Un Company sold office equipment with a cost of $35,120 and accumulated depreciation of $30,783 for $6,540. Required a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? c. How would the sale affect net income (increase, decrease no effect) and by how much?

Un Company sold office equipment with a cost of $35,120 and accumulated depreciation of $30,783 for $6,540. Required a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? c. How would the sale affect net income (increase, decrease no effect) and by how much?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 20E: (Appendix 11.1) Depreciation for Financial Statements and Income Tax Purposes Dinkle Company...

Related questions

Question

Subject - account

Please help me

Transcribed Image Text:ces

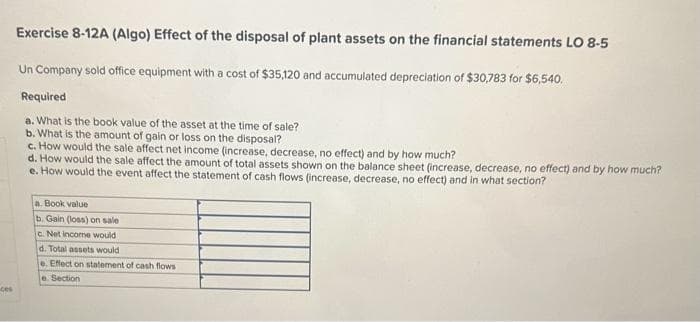

Exercise 8-12A (Algo) Effect of the disposal of plant assets on the financial statements LO 8-5

Un Company sold office equipment with a cost of $35,120 and accumulated depreciation of $30,783 for $6,540.

Required

a. What is the book value of the asset at the time of sale?

b. What is the amount of gain or loss on the disposal?

c. How would the sale affect net income (increase, decrease, no effect) and by how much?

d. How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect) and by how much?

e. How would the event affect the statement of cash flows (increase, decrease, no effect) and in what section?

a. Book value

b. Gain (loss) on sale

c. Net income would

d. Total assets would

e. Effect on statement of cash flows

e. Section

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning