Oliver CommuRNcations, Inc., began 2018 with 260,000 shares of $1 par common stock issUd and outstarang BagiinR in excoss of par common was St60,000, and retained eamings was $810,000. In April 2018, Oliver Communications, Inc., insued 20 shares of stock at $8 per share. In September, when the stock's market price was $15 per share, the board of directors distributed a 1. percent stock dividend Read the requirements

Oliver CommuRNcations, Inc., began 2018 with 260,000 shares of $1 par common stock issUd and outstarang BagiinR in excoss of par common was St60,000, and retained eamings was $810,000. In April 2018, Oliver Communications, Inc., insued 20 shares of stock at $8 per share. In September, when the stock's market price was $15 per share, the board of directors distributed a 1. percent stock dividend Read the requirements

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 22E

Related questions

Question

Please help me

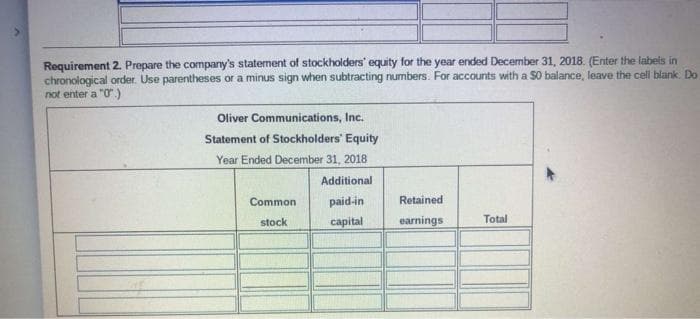

Transcribed Image Text:Requirement 2. Prepare the company's statement of stockholders' equity for the year ended December 31, 2018. (Enter the labels in

chronological order. Use parentheses or a minus sign when subtracting numbers. For accounts with a S0 balance, leave the cell blank Do

not enter a "0".)

Oliver Communications, Inc.

Statement of Stockholders' Equity

Year Ended December 31, 2018

Additional

Common

paid-in

Retained

Total

stock

capital

earnings

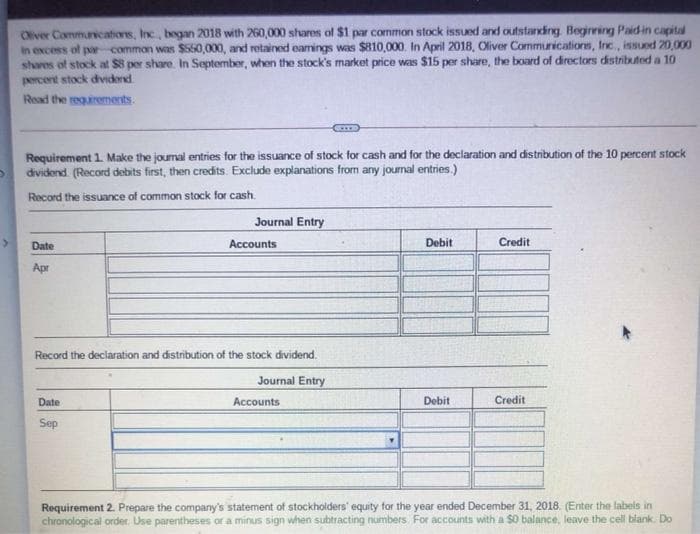

Transcribed Image Text:Oliver Communvcations, Inc, began 2018 with 2G0,000 shares of $1 par common stock issued and outstanding Beginning Paidin capital

in excess of par common was $550,000, and retained eamings was $810,000. In April 2018, Oliver Communications, Inc, issued 20,000

shares of stock at $8 per share. In September, when the stock's market price was $15 per share, the board of directors distributed a 10

percent stock dividend

Read the requirements

Requirement 1 Make the journal entries for the issuance of stock for cash and for the declaration and distribution of the 10 percent stock

dividend (Record debits first, then credits. Exclude explanations from any journal entries.)

Record the issuance of common stock for cash.

Journal Entry

Date

Accounts

Debit

Credit

Apr

Record the deciaration and distribution of the stock dividend.

Journal Entry

Date

Accounts

Debit

Credit

Sep

Requirement 2. Prepare the company's statement of stockholders' equity for the year ended December 31, 2018. (Enter the labels in

chronological order. Use parentheses or a minus sign when subtracting numbers For accounts with a $0 balance, leave the cell blank. Do

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning