Transactions and financial statements The trustees of the Ketzel Park Special Revenue Fund approved the following budget for calendar year 2022: Estimated Revenues $260,000 140,000 $400,000 General admissions fees Admissions fees (big cat zoo) Appropriations Parks and recreation salaries 280,000 Parks and recreation supplies 40,000 60,000 380,000 Parks and recreation cat food Budgeted Increase in Fund Balance $20.000 Transactions and events for calendar year 2022 were as follows: 1. Recorded the approved budget for the year. 2. Collected $250,000 in general admissions fees and $160,000 in big cat zoo admissions fees during the year. 3. Ordered supplies for $38,000.

Transactions and financial statements The trustees of the Ketzel Park Special Revenue Fund approved the following budget for calendar year 2022: Estimated Revenues $260,000 140,000 $400,000 General admissions fees Admissions fees (big cat zoo) Appropriations Parks and recreation salaries 280,000 Parks and recreation supplies 40,000 60,000 380,000 Parks and recreation cat food Budgeted Increase in Fund Balance $20.000 Transactions and events for calendar year 2022 were as follows: 1. Recorded the approved budget for the year. 2. Collected $250,000 in general admissions fees and $160,000 in big cat zoo admissions fees during the year. 3. Ordered supplies for $38,000.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Please help me with my mistakes! (Pictures attached)

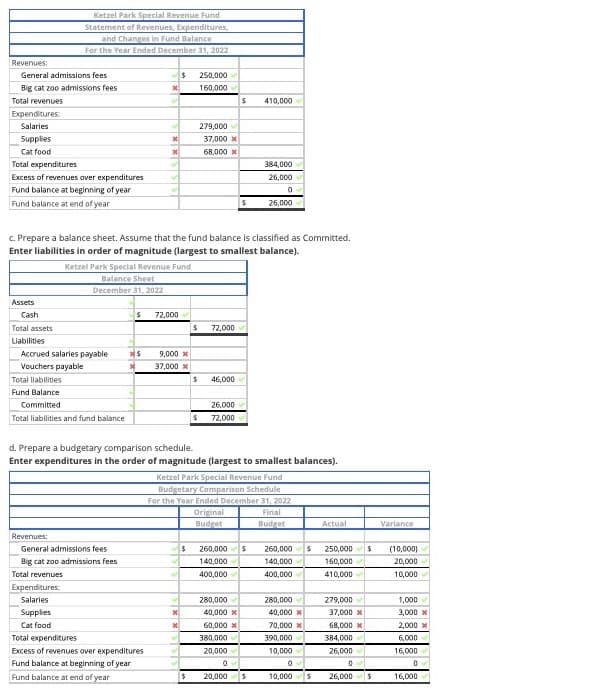

Transcribed Image Text:Ketzel Park Special Revenue Fund

Statement of Revenues, Expenditures,

and Changes in Fund Balance

For the Year Ended December 31, 2022

Revenues:

General admissions fees

250,000

Big cat zoo admissions fees

160,000

Total revenues

410,000

Expenditures

Salaries

279,000

Supplies

37,000 x

Cat food

68,000 x

Total expenditures

Excess of revenues aver expenditures

Fund balance at beginning of year

384,000

26,000

Fund balance at end of year

26,000

c. Prepare a balance sheet. Assume that the fund balance is classified as Committed.

Enter liabilities in order of magnitude (largest to smallest balance).

Ketzel Park Special Revenue Fund

Balance Sheet

December 31, 2022

Assets

Cash

72,000

Total assets

72,000

Liabilities

Accrued salaries payable

9,000 x

Vouchers payable

37,000 x

Total liabilities

46,000

Fund Balance

Committed

26,000

Total liabilities and fund balance

72,000

d. Prepare a budgetary comparison schedule.

Enter expenditures in the order of magnitude (largest to smallest balances).

Ketzel Park Special Revenue Fund

Budgetary Comparison Schedule

For the Year Ended December 31, 2022

Original

Final

Budget

Budget

Actual

Variance

Revenues:

General admissions fees

260,000

260,000

250,000

(10,000)

Big cat zoo admissions fees

140,000

140,000

160,000

20,000

Total revenues

400,000

400,000

410,000

10,000

Expenditures

Salaries

280,000

280,000

279,000

1,000

Supplies

40,000 x

40,000 X

37,000 x

3,000 x

Cat food

60,000 x

70,000 x

68,000 x

2,000 x

Total expenditures

380,000

390,000

384,000

6,000

Excess of revenues over expenditures

20,000

10,000

26,000

16,000

Fund balance at beginning of year

Fund balance at end of year

20,000

10,000

26,000

16,000

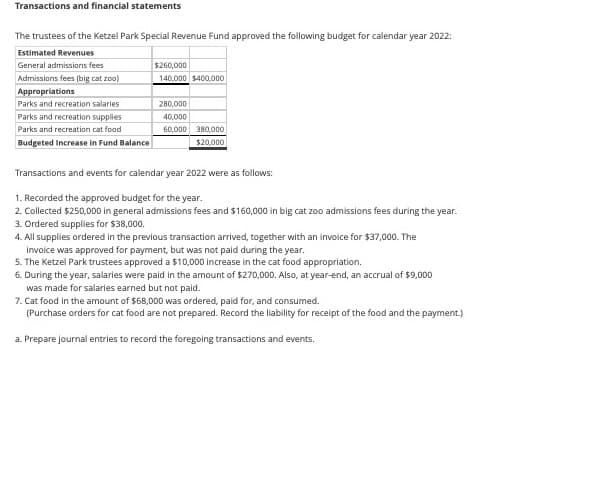

Transcribed Image Text:Transactions and financial statements

The trustees of the Ketzel Park Special Revenue Fund approved the following budget for calendar year 2022:

Estimated Revenues

$260,000

140,000 $400,000

General admissions fees

Admissions fees (big cat zoo)

Appropriations

Parks and recreation salaries

Parks and recreation supplies

280,000

40,000

60,000 380,000

Parks and recreation cat food

Budgeted Increase in Fund Balance

$20,000

Transactions and events for calendar year 2022 were as follows:

1. Recorded the approved budget for the year.

2. Collected $250,000 in general admissions fees and $160,000 in big cat zoo admissions fees during the year.

3. Ordered supplies for $38,000.

4. All supplies ordered in the previous transaction arrived, together with an invoice for $37,000. The

invoice was approved for payment, but was not paid during the year.

5. The Ketzel Park trustees approved a $10,000 increase in the cat food appropriation.

6. During the year, salaries were paid in the amount of $270,000. Also, at year-end, an accrual of $9,000

was made for salaries earned but not paid.

7. Cat food in the amount of $68,000 was ordered, paid for, and consumed.

(Purchase orders for cat food are not prepared. Record the liability for receipt of the food and the payment.)

a. Prepare journal entries to record the foregoing transactions and events.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education