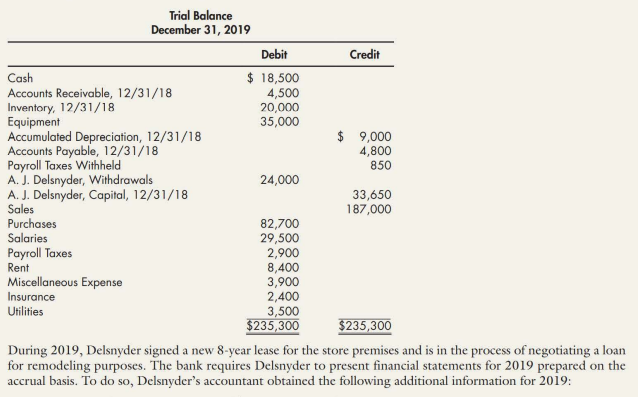

Trial Balance December 31, 2019 Debit Credit $ 18,500 4,500 20,000 35,000 Cash Accounts Receivable, 12/31/18 Inventory, 12/31/18 Equipment Accumulated Depreciation, 12/31/18 Accounts Payable, 12/31/18 Payroll Taxes Withheld A. J. Delsnyder, Withdrawals A. J. Delsnyder, Capital, 12/31/18 Sales Purchases Salaries $ 9,000 4,800 850 24,000 33,650 187,000 82,700 29,500 2,900 8,400 3,900 2,400 Payroll Taxes Rent Miscellaneous Expense Insurance Utilities 3,500 $235,300 $235,300 During 2019, Delsnyder signed a new 8-year lease for the store premises and is in the process of negotiating a loan for remodeling purposes. The bank requires Delsnyder to present financial statements for 2019 prepared on the accrual basis. To do so, Delsnyder's accountant obtaincd the following additional information for 20i9:

Presented below is information pertaining to Delsnyder Specialty Foods, a

calendar-year sole proprietorship, maintaining its books on the cash basis during the year. At year-end, however,A. J. Delsnyder's accountant adjusts the books to the accrual basis only for sales, purchases, ar cost of sales, an

Adapted records

1. Amounts due from customers totaled $ 7 ,900 at December 31.

2 . A review of the receivables at December 31, disclosed at an allowance for doubtful accounts of $1,100 should be provided. Delsnyder had recorded no

3. The inventory amounted to $23,000 at December 31 , based on a physical count of goods priced at cost . No reduction to market was required.

4. On signing new lease on October 1, 2019, Delsnyder paid $ 8,400, representing 1 year’s rent in advance for the lease year ending October 1, 2020. The $7,500 annual rental under the old lease was paid on October

1, 2018, for lease year ended October 1, 2019.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps