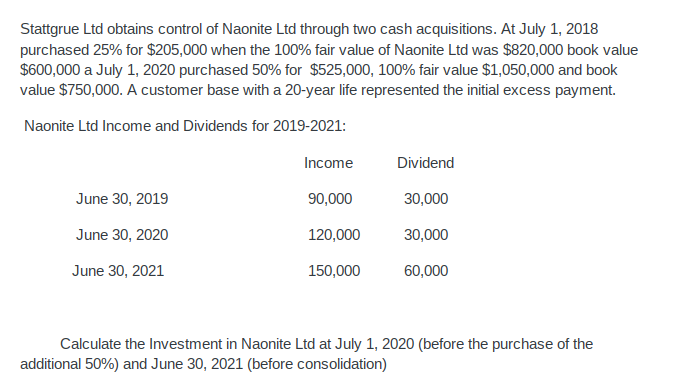

Stattgrue Ltd obtains control of Naonite Ltd through two cash acquisitions. At July 1, 2018 purchased 25% for $205,000 when the 100% fair value of Naonite Ltd was $820,000 book value $600,000 a July 1, 2020 purchased 50% for $525,000, 100% fair value $1,050,000 and book value $750,000. A customer base with a 20-year life represented the initial excess payment.

Stattgrue Ltd obtains control of Naonite Ltd through two cash acquisitions. At July 1, 2018 purchased 25% for $205,000 when the 100% fair value of Naonite Ltd was $820,000 book value $600,000 a July 1, 2020 purchased 50% for $525,000, 100% fair value $1,050,000 and book value $750,000. A customer base with a 20-year life represented the initial excess payment.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:Stattgrue Ltd obtains control of Naonite Ltd through two cash acquisitions. At July 1, 2018

purchased 25% for $205,000 when the 100% fair value of Naonite Ltd was $820,000 book value

$600,000 a July 1, 2020 purchased 50% for $525,000, 100% fair value $1,050,000 and book

value $750,000. A customer base with a 20-year life represented the initial excess payment.

Naonite Ltd Income and Dividends for 2019-2021:

Income

Dividend

June 30, 2019

90,000

30,000

June 30, 2020

120,000

30,000

June 30, 2021

150,000

60,000

Calculate the Investment in Naonite Ltd at July 1, 2020 (before the purchase of the

additional 50%) and June 30, 2021 (before consolidation)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning