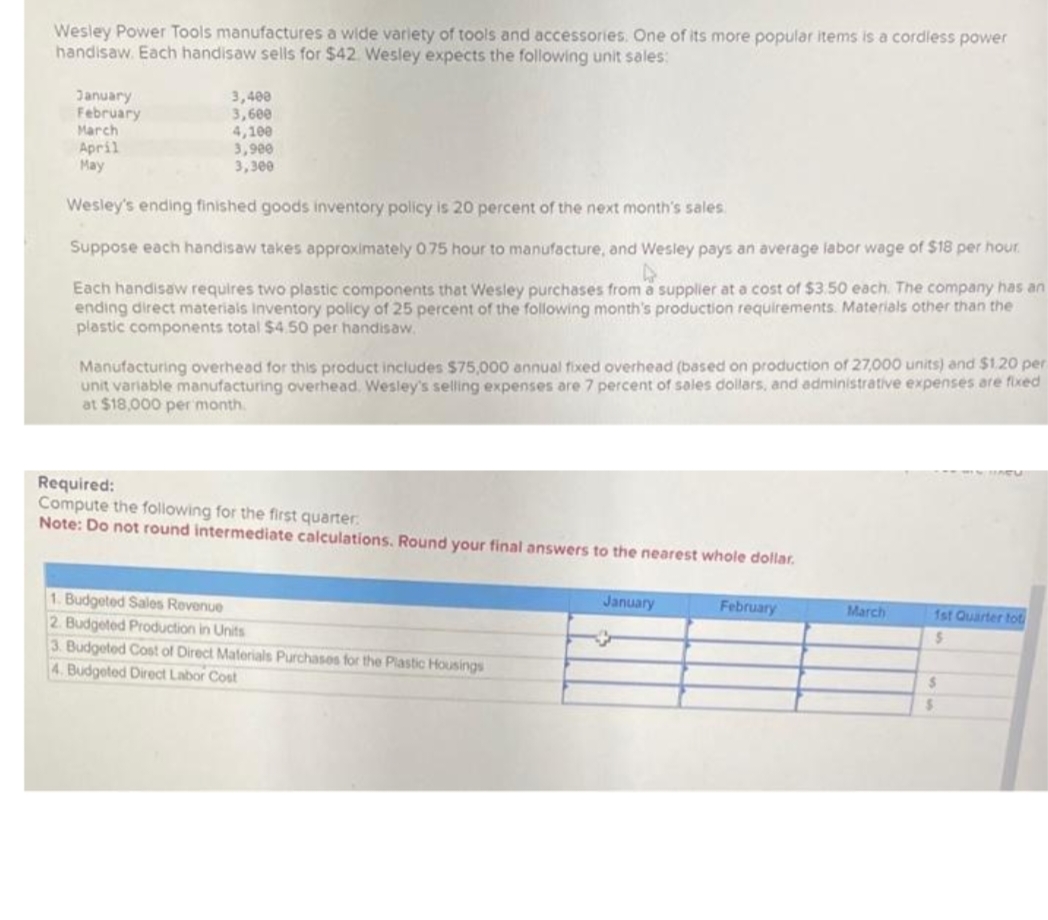

Transcribed Image Text:Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular items is a cordless power

handisaw. Each handisaw sells for $42. Wesley expects the following unit sales:

January

February

March

April

May

3,400

3,600

4,100

3,900

3,300

Wesley's ending finished goods inventory policy is 20 percent of the next month's sales.

Suppose each handisaw takes approximately 0.75 hour to manufacture, and Wesley pays an average labor wage of $18 per hour.

Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.50 each. The company has an

ending direct materials Inventory policy of 25 percent of the following month's production requirements. Materials other than the

plastic components total $4.50 per handisaw.

Manufacturing overhead for this product includes $75,000 annual fixed overhead (based on production of 27,000 units) and $1.20 per

unit variable manufacturing overhead. Wesley's selling expenses are 7 percent of sales dollars, and administrative expenses are fixed

at $18,000 per month.

Required:

Compute the following for the first quarter.

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar.

1. Budgeted Sales Revenue

2. Budgeted Production in Units

3. Budgeted Cost of Direct Materials Purchases for the Plastic Housings

4. Budgeted Direct Labor Cost

January

February

March

1st Quarter tot

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,