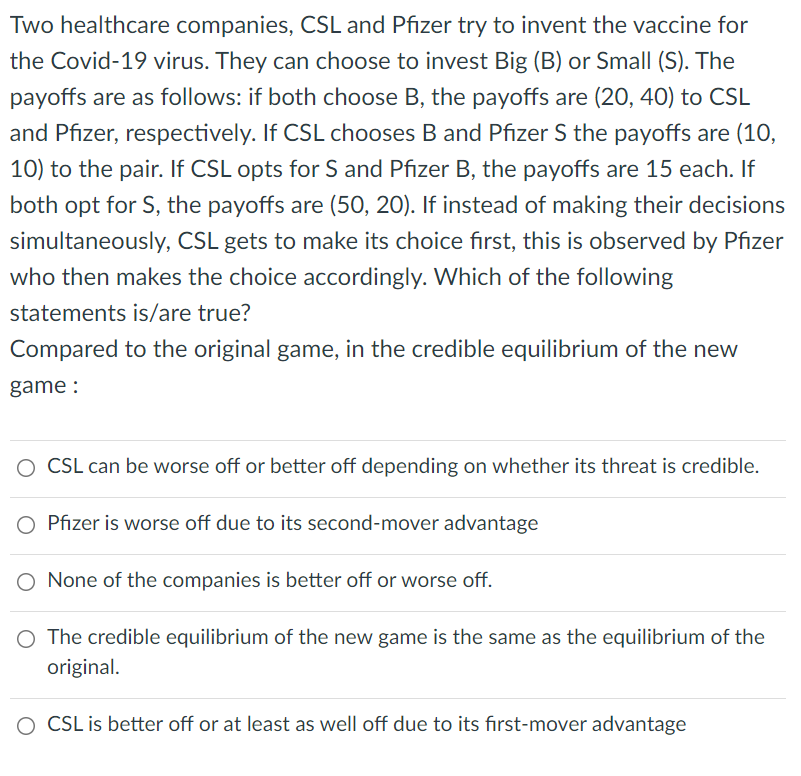

Two healthcare companies, CSL and Pfizer try to invent the vaccine for the Covid-19 virus. They can choose to invest Big (B) or Small (S). The payoffs are as follows: if both choose B, the payoffs are (20, 40) to CSL and Pfizer, respectively. If CSL chooses B and Pfizer S the payoffs are (10, 10) to the pair. If CSL opts for S and Pfizer B, the payoffs are 15 each. If both opt for S, the payoffs are (50, 20). If instead of making their decisions simultaneously, CSL gets to make its choice first, this is observed by Pfizer who then makes the choice accordingly. Which of the following statements is/are true? Compared to the original game, in the credible equilibrium of the new game : O CSL can be worse off or better off depending on whether its threat is credible. O Pfizer is worse off due to its second-mover advantage None of the companies is better off or worse off. O The credible equilibrium of the new game is the same as the equilibrium of the original. O CSL is better off or at least as well off due to its first-mover advantage

Two healthcare companies, CSL and Pfizer try to invent the vaccine for the Covid-19 virus. They can choose to invest Big (B) or Small (S). The payoffs are as follows: if both choose B, the payoffs are (20, 40) to CSL and Pfizer, respectively. If CSL chooses B and Pfizer S the payoffs are (10, 10) to the pair. If CSL opts for S and Pfizer B, the payoffs are 15 each. If both opt for S, the payoffs are (50, 20). If instead of making their decisions simultaneously, CSL gets to make its choice first, this is observed by Pfizer who then makes the choice accordingly. Which of the following statements is/are true? Compared to the original game, in the credible equilibrium of the new game : O CSL can be worse off or better off depending on whether its threat is credible. O Pfizer is worse off due to its second-mover advantage None of the companies is better off or worse off. O The credible equilibrium of the new game is the same as the equilibrium of the original. O CSL is better off or at least as well off due to its first-mover advantage

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 19P: A firm has three investment alternatives. Payoffs are in thousands of dollars. a. Using the expected...

Related questions

Question

Transcribed Image Text:Two healthcare companies, CSL and Pfizer try to invent the vaccine for

the Covid-19 virus. They can choose to invest Big (B) or Small (S). The

payoffs are as follows: if both choose B, the payoffs are (20, 40) to CSL

and Pfizer, respectively. If CSL chooses B and Pfizer S the payoffs are (10,

10) to the pair. If CSL opts for S and Pfizer B, the payoffs are 15 each. If

both opt for S, the payoffs are (50, 20). If instead of making their decisions

simultaneously, CSL gets to make its choice first, this is observed by Pfizer

who then makes the choice accordingly. Which of the following

statements is/are true?

Compared to the original game, in the credible equilibrium of the new

game :

O CSL can be worse off or better off depending on whether its threat is credible.

Pfizer is worse off due to its second-mover advantage

O None of the companies is better off or worse off.

O The credible equilibrium of the new game is the same as the equilibrium of the

original.

O CSL is better off or at least as well off due to its first-mover advantage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning