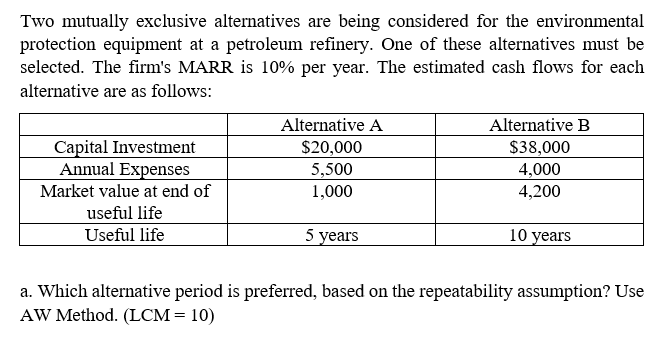

Two mutually exclusive alternatives are being considered for the environmental protection equipment at a petroleum refinery. One of these alternatives must be selected. The firm's MARR is 10% per year. The estimated cash flows for each alternative are as follows: Alternative B $38,000 4,000 4,200 Alternative A Capital Investment Annual Expenses Market value at end of $20,000 5,500 1,000 useful life Useful life 10 years 5 years a. Which alternative period is preferred, based on the repeatability assumption? Use AW Method. (LCM = 10)

Two mutually exclusive alternatives are being considered for the environmental protection equipment at a petroleum refinery. One of these alternatives must be selected. The firm's MARR is 10% per year. The estimated cash flows for each alternative are as follows: Alternative B $38,000 4,000 4,200 Alternative A Capital Investment Annual Expenses Market value at end of $20,000 5,500 1,000 useful life Useful life 10 years 5 years a. Which alternative period is preferred, based on the repeatability assumption? Use AW Method. (LCM = 10)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

please answer all with complete solution and draw the cash flow diagram,,, do not use excel please. thank you....

Transcribed Image Text:Two mutually exclusive alternatives are being considered for the environmental

protection equipment at a petroleum refinery. One of these alternatives must be

selected. The firm's MARR is 10% per year. The estimated cash flows for each

alternative are as follows:

Alternative A

Alternative B

Capital Investment

Annual Expenses

$20,000

$38,000

5,500

4,000

Market value at end of

1,000

4,200

useful life

Useful life

5 years

10 years

a. Which alternative period is preferred, based on the repeatability assumption? Use

AW Method. (LCM= 10)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning