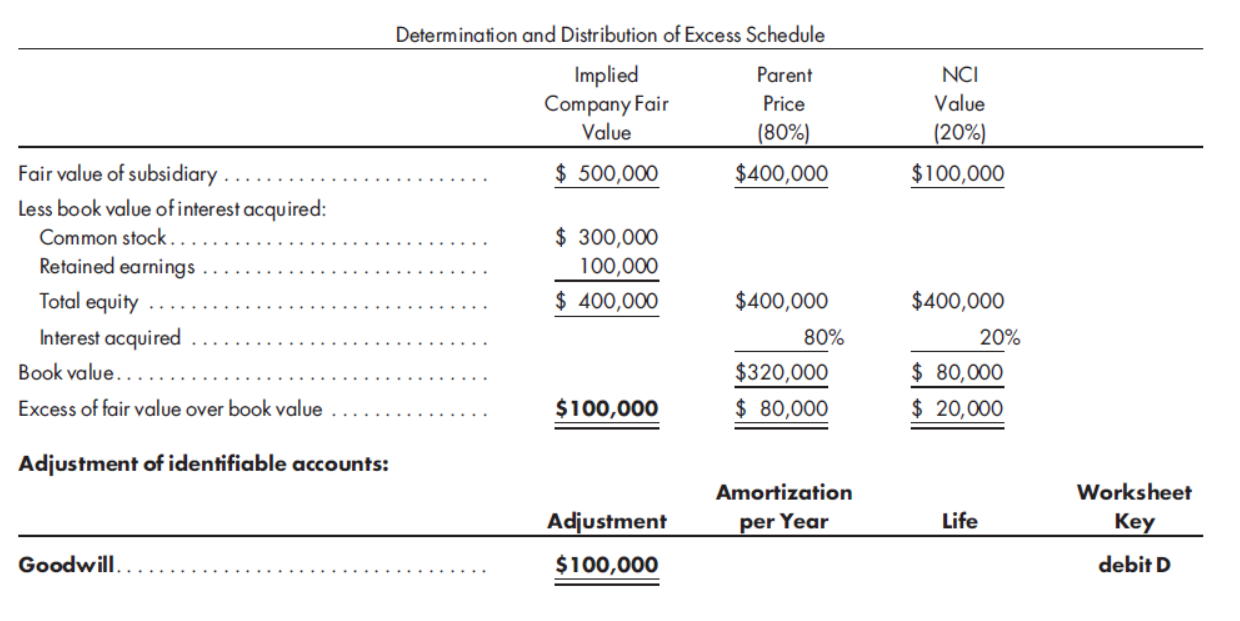

Determination and Distribution of Excess Schedule Implied Company Fair Value Parent NCI Price Value (80%) (20%) Fair value of subsidiary . $ 500,000 $400,000 $100,000 Less book value of interest acquired: Common stock.. Retained earnings $ 300,000 100,000 Total equity $ 400,000 $400,000 $400,000 Interest acquired 80% 20% Book value.. $ 80,000 $ 20,000 $320,000 Excess of fair value over book value $100,000 $ 80,000 Adjustment of identifiable accounts: Amortization Worksheet Adjustment per Year Life Key Goodwill.. $100,000 debit D

On May 1, 2016, Tole Company acquires a 80% interest in Marco Company for $400,000. The fair value of the NCI is $100,000. The following determination and distribution of excess schedule is prepared:(attached)

Tole Company Marco Company

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . .$750,000 $600,000

Less cost of goods sold. . . . . . . . . . .440,000 350,000

Gross profit . . . . . . . . . . . . . . . . . . . . .$310,000 $250,000

Less other expenses . . . . . . . . . . . . . .250,000 140,000

Income before dividends . . . . . . . . $110,000 $110,000

Dividends received . . . . . . . . . . . . . . . 17,500

Income before tax . . . . . . . . . . . . . . . $127,500 $110,000

During 2018,Marco Company pays cash dividends of $25,000. Prepare the entry to record income tax payable on each company’s books. Assume a 30% corporate income tax rate.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images