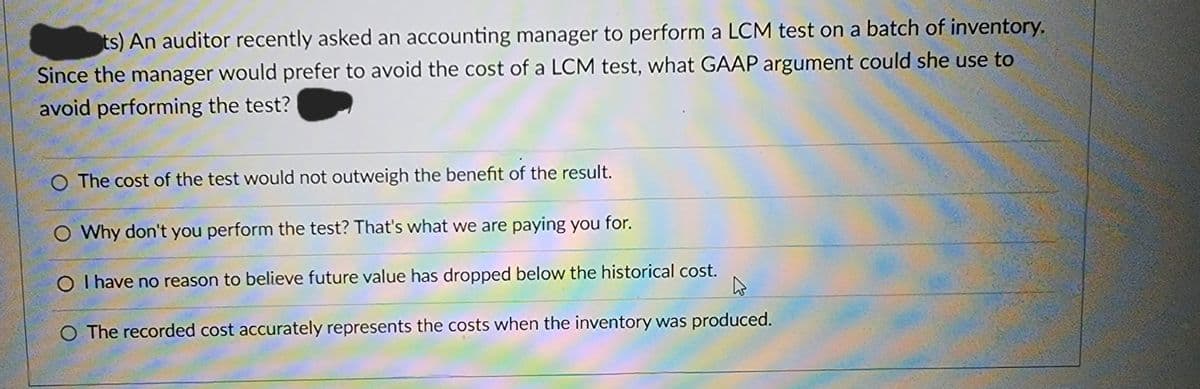

ts) An auditor recently asked an accounting manager to perform a LCM test on a batch of inventory. Since the manager would prefer to avoid the cost of a LCM test, what GAAP argument could she use to avoid performing the test? O The cost of the test would not outweigh the benefit of the result. O Why don't you perform the test? That's what we are paying you for. O I have no reason to believe future value has dropped below the historical cost. O The recorded cost accurately represents the costs when the inventory was produced.

ts) An auditor recently asked an accounting manager to perform a LCM test on a batch of inventory. Since the manager would prefer to avoid the cost of a LCM test, what GAAP argument could she use to avoid performing the test? O The cost of the test would not outweigh the benefit of the result. O Why don't you perform the test? That's what we are paying you for. O I have no reason to believe future value has dropped below the historical cost. O The recorded cost accurately represents the costs when the inventory was produced.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 24DQ

Related questions

Question

Transcribed Image Text:ts) An auditor recently asked an accounting manager to perform a LCM test on a batch of inventory.

Since the manager would prefer to avoid the cost of a LCM test, what GAAP argument could she use to

avoid performing the test?

O The cost of the test would not outweigh the benefit of the result.

O Why don't you perform the test? That's what we are paying you for.

O I have no reason to believe future value has dropped below the historical cost.

h

O The recorded cost accurately represents the costs when the inventory was produced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning