Universal Exporting has three warehouse employees: John Abner earns $422 per week, Anne Clark earns $510 per week, and Todd Corbin earns $695 per week. The company's SUTA tax rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. a. How much SUTA and FUTA tax does the company owe on these employees for the first quarter of the year?

Universal Exporting has three warehouse employees: John Abner earns $422 per week, Anne Clark earns $510 per week, and Todd Corbin earns $695 per week. The company's SUTA tax rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. a. How much SUTA and FUTA tax does the company owe on these employees for the first quarter of the year?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.2: Recording Employer Payroll Taxes

Problem 2AYU

Related questions

Question

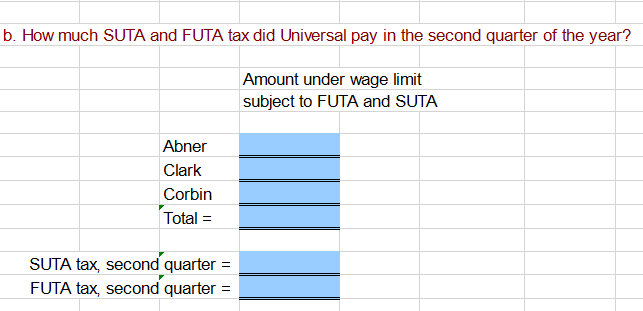

Transcribed Image Text:b. How much SUTA and FUTA tax did Universal pay in the second quarter of the year?

Amount under wage limit

subject to FUTA and SUTA

Abner

Clark

Corbin

Total =

SUTA tax, second quarter =

FUTA tax, second quarter =

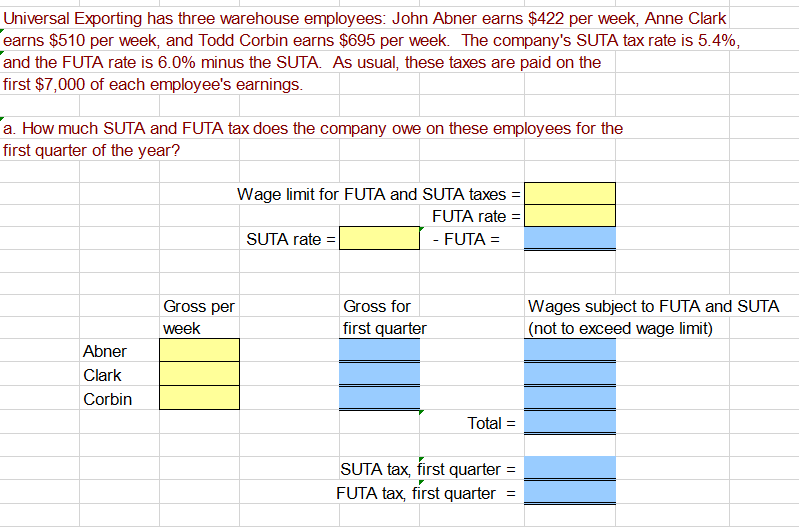

Transcribed Image Text:Universal Exporting has three warehouse employees: John Abner earns $422 per week, Anne Clark

earns $510 per week, and Todd Corbin earns $695 per week. The company's SUTA tax rate is 5.4%,

and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the

first $7,000 of each employee's earnings.

a. How much SUTA and FUTA tax does the company owe on these employees for the

first quarter of the year?

Wage limit for FUTA and SUTA taxes =

FUTA rate

SUTA rate =

FUTA =

Gross per

Gross for

Wages subject to FUTA and SUTA

week

first quarter

(not to exceed wage limit)

Abner

Clark

Corbin

Total =

SUTA tax, first quarter =

FUTA tax, first quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College