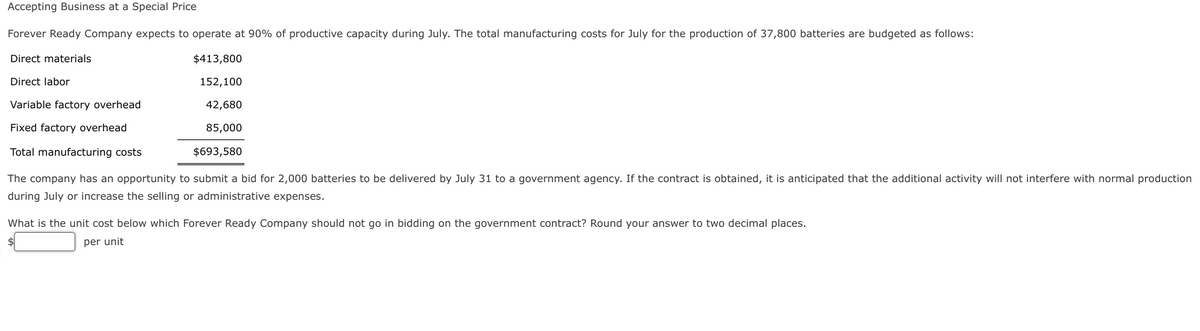

Accepting Business at a Special Price Forever Ready Company expects to operate at 90% productive capacity during July. The total manufacturing costs for July for the production of 37,800 batteries are budgeted as follows: Direct materials $413,800 152,100 Direct labor Variable factory overhead 42,680 Fixed factory overhead 85,000 Total manufacturing costs $693,580 The company has an opportunity to submit a bid for 2,000 batteries to be delivered by July 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during July or increase the selling or administrative expenses. What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places. per unit

Accepting Business at a Special Price Forever Ready Company expects to operate at 90% productive capacity during July. The total manufacturing costs for July for the production of 37,800 batteries are budgeted as follows: Direct materials $413,800 152,100 Direct labor Variable factory overhead 42,680 Fixed factory overhead 85,000 Total manufacturing costs $693,580 The company has an opportunity to submit a bid for 2,000 batteries to be delivered by July 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during July or increase the selling or administrative expenses. What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places. per unit

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 14E: Accepting business at a special price Box Elder Power Company expects to operate at 85% of...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

100%

Transcribed Image Text:Accepting Business at a Special Price

Forever

Ready Company expects to operate at 90% of productive capacity during July. The total manufacturing costs for July for the production of 37,800 batteries are budgeted as follows:

Direct materials

$413,800

152,100

Direct labor

Variable factory overhead

42,680

Fixed factory overhead

85,000

Total manufacturing costs

$693,580

The company has an opportunity to submit a bid for 2,000 batteries to be delivered by July 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production

during July or increase the selling or administrative expenses.

What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places.

per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning