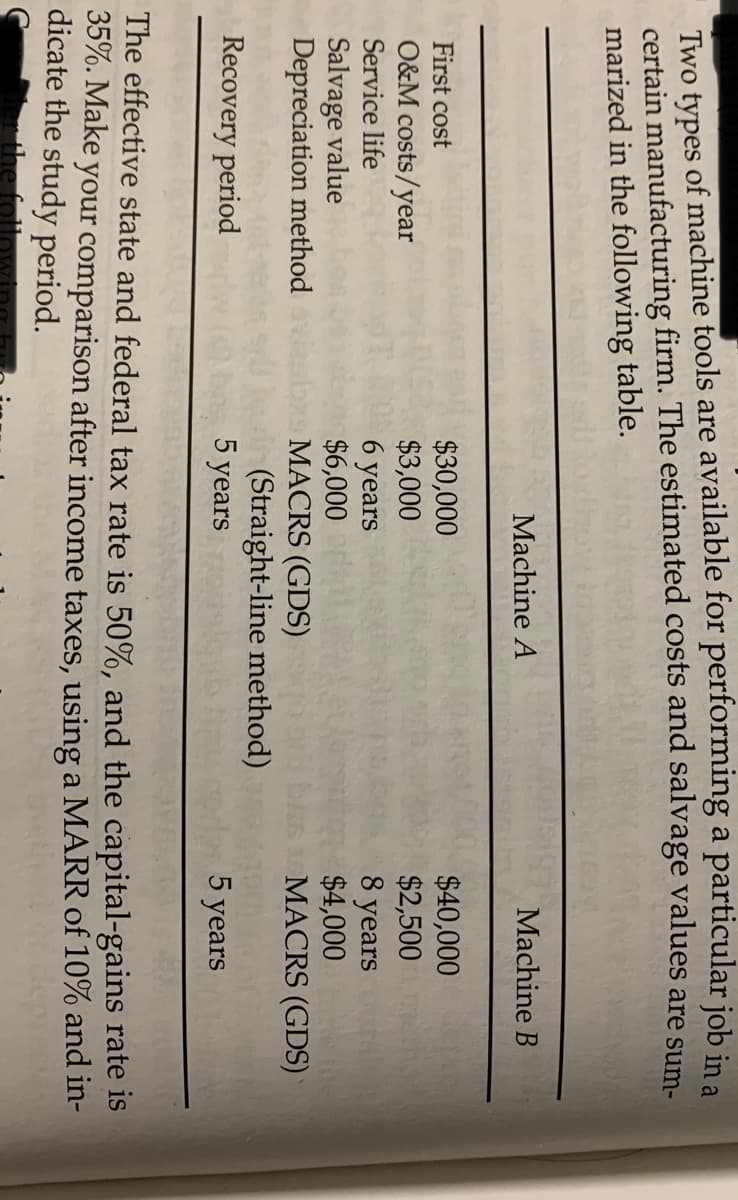

Two types of machine tools are available for performing certain manufacturing firm. The estimated costs and salv: marized in the following table. Machine A $30,000 $3,000 6 years $6,000 MACRS (GDS) (Straight-line method) 5 years First cost O&M costs/year Service life Salvage value Depreciation method Recovery period The effective state and federal tax rate is 50%, and the c 35%. Make your comparison after income taxes, using a M. dicate the study period.

Q: (d) Journalize the closing entries from the financial statement columns of the worksheet.

A: Closing entries are passed at the end of the accounting period for some required adjustments.

Q: Madrid Company plans to issue 8% bonds with a par value of $4,000,000. The company sells $3,600,000 ...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: Chef Amy does beginning inventory on Thursday night and finds that she has $4194 in food products in...

A: Total food cost = Beginning Inventory + Purchases - Ending Inventory

Q: On November 1, 2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a for...

A: In the given problem, here the Yuan is selling at a discount in the forward Market where( Forward ra...

Q: A company can opt not to take the Bonus Depreciation by completing Form 4562, Depreciation and Amort...

A: Depreciation is an expense which shows the decrease in asset value over its life due to use, wear an...

Q: Split Company produces three products — X, Y, and Z — from a joint process. Each product may be sold...

A: Solution... JOINT cost = $120,000. Total sales value at split off point = $40,000 + $15,000 + $...

Q: American Importers reports net income of $50,000 and sales revenue of S625,000. If the company's gro...

A: Gross profit = Sales - Cost of goods sold where, Gross profit = Sales x Gross profit ratio

Q: Mercedes Co. acquired all of the common stock of Tesla Co. on January 1, 2018. As of that date, Tesl...

A: Solution A journal is a company's official book in which all business transaction are recorded in ch...

Q: Please solve d, e1,e2,f,g Oriole Industries and Waterway Inc. enter into an agreement that require...

A: Annual lease payment PVF @7% Present value of lease payments 3,62,863 7.02358 2,548,598

Q: What is ethical accounting

A: Ethics: At its most basic level, ethics is a set of moral rules that guide behavior. They have an im...

Q: ABC Juice Limited manufactures and sells juice locally in Trinidad and in the Caribbean. The busines...

A: Value-added tax: Value-added tax is one type of indirect tax which is levied on the goods and servic...

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The fo...

A: Journal entries to record interest and amortization Date Accounting title and explanation Debit C...

Q: What is a tax consequence for a noncorporate shareholder who receives a liquidating distribution fro...

A: As per sec 331, liquidating distribution from corporation is full and final payment for the shareho...

Q: Bless Qulinto began operating the Quinto Modeling Agency with following: Invested cash of P500,000 a...

A: The accounting equation states that assets equal to sum of liabilities and equity. Assets = Liabilit...

Q: The Department and Board may remove a license limitation as soon as the next license cycle begins. i...

A: The Department and Board may remove a license limitation when they determine that the person who has...

Q: Tiger Golf Accessories sells golf shoes, gloves, and a laser-guided range-finder that measures dista...

A: Contribution margin is the amount which is computed after deducting the variable costs from the sale...

Q: CBA Corporation was incorporated on January 1, 2020. The following equity-related transactions occur...

A: Stockholders' Equity Statement For the Year Ended December 31, 2020 Common Stock P 1 par Pa...

Q: Oliver CommuRNcations, Inc., began 2018 with 260,000 shares of $1 par common stock issUd and outstar...

A: Answer) Journal Entry for Issuance of Common Stock Date Accounts Debit Credit Ap...

Q: On June 30th, Ray Corporation had a market price of $100 per share of common stock. For the previous...

A: Market price = 100 per share Previous year annual dividend = $8.00 per share Calculation of Divide...

Q: ptual Connection: Shõüld Hêti continue to make its own crowns, or should they be purchased from tne ...

A: Solution:- 1)Calculation of dolor effect of purchasing as follows under:- Preparation of relevant co...

Q: Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a con...

A: Solution:- 1)Preparation of traditional income statement as follows under:-

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited p...

A: Introduction Partners basis is the partners interest in partner ship, partnership tax law often refe...

Q: Banking Hanna has an income of $120.000 that she is willing to spend over a year, f her bank account...

A: Total Income = $1,20,000 Bank gives 4% That is 1,20,000 * 4% = $4,800

Q: 15 Declared a cash dividend payable to common stockholders of $165, 15 Date of record is August 15 f...

A: Solution: Dividend declared and paid are recorded on their respective dates of declaration and payme...

Q: A, B and C form a general partnership. A contributes Land, a capital asset A acquired several years...

A:

Q: Compute for the following: a. Accumulated profit as of December 31, 2018 and 2020 b. Profit (Loss) f...

A: We are given the unadjusted balance of accumulated profit of Brin Inc. from 2018 to 2020. Based on v...

Q: Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1) ...

A:

Q: Skyline Florists uses an activity-based costing system to compute the cost of making floral bouquets...

A: Total cost for delivery = ($170,000×30%) + ($80,000×20%) = $51000 + $16000 = $67, 000.

Q: Using Declining Balance Method, a machine with an initial cost of $200,000 and a life of 10 years.

A: The value of the specific machinery or asset after its effective or expected life of usage is regard...

Q: If a bank loan increases from period one to period two, what happened to cash? Select one: a. Cash i...

A: Solution: Bank loan brings the cash in and creates a liability to be paid in future. By this transac...

Q: The cash flow statement reveals: Select one: a. Sources of funds only b. Loan sources only c. Uses o...

A: Cash flow statement is a report in financial statements of an organization which reflects about the ...

Q: Fixed Cost per Month Cost per Car Washed Cleaning supplies $ 0.80 Electricity $ 1,200 $ 0.15 Maint...

A: Solution: Lavage Rapide Revenue and spending Variances For the month ended August 31 Partic...

Q: Whispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning D...

A: Lease Amortization Schedule :- Date Lease payment Interest (8%) Principle amount Lease liability...

Q: preferred stock from Duquesne Light Company (DQUPRA) pays $3.55 in annual dividends. If the require...

A: Solution: Preferred stock are those stock which gets preference in receiving dividends over common s...

Q: Mars Company manufactures and sells three products. Relevant per unit data concerning each product a...

A: Solution:- 1)Computation of the contribution margin per unit of limited resource (machine hours) for...

Q: The amount of cash received from a sale of property, plant and equipment with associated accumulated...

A: Comparative Balance sheet provides the change in the cost and accumulated depreciation of the fixed ...

Q: Denzel was very pleased with the proposal, commenting that the $2,400,000 1s exactly the same as wha...

A: ('$000) ('$000) Sales 16000 Cost of Good Sold Variable 7200 Fixed 2340 95...

Q: Split Company produces three products — X, Y, and Z — from a joint process. Each product may be sold...

A: Solution: There are several method to allocation joint costs to product such as physical quantity me...

Q: Calculate the depreciation expense recognised in the current financial year ending 31 December 2019.

A: Depreciation expense is writing down the value of assets as the asset is used in business. In straig...

Q: Suppose that Al Ma'arif Group is engaged in manufacturing and sales of a seasonal product. Based on ...

A: Level production plan is used where the demand for the product is seasonal. Under this plan units ar...

Q: Discuss auditors' legal liabilities under SOX.

A: SOX refers to Sarbanes and Oxley Act. It is a legislation passed in 2002 to prevent the corporate fr...

Q: ABC Company (ABC), a manufacturer of hybrid engine vehicles, had pretax financial income of P30 bill...

A: Deferred tax liability arises out of the temporary differences between the tax-deductible expenses a...

Q: Alpha Electronics Corp (AEC) manufactures and sells a unique intermediate component part that is wid...

A: Lean Production: It is a method to decrease times within the production system to eliminate wast...

Q: Disregarding business and professional income, how much is the gross compensation income of ROSE for...

A: The calculation of the gross compensation income of ROSE for the taxable income 2019 is shown hereun...

Q: legal

A: Sarbanes-Oxley Act 2002 (SOX) The Act which was implemented by the Congress which can increase the r...

Q: A recent income statement of McClennon Corporation reported the following data: Units so...

A: Number of units to be sold to earn a desired profit of $ 1875,000 = (Fixed cost + Desired profit) /c...

Q: ProTech began business at the start of the current year. The company planned to produce 40,000 units...

A: Absorption costing income can be calculated by deducting the cost of goods sold and other expenses f...

Q: Chandler Company purchased a factory machinery on May 1, 2030 for $133,500 with an estimated 5- year...

A: Depreciation will be charged for only 8 months of usage in the Year 2030

Q: Sarasota Corp. reported net sales $ 600,000, cost of goods sold $ 336,000, operating expenses $ 160,...

A: Profit margin = Net Income / Net sales where, Net Income = Sales - cost of goods sold - operating ex...

Q: A trial balance prepared before any adjustments have been recorded is: Multiple Choice An unadjusted...

A: Trial balance is a statement of all accounts of a business entity with their individual balances sep...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- St. Johns Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMCs Cath Lab. Each technician is paid a salary of 36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for 250,000. It is expected to last five years. The equipments capacity is 25,000 procedures over its life. Depreciation is computed on a straight-line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is 120 per test. The technicians report with the outside physicians note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends 50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMCs business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging 850 for the procedureenough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services). At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be 550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporaryfor one year only. The HMO expects to have its own testing capabilities within one year. Required: 1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources. 2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning. 3. Assume that SJMC will accept the HMO offer if it reduces the hospitals operating costs. Should the HMO offer be accepted? 4. Jerold Bosserman, SJMCs hospital controller, argued against accepting the HMOs offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesnt even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for 550. Discuss the merits of Jerolds position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation. 5. Chandra Denton, SJMCs administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC wont need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of 2,000 per year. How does this outcome affect the analysis of the HMO offer? 6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activitys first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.Ronson recently purchased a new boat to help ship product overseas. The following information is related to that purchase: purchase price $4,500,000 cost to bring boat to production facility $15,000 yearly insurance cost $12,000 pays annual maintenance cost of $22,000 received a 10% discount on sales price Determine the acquisition cost of the boat and record the journal entry needed.

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?

- During the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated five machines for $100,000 to improve efficiency in production of their remaining useful life of five years Low-cost repairs throughout the year totaled $70,000 Replaced a broken gear on a machine for $10,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?When depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.Hicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)

- Two lathes are being considered in the manufacture of certain machine parts. Data is given below, all cost in peso: LATHE A LATHE B First Cost 40,000 56,000 Salvage Value 5,000 7,000 Annual Maintenance 2,000 2,800 Operation, Cost/hour 4 3.5 Life, in years 10 12 Time per part (hours) 0.40 0.25 REQUIRED: If the number of parts is 10,000 units, which lathe will you recommend? Use ROR If the number of parts is 10,000 units, which lathe will you recommend? Use EUACA company owner has asked his accountant to research the photocopier equipment available from vendors, and to recommend the two best equipment alternatives. The company owner will decide on one piece of equipment topurchase. The fee charged for the accountant’s research was $500. The accountant’s report produced the following information: Photocopier (A) Photocopier (B) Initial cost, including installation $6,500 $ 6,000 Economic life 5 years 5 years Scrap value at end of economic life -0- -0- Initial training cost $ 500 $ 700 Annual maintenance $ 400 $ 300 Annual wage cost $12,500 $12,500 REQUIRED 1. Which photocopier should the company owner choose? Why? 2. The company owner requested your help in preparing the coming year company budget. Please, guide him to the best method and appropriate type from your perspective.ABC company pays $262,500 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment:1.During the second year of the equipment’s life, $21,000 cash is paid for for a new component expected to increase the equipment’s productivity by 10% a year.2. During the 3rd year ,$5,250 cash is paid for normal repairs necessary to keep the equipment in good working order.3. During the 4th year, $13,950 is paid for repairs expected to increase the useful life of the equipment from 4 to 5 years.