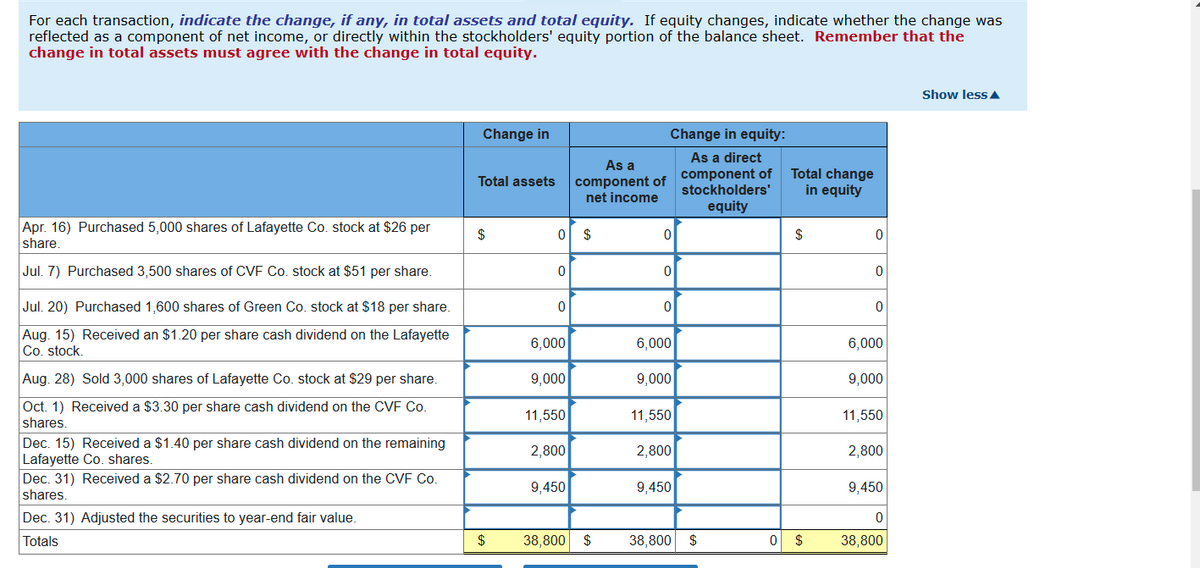

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. For the Dec 31ST Adjustment Period what formula would I use? It's the only one that I can not figure out. Apr. 16 Purchased 5,000 shares of Lafayette Co. stock at $26 per share. July 7 Purchased 3,500 shares of CVF Co. stock at $51 per share. 20 Purchased 1,600 shares of Green Co. stock at $18 per share. Aug. 15 Received an $1.20 per share cash dividend on the Lafayette Co. stock. 28 Sold 3,000 shares of Lafayette Co. stock at $29 per share. Oct. 1 Received a $3.30 per share cash dividend on the CVF Co. shares. Dec. 15 Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. 31 Received a $2.70 per share cash dividend on the CVF Co. shares.

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. For the Dec 31ST Adjustment Period what formula would I use? It's the only one that I can not figure out. Apr. 16 Purchased 5,000 shares of Lafayette Co. stock at $26 per share. July 7 Purchased 3,500 shares of CVF Co. stock at $51 per share. 20 Purchased 1,600 shares of Green Co. stock at $18 per share. Aug. 15 Received an $1.20 per share cash dividend on the Lafayette Co. stock. 28 Sold 3,000 shares of Lafayette Co. stock at $29 per share. Oct. 1 Received a $3.30 per share cash dividend on the CVF Co. shares. Dec. 15 Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. 31 Received a $2.70 per share cash dividend on the CVF Co. shares.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA1: International Financial Reporting Standards

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017.

For the Dec 31ST Adjustment Period what formula would I use? It's the only one that I can not figure out.

| Apr. | 16 | Purchased 5,000 shares of Lafayette Co. stock at $26 per share. | ||

| July | 7 | Purchased 3,500 shares of CVF Co. stock at $51 per share. | ||

| 20 | Purchased 1,600 shares of Green Co. stock at $18 per share. | |||

| Aug. | 15 | Received an $1.20 per share cash dividend on the Lafayette Co. stock. | ||

| 28 | Sold 3,000 shares of Lafayette Co. stock at $29 per share. | |||

| Oct. | 1 | Received a $3.30 per share cash dividend on the CVF Co. shares. | ||

| Dec. | 15 | Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. | ||

| 31 | Received a $2.70 per share cash dividend on the CVF Co. shares. |

Transcribed Image Text:For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was

reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the

change in total assets must agree with the change in total equity.

Show less A

Change in

Change in equity:

As a direct

As a

component of component of

net income

Total change

in equity

Total assets

stockholders'

equity

Apr. 16) Purchased 5,000 shares of Lafayette Co. stock at $26 per

share.

$

2$

$

Jul. 7) Purchased 3,500 shares of CVF Co. stock at $51 per share.

Jul. 20) Purchased 1,600 shares of Green Co. stock at $18 per share.

Aug. 15) Received an $1.20 per share cash dividend on the Lafayette

Co. stock.

6,000

6,000

6,000

Aug. 28) Sold 3,000 shares of Lafayette Co. stock at $29 per share.

9,000

9,000

9,000

Oct. 1) Received a $3.30 per share cash dividend on the CVF Co.

shares.

11,550

11,550

11,550

Dec. 15) Received a $1.40 per share cash dividend on the remaining

Lafayette Co. shares.

Dec. 31) Received a $2.70 per share cash dividend on the CVF Co.

2,800

2,800

2,800

9,450

9,450

9,450

shares.

Dec. 31) Adjusted the securities to year-end fair value.

Totals

$

38,800

$

38,800

$

$

38,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,