Uning the tax brackets and rates for 2014, compute the tutal tax for each of the fullwing income les fornge tp each c caate veage and margl te Ame ahcatelapa d the standard deduction of $4200 and qualfes for single comption Asingle texpayer eaming $25.000 would pay tas ofSwith an average tax ate of percent and a margnal t ate of percent Rud your epons decimal places)

Uning the tax brackets and rates for 2014, compute the tutal tax for each of the fullwing income les fornge tp each c caate veage and margl te Ame ahcatelapa d the standard deduction of $4200 and qualfes for single comption Asingle texpayer eaming $25.000 would pay tas ofSwith an average tax ate of percent and a margnal t ate of percent Rud your epons decimal places)

Chapter16: Property Transactions: Capital Gains And Losses

Section: Chapter Questions

Problem 48P

Related questions

Question

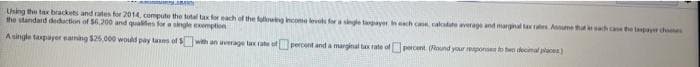

Transcribed Image Text:Uhing thu tax brackets and rates for 2014, compute the total taxfor each of the folkwing incon levels for asngle tarpayer ineach cane alcatate average and marginal lax a A me tht ach case he laspar choe

the standard deduction of $6,200 and qualies for asingle eomption

A single taxpayer earming $25,000 woukd pay taes of $with an average tax rate of percent and a marginal tax tate of percent. (ound your espona to hwo decimal lacea)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning