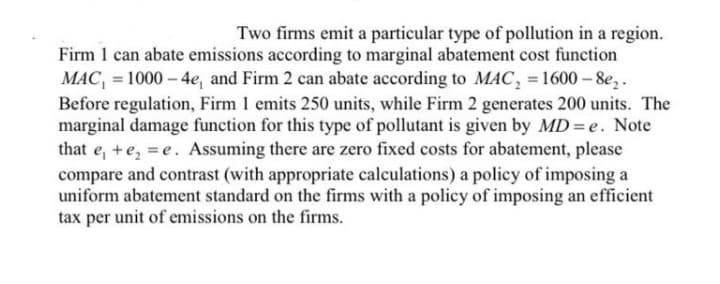

Two firms emit a particular type of pollution in a region. Firm 1 can abate emissions according to marginal abatement cost function MAC, = 1000 – 4e, and Firm 2 can abate according to MAC, = 1600 – 8e,. %3D Before regulation, Firm 1 emits 250 units, while Firm 2 generates 200 units. The marginal damage function for this type of pollutant is given by MD= e. Note that e, +e, = e. Assuming there are zero fixed costs for abatement, please compare and contrast (with appropriate calculations) a policy of imposing a uniform abatement standard on the firms with a policy of imposing an efficient tax per unit of emissions on the firms.

Two firms emit a particular type of pollution in a region. Firm 1 can abate emissions according to marginal abatement cost function MAC, = 1000 – 4e, and Firm 2 can abate according to MAC, = 1600 – 8e,. %3D Before regulation, Firm 1 emits 250 units, while Firm 2 generates 200 units. The marginal damage function for this type of pollutant is given by MD= e. Note that e, +e, = e. Assuming there are zero fixed costs for abatement, please compare and contrast (with appropriate calculations) a policy of imposing a uniform abatement standard on the firms with a policy of imposing an efficient tax per unit of emissions on the firms.

Chapter19: Externalities And Public Goods

Section: Chapter Questions

Problem 19.9P

Related questions

Question

Transcribed Image Text:Two firms emit a particular type of pollution in a region.

Firm 1 can abate emissions according to marginal abatement cost function

MAC, = 1000 – 4e, and Firm 2 can abate according to MAC, = 1600 – 8e,.

Before regulation, Firm 1 emits 250 units, while Firm 2 generates 200 units. The

marginal damage function for this type of pollutant is given by MD=e. Note

that e, +e, = e. Assuming there are zero fixed costs for abatement, please

compare and contrast (with appropriate calculations) a policy of imposing a

uniform abatement standard on the firms with a policy of imposing an efficient

tax per unit of emissions on the firms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning