Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. Apr. 16 Purchased 5,000 shares of Lafayette Co. stock at $26 per share. July 7 Purchased 3,500 shares of CVF Co. stock at $51 per share. 20 Purchased 1,600 shares of Green Co. stock at $18 per share. Aug. 15 Received an $1.20 per share cash dividend on the Lafayette Co. stock. 28 Sold 3,000 shares of Lafayette Co. stock at $29 per share. Oct. 1 Received a $3.30 per share cash dividend on the CVF Co. shares. Dec. 15 Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. 31 Received a $2.70 per share cash dividend on the CVF Co. shares.

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. Apr. 16 Purchased 5,000 shares of Lafayette Co. stock at $26 per share. July 7 Purchased 3,500 shares of CVF Co. stock at $51 per share. 20 Purchased 1,600 shares of Green Co. stock at $18 per share. Aug. 15 Received an $1.20 per share cash dividend on the Lafayette Co. stock. 28 Sold 3,000 shares of Lafayette Co. stock at $29 per share. Oct. 1 Received a $3.30 per share cash dividend on the CVF Co. shares. Dec. 15 Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. 31 Received a $2.70 per share cash dividend on the CVF Co. shares.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 23P

Related questions

Question

100%

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017.

| Apr. | 16 | Purchased 5,000 shares of Lafayette Co. stock at $26 per share. | ||

| July | 7 | Purchased 3,500 shares of CVF Co. stock at $51 per share. | ||

| 20 | Purchased 1,600 shares of Green Co. stock at $18 per share. | |||

| Aug. | 15 | Received an $1.20 per share cash dividend on the Lafayette Co. stock. | ||

| 28 | Sold 3,000 shares of Lafayette Co. stock at $29 per share. | |||

| Oct. | 1 | Received a $3.30 per share cash dividend on the CVF Co. shares. | ||

| Dec. | 15 | Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares. | ||

| 31 | Received a $2.70 per share cash dividend on the CVF Co. shares. |

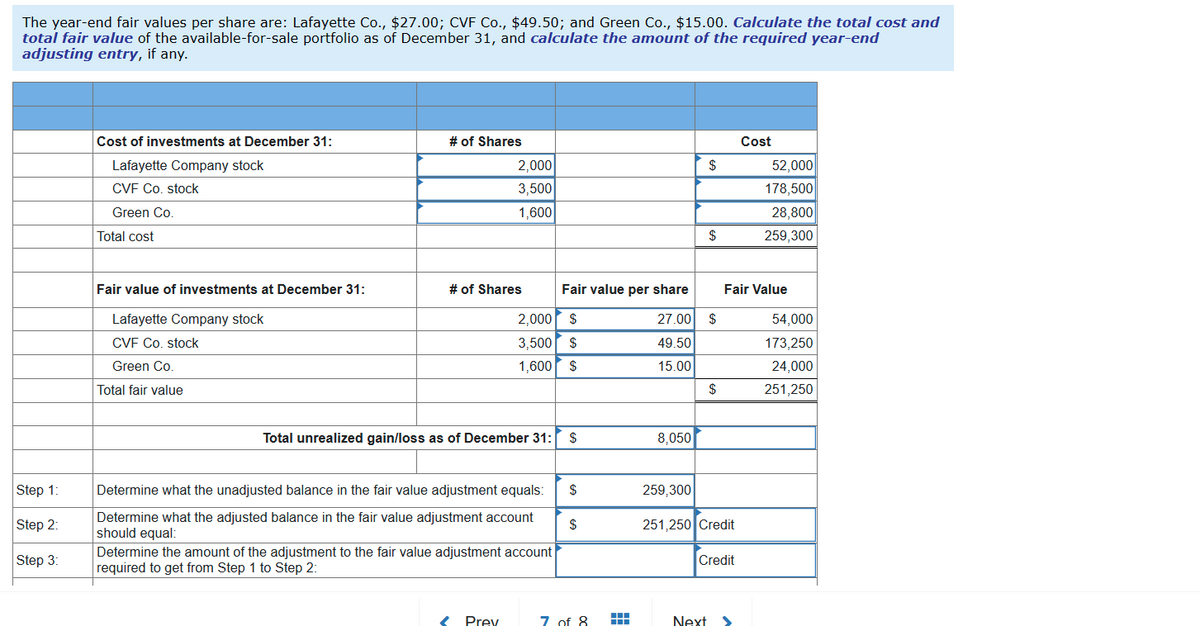

Transcribed Image Text:The year-end fair values per share are: Lafayette Co., $27.00; CVF Co., $49.50; and Green Co., $15.00. Calculate the total cost and

total fair value of the available-for-sale portfolio as of December 31, and calculate the amount of the required year-end

adjusting entry, if any.

Cost of investments at December 31:

# of Shares

Cost

Lafayette Company stock

2,000

$

52,000

CVF Co. stock

3,500

178,500

Green Co

1,600

28,800

Total cost

$

259,300

Fair value of investments at December 31:

# of Shares

Fair value per share

Fair Value

Lafayette Company stock

2,000 $

27.00 $

54,000

CVF Co. stock

3,500 $

49.50

173,250

Green Co.

1,600 S

15.00

24,000

Total fair value

$

251,250

Total unrealized gain/loss as of December 31:

$

8,050

Step 1:

Determine what the unadjusted balance in the fair value adjustment equals:

$

259,300

Step 2:

Determine what the adjusted balance in the fair value adjustment account

should equal:

$

251,250 Credit

Step 3:

Determine the amount of the adjustment to the fair value adjustment account

required to get from Step 1 to Step 2:

Credit

Prev

7 of 8

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning