Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method table

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method table

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BD

Related questions

Question

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent.

Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method table

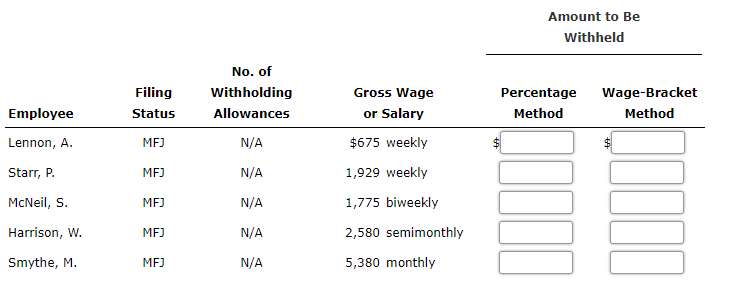

Transcribed Image Text:Amount to Be

Withheld

No. of

Filing

withholding

Gross Wage

Percentage

Wage-Bracket

Employee

Allowances

or Salary

Method

Method

Status

Lennon, A.

MFJ

N/A

$675 weekly

Starr, P.

MFJ

N/A

1,929 weekly

McNeil, S.

MFJ

N/A

1,775 biweekly

Harrison, W.

MFJ

N/A

2,580 semimonthly

Smythe, M.

MFJ

N/A

5,380 monthly

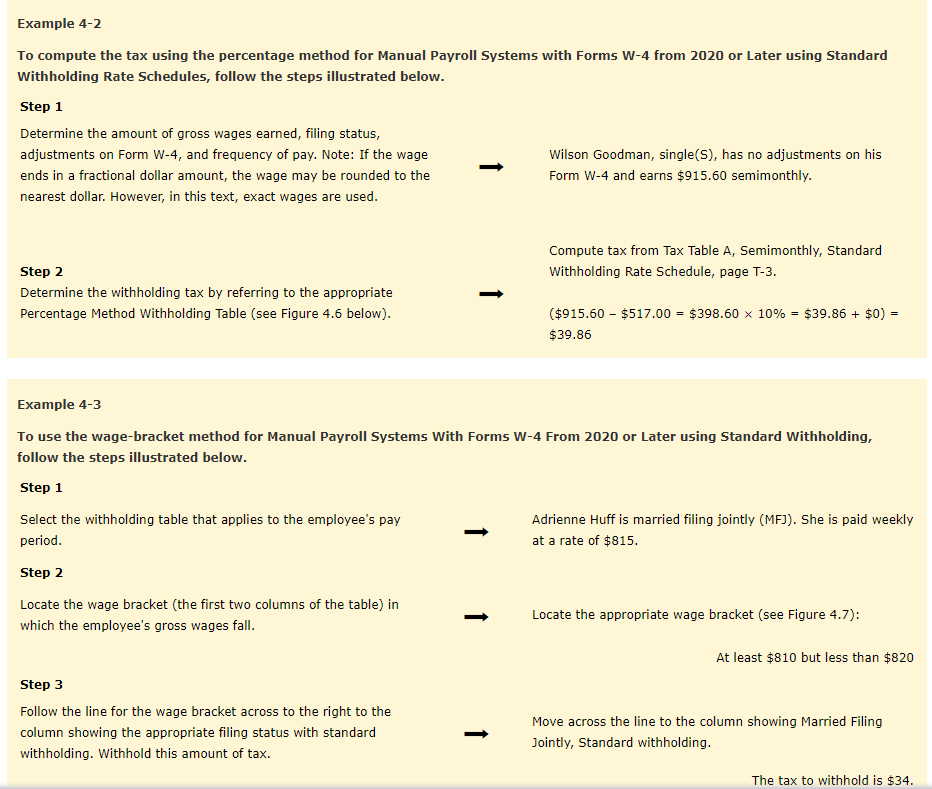

Transcribed Image Text:Example 4-2

To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 from 2020 or Later using Standard

Withholding Rate Schedules, follow the steps illustrated below.

Step 1

Determine the amount of gross wages earned, filing status,

adjustments on Form W-4, and frequency of pay. Note: If the wage

Wilson Goodman, single(S), has no adjustments on his

ends in a fractional dollar amount, the wage may be rounded to the

Form W-4 and earns $915.60 semimonthly.

nearest dollar. However, in this text, exact wages are used.

Compute tax from Tax Table A, Semimonthly, Standard

Step 2

Withholding Rate Schedule, page T-3.

Determine the withholding tax by referring to the appropriate

Percentage Method Withholding Table (see Figure 4.6 below).

($915.60 - $517.00 = $398.60 x 10% = $39.86 + $0) =

$39.86

Example 4-3

To use the wage-bracket method for Manual Payroll Systems With Forms W-4 From 2020 or Later using Standard Withholding,

follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee's pay

Adrienne Huff is married filing jointly (MFJ). She is paid weekly

period.

at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in

Locate the appropriate wage bracket (see Figure 4.7):

which the employee's gross wages fall.

At least $810 but less than $820

Step 3

Follow the line for the wage bracket across to the right to the

Move across the line to the column showing Married Filing

column showing the appropriate filing status with standard

Jointly, Standard withholding.

withholding. Withhold this amount of tax.

The tax to withhold is $34.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning