Ung the eirrent periol to its whholly owned subsidiary, Marcia Lid, for $45 000, These items previously cot Stan Ld 537 500, Marcia Ltd subsequently sold balf the items to an extermal entity for $27 500. The remainder of the inventory was sold outside the group the following yeat. The tax te is 30% Required: Prepare the consolidation journal entries for the current and the following year. At the start of the current period, Stan Ltd sold machinery to its wholly owned subsidiary, Marcia Ltd, for $200 000, Stan Ltd had originally purchased the machinery for $500 000, and at the time of sale had charged depreciation of $375 000. Marcia Ltd uses the machinery differently from Stan Ltd, and applied a 20% p.a. straight-line depreciation rate whlist Stan Ltd used a 10% p.a. straight-line rate. B Required: Prepare the consolidation journal entries to eliminate the gain from sale recorded by Stan Ltd and to restore the cost and accumulated depreciation o the group, and eliminate the excess depreciation recorded by Marcia Ltd. Marcia Ltd declared a dividend in August 2021 of $37 500. In February 2022 Stan Ltd paid an interim dividend of $22 500 and Marcia Ltd paid an interim dividend of S11 250. At the 30th June 2020 there were intercompany accounts balances of S125 000. Marcia Ltd rented a warehouse from Stan Ltd and paid annual rent of $35 000 to Stan Ltd. Required: repare the consolidation journal entries at 30th June 2022 to eliminate the intragroup items.

Ung the eirrent periol to its whholly owned subsidiary, Marcia Lid, for $45 000, These items previously cot Stan Ld 537 500, Marcia Ltd subsequently sold balf the items to an extermal entity for $27 500. The remainder of the inventory was sold outside the group the following yeat. The tax te is 30% Required: Prepare the consolidation journal entries for the current and the following year. At the start of the current period, Stan Ltd sold machinery to its wholly owned subsidiary, Marcia Ltd, for $200 000, Stan Ltd had originally purchased the machinery for $500 000, and at the time of sale had charged depreciation of $375 000. Marcia Ltd uses the machinery differently from Stan Ltd, and applied a 20% p.a. straight-line depreciation rate whlist Stan Ltd used a 10% p.a. straight-line rate. B Required: Prepare the consolidation journal entries to eliminate the gain from sale recorded by Stan Ltd and to restore the cost and accumulated depreciation o the group, and eliminate the excess depreciation recorded by Marcia Ltd. Marcia Ltd declared a dividend in August 2021 of $37 500. In February 2022 Stan Ltd paid an interim dividend of $22 500 and Marcia Ltd paid an interim dividend of S11 250. At the 30th June 2020 there were intercompany accounts balances of S125 000. Marcia Ltd rented a warehouse from Stan Ltd and paid annual rent of $35 000 to Stan Ltd. Required: repare the consolidation journal entries at 30th June 2022 to eliminate the intragroup items.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Please help me

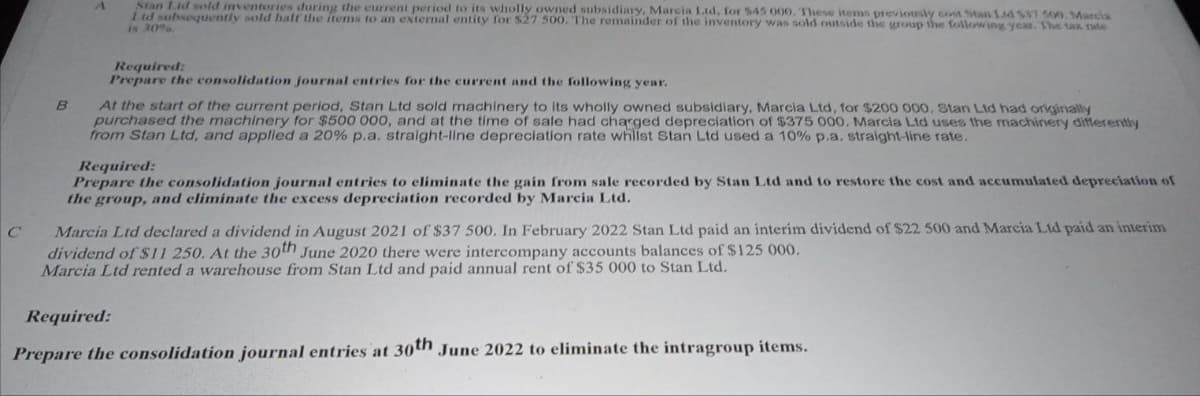

Transcribed Image Text:Stan Lid sold inventories during the current period to its wholly owned subsidiary, Marcia Ltd, for $45 000, These items previously cont Stan S46 S37500,Marca

Ltd subsequently sold halt the items to an external entity for $27 500. The remainder of the inventory was ssold outside the group the following year. The tax rate

is 30

Required:

Prepare the consolidation journal entries for the current and the following year.

At the start of the current period, Stan Ltd sold machinery to its wholly owned subsidiary, Marcia Ltd, for $200 000, Stan Ltd had originally

purchased the machinery for $500 000, and at the time of sale had charged depreciation of $375 000. Marcia Ltd uses the machinery differently

from Stan Ltd, and appled a 20% p.a. straight-line depreciation rate whilst Stan Ltd used a 10% p.a. straight-line rate.

B

Required:

Prepare the consolidation journal entries to eliminate the gain from sale recorded by Stan Ltd and to restore the cost and accumulated depreciation of

the group, and climinate the excess depreciation recorded by Marcia Ltd.

Marcia Ltd declared a dividend in August 2021 of $37 500. In February 2022 Stan Ltd paid an interim dividend of $22 500 and Marcia Ltd paid an interim

dividend of $11 250. At the 30th June 2020 there were intercompany accounts balances of $125 000.

Marcia Ltd rented a warehouse from Stan Ltd and paid annual rent of $35 000 to Stan Ltd.

Required:

Prepare the consolidation journal entries at 30th June 2022 to eliminate the intragroup items.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning