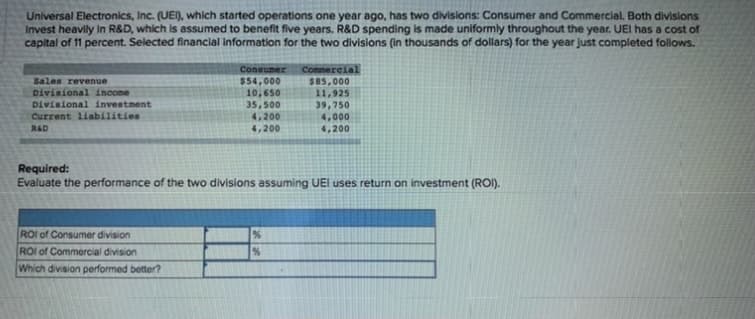

Universal Electronics, Inc. (UEI), which started operations one year ago, has two divisIOn Invest heavily in R&D, which is assumed to benefit five years. R&D spending is made uniformly throughout the year. UEI has a cost of capital of 11 percent. Selected financial information for the two divisions (in thousands of dollars) for the year just completed follows. ner and Commercial. Both divisions Consuner $54,000 10,650 35,500 4,200 4,200 Comnercial $85,000 11,925 39,750 4,000 4,200 Sales revenue Divisional inoone Diviaional investnent Current liabilities RAD Required: Evaluate the performance of the two divisions assuming UEl uses return on investment (ROI).

Q: Stable Enterprises is organized into two geographic divisions (Asia and Europe) and a corporate…

A: Variable cost: Costs which vary with the level of output. Eg: material cost, labor cost etc. Fixed…

Q: Scott Healthcare provides a walk-in clinic for its patients and a pharmacy for any medication…

A: Calculation of various ratios: Excel workings:

Q: Jasper Corporation is organized in three separate divisions. The three divisional managers are…

A: If the Return on Investment (ROI) on the new opportunity is more than the existing ROI, then the new…

Q: Complete the following Divisional Income Statements. If there is no amount or an amount is zero,…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Payback period is the period in which total investment made into a project is returned ignoring the…

Q: Creative Business Solutions (CBS), a division of Doug Jorgenson CPA, buys and installs modular…

A: SEGMENT MARGIN FOR CBS : PARTICULARS AMOUNT $ SALES $9,000,000 VARIABLE OPERATING COST…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Net Present value = Present value of cash inflows - Present value of cash outflows Payback Period…

Q: Mr. Bailey asks that you prepare Divisional Income Statements showing what 20Y1 results would have…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Back Mountain Industries (BMI) has two divisions: East and West. BMI has a cost of capital of 15…

A: Formula: Residual income = Income - ( cost of capital x Average operating Assets )

Q: Jasper Corporation is organized in three separate divisions. The three divisional managers are…

A: Under the residual income approach, if the residual income after undertaking the new opportunity is…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A:

Q: Book of Life has a current return on investment of 10% and the company has established an 8% minimum…

A: Residual value = Annual controllable margin - Operating assets x minimum rate of return

Q: Required: 1. Calculate the payback period for each product. 2. Calculate the net present value…

A: Pay Back period is calculated by the Business Entities to know that in how many years their…

Q: Back Mountain Industries (BMI) has two divisions: East and West BMI has a cost of capital of 10…

A: Investment: It is an asset or item which is purchased and held to generate income or for…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: “As the question has more than 3 sub-parts, the first 3 subparts are answered. If you want the…

Q: The Campus Division of All-States Bank has assets of $1,800 million. During the past year, the…

A: Return on investment is calculated by dividing after tax income by the divisional assets.

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Calculation of Annual net cash inflow: Product A Product B Annual Sales revenue $380,000…

Q: ivision of Pitt, Inc., a manufacturer of biotech products. Forbes Division, which has $4.08 million…

A: Return on investment Return on income is used as a measure to the divisional performance. This a…

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Solution 1: Total net operating income for division after making additional investment = $2,100,000…

Q: A company's invested capital is $13,000,000 and management has determined that the target rate of…

A: Operating income: A company's operating income is the amount of profit it makes after subtracting…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: PI stands for Profitability index which states the relationship among the costs as well as the…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Net present value method: Net present value method is the method which is used to compare the…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Profitability index compares the present value of inflow and present value of outflow of a project.…

Q: Jasper Corporation is organized in three separate divisions. The three divisional managers are…

A: Return on investment: A realized gain on the investment is called return on investment. If their a…

Q: Sunland Corporation recently announced a bonus plan to reward the manager of its most profitable…

A: The question is based on the concept of Cost Accounting.

Q: Required: 3. Calculate the internal rate of return for each product. 4. Calculate the…

A: Internal Rate of return is that Rate of Return upon which Present Value of Cash Inflows is Equal to…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Internal rate of return : It is the return that the project is estimated to generate to cover its…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Products A Cost =330000 Revenue =370000 Cost =168000+66000+82000=316000 Product B Cost =515000…

Q: Mr. Sy is the general manager of the XXX Division, and his performance is measured using the…

A: Residual Income: Residual income in corporate finance means that excess income earned beyond the…

Q: ) Khesrow Sadiqi is chief operations officer for Herat Manufacturing, and has been given an…

A: Profitability index is simply equal to present value of cash inflows divided by initial investment…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Blossom Industries operates as an investment center. Buddy Hall, the region's division manager, has…

A: Economic Value added is the rate of return earned over and above the minimum required rate of return…

Q: Creative Business Solutions (CBS), a division of Doug Jorgenson CPA, buys and installs modular…

A: WORKING : 1. SEGMENT MARGIN FOR CBS : PARTICULARS AMOUNT $ SALES $9,000,000 VARIABLE…

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Solution 1: Annual operating income of division after making additional investment = $1,820,000 +…

Q: Lumberton Home Maintenance Company (LHMC) earned operating income of $6,000,000 on operating assets…

A: Definition: Return on Investment tells about the percentage of return obtained on total investment.…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: As you have posted multiple sub-parts and have not mentioned which are to be answered, I am…

Q: Calculate the payback period for each product. 2. Calculate the net present value for each product.…

A: Payback Period: It refers to the period in which an investment or a project recovers its initial…

Q: You have been recently promoted to the divisional manager of Hadi Ltd (“the Company”), a company…

A: Hadi Ltd.'s Head office expects the controllable profit of a division = 35% sales For the month of…

Q: Mr. Bailey asks that you prepare Divisional Income Statements showing what 20Y1 results would have…

A: Audit division refers is an independent activity which is designed for improving the operations of…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Karim Ahmed, a recent graduate of an accounting program, evaluated the operating performance of…

A: Under Incremental analysis only those eliminates will be consider which will effected if division…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Hey, since there are multiple requirements posted, we will answer the first three requirements. If…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Workings:

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Average operating assets after investment = $7,300,000 + 700,000 = $8,000,000 Average operating…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.Evans Company had total sales of 3,000,000 for fiscal 20x5. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution. 3. What if, five years from now, quality costs are 7.5 percent of sales, with control costs being 65 percent of the total quality costs? What would your conclusion be?Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).

- In 20x4, Tru-Delite Frozen Desserts, Inc., instituted a quality improvement program. At the end of 20x5, the management of the corporation requested a report to show the amount saved by the measures taken during the year. The actual sales and quality costs for 20x4 and 20x5 are as follows: Tru-Delites management believes that quality costs can be reduced to 2.5 percent of sales within the next five years. At the end of 20x9, Tru-Delites sales are projected to grow to 750,000. The projected relative distribution of quality costs at the end of 20x9 is as follows: Required: 1. Profits increased by what amount due to quality improvements made in 20x5? 2. Prepare a long-range performance report that compares the quality costs incurred at the end of 20x5 with the quality cost structure expected at the end of 20x9. 3. Are the targeted costs in the year 20x9 all value-added costs? How would you interpret the variances if the targeted costs are value-added costs? 4. What would be the profit increase in 20x9 if the 2.5 percent performance standard is met in that year?Foy Company has a welding activity and wants to develop a flexible budget formula for the activity. The following resources are used by the activity: Four welding units, with a lease cost of 12,000 per year per unit Six welding employees each paid a salary of 50,000 per year (A total of 9,000 welding hours are supplied by the six workers.) Welding supplies: 300 per job Welding hours: Three hours used per job During the year, the activity operated at 90 percent of capacity and incurred the actual activity and resource costs, shown on page 676. Lease cost: 48,000 Salaries: 315,000 Parts and supplies: 805,000 Required: 1. Prepare a flexible budget formula for the welding activity using welding hours as the driver. 2. Prepare a performance report for the welding activity. 3. What if welders were hired through outsourcing and paid 30 per hour (the welding equipment is provided by Foy)? Repeat Requirement 1 for the outsourcing case.Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 23% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 290,000 $ 490,000 Annual revenues and costs: Sales revenues $ 340,000 $ 440,000 Variable expenses $ 154,000 $ 206,000 Depreciation expense $ 58,000 $ 98,000 Fixed out-of-pocket operating costs $ 79,000 $ 59,000 The company’s discount rate is 15%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate…Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 23% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 290,000 $ 490,000 Annual revenues and costs: Sales revenues $ 340,000 $ 440,000 Variable expenses $ 154,000 $ 206,000 Depreciation expense $ 58,000 $ 98,000 Fixed out-of-pocket operating costs $ 79,000 $ 59,000 The company’s discount rate is 15%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. 4. Calculate the profitability index for each product. 5. Calculate the simple rate of return for each product. 6a. For each measure, identify…Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 19% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 180,000 $ 390,000 Annual revenues and costs: Sales revenues $ 270,000 $ 360,000 Variable expenses $ 130,000 $ 180,000 Depreciation expense $ 44,000 $ 86,000 Fixed out-of-pocket operating costs $ 80,000 $ 60,000 The company’s discount rate is 16%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. Required: 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the profitability index for each…

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 19% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 180,000 $ 390,000 Annual revenues and costs: Sales revenues $ 270,000 $ 360,000 Variable expenses $ 130,000 $ 180,000 Depreciation expense $ 44,000 $ 86,000 Fixed out-of-pocket operating costs $ 80,000 $ 60,000 The company’s discount rate is 16%. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product.Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 19% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 180,000 $ 390,000 Annual revenues and costs: Sales revenues $ 270,000 $ 360,000 Variable expenses $ 130,000 $ 180,000 Depreciation expense $ 44,000 $ 86,000 Fixed out-of-pocket operating costs $ 80,000 $ 60,000 The company’s discount rate is 16%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. Required: 3. Calculate the internal rate of return for each product. Calculate the internal rate of return for each product. (Round your percentage answers to 1…Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial Investment: Cost of Equipment (zero salvage value) $170,000 $380,000 Annual Revenues and Costs: Sales Revenue $250,000 $350,000 Variable expenses $120,000 $170,000 Depreciation Expenses $34,000 $76,000 Fixed out-of-pocket operating…