Un January 1, 20x1, Inverse Co. leased a piece of equipment to reimburse, Inc. Information on the lease is as folloWs. Cost of equipment- P600,000 Useful life of equipment- 5 years Lease term- 4 years Annual rental payable at the end of each year - P220,000 The annual lease payment includes P18,098 pertaining to non-lease component. This amount reflects the stand alone selling price of the service. Inverse Co. incurred P40,000 initial direct costs in negotiating the lease. The interest rate implicit in the lease is 10%. How much are (1) the total interest revenue that Inverse Co. will recognize over the lease term and (2) the carying amount of the net investment in the lease on December 31 20x1? O a. 172,342; 462,098 O b. 167,608; 502,098 O . 176,904; 542,098 Od 1 67 G09. G42

Un January 1, 20x1, Inverse Co. leased a piece of equipment to reimburse, Inc. Information on the lease is as folloWs. Cost of equipment- P600,000 Useful life of equipment- 5 years Lease term- 4 years Annual rental payable at the end of each year - P220,000 The annual lease payment includes P18,098 pertaining to non-lease component. This amount reflects the stand alone selling price of the service. Inverse Co. incurred P40,000 initial direct costs in negotiating the lease. The interest rate implicit in the lease is 10%. How much are (1) the total interest revenue that Inverse Co. will recognize over the lease term and (2) the carying amount of the net investment in the lease on December 31 20x1? O a. 172,342; 462,098 O b. 167,608; 502,098 O . 176,904; 542,098 Od 1 67 G09. G42

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 14E: Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease...

Related questions

Question

Can Please Help Me: Accounting / Intermediate Accounting 2

60 minutes only the given time. Wish you could help me.

I will give UPVOTE and GOOD FEEDBACK.

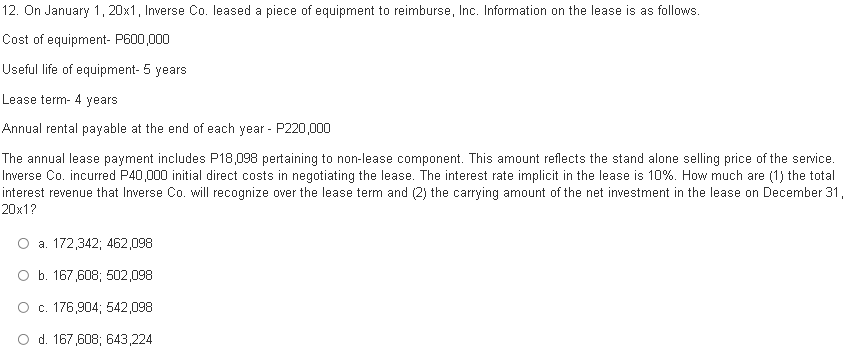

Transcribed Image Text:12. On January 1, 20x1, Inverse Co. leased a piece of equipment to reimburse, Inc. Information on the lease is as follows.

Cost of equipment- P600,000

Useful life of equipment- 5 years

Lease term- 4 years

Annual rental payable at the end of each year - P220,000

The annual lease payment includes P18,098 pertaining to non-lease component. This amount reflects the stand alone selling price of the service.

Inverse Co. incurred P40,000 initial direct costs in negotiating the lease. The interest rate implicit in the lease is 10%. How much are (1) the total

interest revenue that Inverse Co. will recognize over the lease term and (2) the carrying amount of the net investment in the lease on December 31,

20x1?

O a. 172,342; 462,098

O b. 167,608; 502,098

O . 176,904; 542,098

O d. 167,608; 643,224

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning