umber of the que .HBB Company for the last ten years, has earned and had cash flows of about Php 500,000 every year. As per the predictions of the company's earnings, the same cash flow would continue for the foreseeable future, The expenses for the business every year is about Php 100,000 ohly. Based on the available públic information a Php 4 million Treasury bond has a prevailing return of Php 400,000 annually. Using Capitalization of Earnings approach, what is the value of HBB Company?

umber of the que .HBB Company for the last ten years, has earned and had cash flows of about Php 500,000 every year. As per the predictions of the company's earnings, the same cash flow would continue for the foreseeable future, The expenses for the business every year is about Php 100,000 ohly. Based on the available públic information a Php 4 million Treasury bond has a prevailing return of Php 400,000 annually. Using Capitalization of Earnings approach, what is the value of HBB Company?

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 5EP

Related questions

Question

Transcribed Image Text:FRIXION

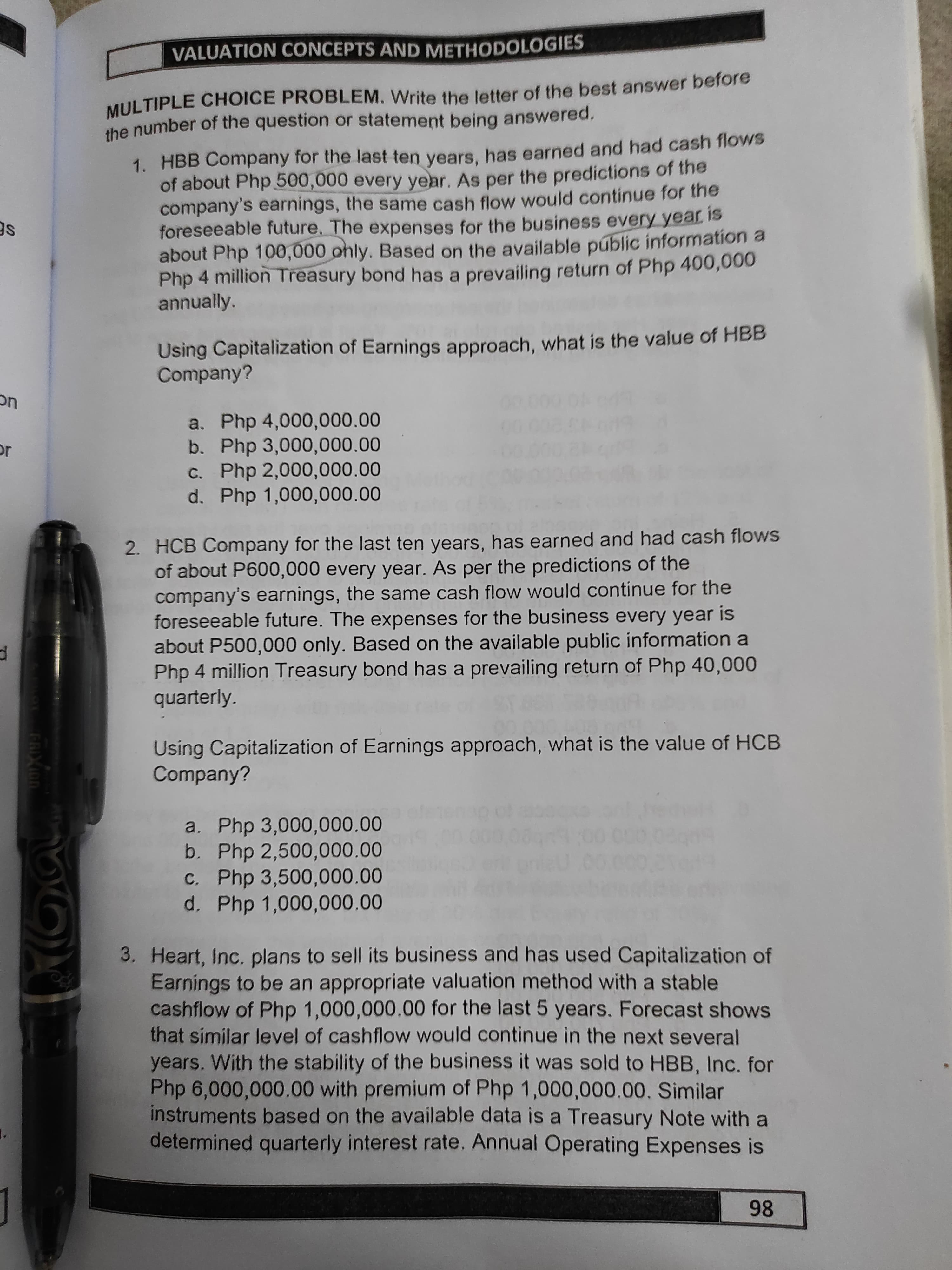

VALUATION CONCEPTS AND METHODOLOGIES

MULTIPLE CHOICE PROBLEM. Write the letter of the best answer before

the number of the question or statement being answered,

1. HBB Company for the last ten years, has earned and had cash flows

of about Php 500,000 every year. As per the predictions of the

company's earnings, the same cash flow would continue for the

foreseeable future, The expenses for the business every year is

about Php 100,000 ohly. Based on the available públic information a

Php 4 million Treasury bond has a prevailing return of Php 400,000

annually.

SE

Using Capitalization of Earnings approach, what is the value of HBB

Company?

uc

a. Php 4,000,000.00

b. Php 3,000,000.00

C. Php 2,000,000.00

d. Php 1,000,000.00

2. HCB Company for the last ten years, has earned and had cash flows

of about P600,000 every year. As per the predictions of the

company's earnings, the same cash flow would continue for the

foreseeable future. The expenses for the business every year is

about P500,000 only. Based on the available public information a

Php 4 million Treasury bond has a prevailing return of Php 40,000

quarterly.

Using Capitalization of Earnings approach, what is the value of HCB

Company?

a. Php 3,000,000.00

b. Php 2,500,000.00

C. Php 3,500,000.00

d. Php 1,000,000.00

3. Heart, Inc. plans to sell its business and has used Capitalization of

Earnings to be an appropriate valuation method with a stable

cashflow of Php 1,000,000.00 for the last 5 years, Forecast shows

that similar level of cashflow would continue in the next several

years. With the stability of the business it was sold to HBB, Inc. for

Php 6,000,000.00 with premium of Php 1,000,000.00. Similar

instruments based on the available data is a Treasury Note with a

determined quarterly interest rate. Annual Operating Expenses is

98

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT