TPPY investment in research and development has given it a techn advantage in manufacturing a previously difficult to make electrom firm is now experiencing rapid growth due to the advantages it no competitors. It estimates growth rates of 12% next year, 10% in th 9% the year after that. It believes that its competitors would have processes by the fourth year, at which time it expects its growth ra constant rate of 4% thereafter. Its last dividend was $1.80 per shar equity is 15%. What is the value of the stock today Po?

TPPY investment in research and development has given it a techn advantage in manufacturing a previously difficult to make electrom firm is now experiencing rapid growth due to the advantages it no competitors. It estimates growth rates of 12% next year, 10% in th 9% the year after that. It believes that its competitors would have processes by the fourth year, at which time it expects its growth ra constant rate of 4% thereafter. Its last dividend was $1.80 per shar equity is 15%. What is the value of the stock today Po?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter5: Probability: An Introduction To Modeling Uncertainty

Section: Chapter Questions

Problem 18P: The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin...

Related questions

Question

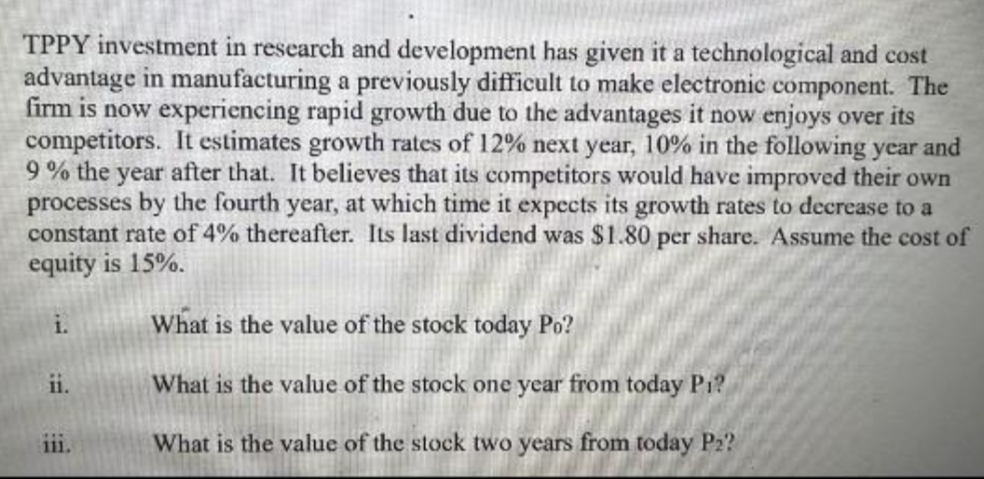

Transcribed Image Text:TPPY investment in research and development has given it a technological and cost

advantage in manufacturing a previously difficult to make electronic component. The

firm is now experiencing rapid growth due to the advantages it now enjoys over its

competitors. It estimates growth rates of 12% next year, 10% in the following year and

9% the year after that. It believes that its competitors would have improved their own

processes by the fourth year, at which time it expects its growth rates to decrease to a

constant rate of 4% thereafter. Its last dividend was $1.80 per share. Assume the cost of

equity is 15%.

1.

ii.

111.

What is the value of the stock today Po?

What is the value of the stock one year from today P₁?

What is the value of the stock two years from today P₂?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning