Transportation (LO 3.3) Martha is a self-employed tax accountant whe 10,000 miles for commuting and other person

Q: His total home office expenses are: His net business income based on notes 4 to 6 above is : 7. Paul…

A: 6. Total office expenses = 25% of personal residence Total cost associated with Paul's home is as…

Q: Julie works as at home and is self-employed. She uses 17% of her home as office space. She has the…

A: Home office deduction can be calculated under 2 methods: 1. Actual expense method 2. Simplified…

Q: Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes?…

A: The tax credit is the amount of reduction from the tax payable while tax deduction is the reduction…

Q: Marissa Moose is a self-employed tax accountant in Alberta. The current year’s income statement for…

A: Answer: Computation of net business income for the purpose of tax for Marissa's business is as…

Q: QUESTION E Ellen, age 48, is a single taxpayer. She is self-employed. She has business profit of…

A: Simplified Employee Pension (SEP) is described as a retirement based plan in which the owners…

Q: Teresa is getting ready to do her taxes. She is single and lives in San Francisco. Teresa earned…

A: Federal Income tax: Federal income tax is a tax on income and is imposed by the United State federal…

Q: Mr. Holm has Net Income for Tax Purposes of $55,000, all of which is investment income. He is…

A: The Canada Pension Plan is a government pension plan which provides pension to retirees…

Q: 1. An unmarried taxpayer who maintains a household for a dependent child and whose spouse died four…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Marie had a good year. She received the following prizes and awards: - an iPad from The Famous…

A: SOLUTION- THE AWARD FROM HER JOB EXCLUDED PLAQUE WORTH $25 PLUS $100 OF GODIVA CHOCOLATE IN…

Q: Barry is a self-employed attorney who travels to New York on a business trip during the year.…

A: Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Paul & Sally are married and have a combined household income of $80,000 per year. They're trying to…

A: TAX LIABILITY is the total amount of tax debt owed by an individual, corporation, or other entity to…

Q: Gordon is a health care assistant living in Belfast, earning £20,000 a year after deductions for…

A: Here talking about the net earning which can be useful for the individual who can covert to living…

Q: Jordan pays $3,000 in tuition to New York University for completion of his Masters in Tax degree.…

A: If you’re self-employed, you can deduct the cost of education for your trade or business on Schedule…

Q: Rita owns a sole proprietorship in which she works as a management consultant. She maintains an…

A: The operating expenses include the salary of employees, insurance exp.,travel exp.,office exp.…

Q: Amanda, who works 1,500 hours annually as a second grade teacher purchased $300 worth of supplies…

A: Deduction for teachers and other education professionals for up to $250 in out-of-pocket expenses.…

Q: Melanie is employed full-time as an accountant for a national hardware chain. She also has recently…

A: Answer a:

Q: Maria Clara Santos works is an accountant with her own accounting firm as well as teaching full time…

A: Annual income is the income earned by the person in the whole year. Income can be earned by doing a…

Q: Candace uses an office in her home exclusively for her business. The business use of the home is 100…

A: Home office deduction should be proportionate to the area that is used for business purpose.

Q: Instructions: Read each situation carefully and tell what type of tax/es apply/ies. Income Tax,…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: 1.Ms. Evelyn is tax comiance officer at the breau of internal revenue earning monthly salary of…

A: Take home pay in corporate terms is mentioned as "Net Pay"which an salaried person receives after…

Q: 38 PPP is a Filipino residing in Muntinlupa City. Aside from being employed as an accounting…

A: Taxable Income Taxable Income means the part of income that is subject to taxes. It is calculated by…

Q: Mr A is a dentist having his own clinic in Alsancak/ İzmir. He calculated his gross independent…

A: Tax laws categorize taxpayers based on their taxable income and apply different rates of income tax…

Q: 1. Sergio is single and has a 12 year old daughter whom he supports and lives with him all year…

A: “Since you have posted a many question, we will solve first question for you. To get the remaining…

Q: Janet is getting ready to do her taxes. She is single and lives in Denver. Janet earned $110,000 in…

A: Given: Janet is getting ready to do her taxes. The earning includes $110,000 in 2015. The IRS tax is…

Q: 1. Peter is 66 years old and single. He has the following Income and expenses: What is his taxable…

A: Income tax: It is the amount a person is liable to pay on the earned amount in an accounting year.…

Q: What amount can Melanie claim this year for her office in the home deduction under the Regular…

A: Information Provided: Real Property Taxes = $3600 Interest on home mortgage = $3800 Operating exp =…

Q: Cindy, who is self-employed, maintains an office in her home that comprises 12% (260 square feet) of…

A: WORKING : 1. Business occupancy space= 260 Sq. ft. (12%) 2. Gross income= $ 45,650 3. Rent…

Q: Question 1 Sharon runs a lawn mowing business (which is GST registered) and she decides to…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Melanie is employed full-time as an accountant for a national hardware chain. She also has recently…

A: Home office deduction A home office is a space set aside in a person's residence for professional…

Q: Nicanor is a married man with surviving spouse: Community Properties: Real Property located in…

A: Taxable estate = Gross estate - deduction Gross estate includes all property, real or personal,…

Q: Tim and Sarah Lawrence are married and filing a joint return. Tim's social security number is…

A: Income tax expense: The expenses which are related to the taxable income of the individuals and…

Q: Kelly and Darryl are married. Kelly is a general partner in a successful fashion designing business.…

A: Kelly's share of Ordinary Income= $119655 Kelly's W-2 Wages= $34862 Darryl's W-2 Wages= $145000 As…

Q: Grace is a self-employed sales consultant who spends significant time entertaining potential…

A: Income Tax: Income tax is a direct tax which is paid by the taxpayer depending on his level of…

Q: 1.Charles, who is single and age 61, had AGI of $400,000 during 2020. He incurred the following…

A:

Q: Cindy, who is self-employed, maintains an office in her home that comprises 10% (340 square feet) of…

A: Given that Real property taxes = 4092 interest on mortgage = 6820 operating expenses = 3410…

Q: Amy’s Adjusted Gross Income (AGI)?

A: Adjusted gross income = gross income - deduction Gross income = 50000 Deduction = 5000+10000=15000

Q: 3) Ryan and Nat each have income of over $200,000. During the year, they paid a nanny $20,000 to…

A: Child Care Cost:- It is a cost incurred for taking care of children who are small and require…

Q: Matt and Becky are both 66 years of age. Matt still works and earned $38,000 last year. Matt and…

A: Calculate interest rate for mortgage value:

Q: Boyd Salzer, an unmarried individual, has $226,400 AGI consisting of the following items: Salary…

A: Answer and calculations are given below

Q: Ms. Claveria had a business net income of P300,000. She alsoearned P5,000 commission from selling…

A: The net income is the total profits earned against various costs.

Q: Kendra is a self-employed taxpayer working exclusively from her home office. Before the home office…

A: The correct answer is option (d)Only $6,000 home office expenses may be deducted, resulting in net…

Q: For the following taxpayers, indicate whether the taxpayer should file a tax return and why. a.…

A: based on the US tax rates and rules the individual and the body corporate need to file their tax…

Q: Ken is a self-employed architect in a small firm with four employees: himself, his office assistant,…

A: Employees refer to the individuals who work for a company for a desired period of time in exchange…

Q: Hello! I need your help to resolve this problem. I have an answer for the first question, but I not…

A: Requirement 1: Compute QBI based on the W–2 Wages/Capital Investment Limit?

Q: Calculate the Gross Income, Adjusted Gross Income, and Taxable Income

A:

Q: Julie works as at home and is self-employed. She uses 17% of her home as office space. She has the…

A: Home office deduction can be calculated under 2 methods: Actual expense method Simplified method…

Standard Deduction:

The standard deduction is the direct exclusion of specific expenses from the taxpayers' income that substantially reduces a portion of income and subsequently income tax. Taxpayers have alternatives to the standard deduction and itemized deductions.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

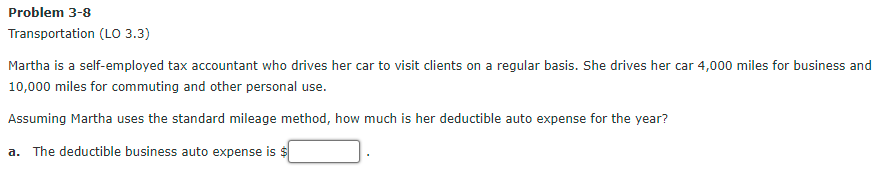

- LO.2 What is the taxpayers gross income in each of the following situations? a. Darrin received a salary of 50,000 from his employer, Green Construction. b. In July, Green gave Darrin an all-expense-paid trip to Las Vegas (value of 3,000) for exceeding his sales quota. c. Megan received 10,000 from her employer to help her pay medical expenses not covered by insurance. d. Blake received 15,000 from his deceased wifes employer to help him in his time of greatest need. e. Clint collected 50,000 as the beneficiary of a group term life insurance policy when his wife died. The premiums on the policy were paid by his deceased wifes employer.LO.2 Determine the effect on gross income in each of the following cases: a. Eloise received 150,000 in settlement of a sex discrimination case against her former employer. b. Nell received 10,000 for damages to her personal reputation. She also received 40,000 in punitive damages. c. Orange Corporation, an accrual basis taxpayer, received 50,000 from a lawsuit filed against its auditor who overcharged for services rendered in a previous year. d. Beth received 10,000 in compensatory damages and 30,000 in punitive damages in a lawsuit she filed against a tanning parlor for severe burns she received from using its tanning equipment. e. Joanne received compensatory damages of 75,000 and punitive damages of 300,000 from a cosmetic surgeon who botched her nose job.Problem 3-8Transportation (LO 3.3) Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her deductible auto expense for the year? a. The deductible business auto expense is $. b. Where in her tax return should Martha claim this deduction? The expense should be deducted on Martha's .

- Comprehensive Problem 1-1A Maria Tallchief is a single taxpayer, age 27 (birthdate May 18, 1994) living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2021, Maria has no dependents, and received a W-2, from her job at a local restaurant where she is a cashier. These wages are Maria's only income for 2021. Maria received a $1,400 EIP in 2021. Required:Complete Form 1040 for Maria Tallchief for the 2021 tax year. If there is an over-payment, she would like a refund. She wants to donate $3 to the Presidential Election Campaign Fund. The election to donate does not affect tax liability in any way. Maria has health care coverage for the full year. Enter all amounts as positive numbers. If an amount box requires no entry or the amount is zero, enter "0". If required, round amounts to the nearest dollar. Maria's W-2, from her job at a local restaurant where she parks cars, contains the following information: a Employee's social security number…Transportation (LO 3.3) Teresa is a self-employed civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2020, of which 80% was business mileage. The actual cost of gasoline, oil, depreciation, repairs, and insurance for the year was $6,440. Teresa is eligible to use the actual or standard method. If required, round your answers to the nearest dollar. a. How much is Teresa's transportation deduction based on the standard mileage method?$fill in the blank f77e440a8016001_1 b. How much is Teresa's transportation deduction based on the actual cost method?$fill in the blank 4eb51bfe9039fc8_1 c. Which method should Teresa use to calculate her transportation deduction? Since the method yields the larger deduction, Teresa should use the method to determine her deduction.Question 40 Grace is a self employeed sales consultant who spends significant time entertainment potential customers. She keeps all the appropriate records to substantiate her entertainment. She has the following expenses in the current year: meals where business was conducted $5000 Greens fees (all fees) 500 tickets to baseball games (all business) 500 country cup dues (all business use) 6000 what are the tax-deductible meals and entertainment expenses Grace May claim in the current year? $ on which tax form should she claim the deduction?

- Question 1 (1 point) Chad and Jason Roberts paid $8,500 during the year for childcare for their three children, aged 2, 6 and 11. Chad’s annual salary was $12,000 and Jason’s annual salary was $42,000. Chad can deduct the $8,500 paid from his income. Question 1 options: a) True b) False Question 2 (1 point) The entire amount of retiring allowance received must be included in income, even if some part of the allowance was transferred to an RRSP. Question 2 options: a) True b) False Question 3 (1 point) Saved The amount earned in a Tax Free Savings Account (TFSA) is not subject to taxation; however, the withdrawals from a TFSA are taxed in the hands of the recipient. Question 3 options: a) True b) False Question 4 (1 point) All…Hello! I need help with this problem. The first one is good, but the rest are wrong. Thank you for helping me. Problem 2-21 (LO. 1) Purple Company has $200,000 in net income for 2018 before deducting any compensation or other payment to its sole owner, Kirsten. Kirsten is single and she claims the $12,000 standard deduction for 2018. Purple Company is Kirsten's only source of income. Ignoring any employment tax considerations, compute Kirsten's after-tax income for each of the following situations. Click here to access the 2018 individual tax rate schedule to use for this problem. Assume the corporate tax rate is 21%. When required, carryout intermediate tax computations to the nearest cent and then round your final tax liability to the nearest dollar. a. If Purple Company is a proprietorship and Kirsten withdraws $50,000 from the business during the year; Kirsten claims a $40,000 deduction for qualified business income ($200,000 × 20%). Kirsten's taxable income is$, and her…Activity 3 Use the following information for the next two questions. Write your answer on a separate sheet of paper. Mr Danny earns the following business income in a taxable year. Sales P 3,900,000 Sales returns and discounts 100,000 Inventory, beg. 30,000 Purchases 1,800,000 Operating expenses (itemized deductions) 780,000 Inventory, end. 80,000 1. How much is the tax due if Mr Danny chose the option to use the itemized deductions? _____________ 2. How much is the tax due if Mr Danny chose the option to use the optional standard deduction? _____________ Assessment 3 Use the following information

- B 12. Susan works part-time with an accounting firm while she completes her accounting degree. She hopes to then be offered a full-time position. She also does some waitressing to supplement her income while studying. Which of the following are deductible to Susan under s8-1? Select one: 1 Purchase of a black skirt and white shirt as required for her waitressing job. 2 Cost of travel from home to her accounting job. 3 Cost of travel from her accounting job to her waitressing job. 4 Purchase of suits as required by her accounting firm.#4-4A – LO 3 Eaton enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee: i have asked this question 4 times and keep getting answer to another problem. Can you assist? Hal Bower married 1 withholding allowance paid weekly wage $1,350 amount to be withheld?Ay 2 Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2022. During that time, he earned $80,000 of self-employment income. On April 1, 2022, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $158,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations to the nearest whole dollar amount.