Upon inspection of the records of Ally Company, the following facts were discovered for ended December 31, 2017. A fire insurance premium of 120,000 was paid and charge ance expense for 2017. The fire insurance policy covers one year from April 1, 2017. Inventory on January 1, 2017 was overstated by 80,000. Inventory on December 31, 2 overstated by 120,000. Taxes of 60,000 for the fourth quarter of 2017 were paid on Januan and charged as expense of 2018. On December 5, 2017 a cash advance of 90,000 by a customer was received for goods ered in January 2018. The amount of 90,000 was credited to sales. The gross profit on sal CEO 000

Upon inspection of the records of Ally Company, the following facts were discovered for ended December 31, 2017. A fire insurance premium of 120,000 was paid and charge ance expense for 2017. The fire insurance policy covers one year from April 1, 2017. Inventory on January 1, 2017 was overstated by 80,000. Inventory on December 31, 2 overstated by 120,000. Taxes of 60,000 for the fourth quarter of 2017 were paid on Januan and charged as expense of 2018. On December 5, 2017 a cash advance of 90,000 by a customer was received for goods ered in January 2018. The amount of 90,000 was credited to sales. The gross profit on sal CEO 000

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PA: The following accounts appear in the ledger of Celso and Company as of June 30, the end of this...

Related questions

Question

If the errors were discovered in January 2018, what must be the

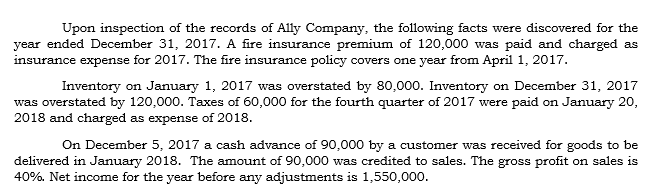

Transcribed Image Text:Upon inspection of the records of Ally Company, the following facts were discovered for the

year ended December 31, 2017. A fire insurance premium of 120,000 was paid and charged as

insurance expense for 2017. The fire insurance policy covers one year from April 1, 2017.

Inventory on January 1, 2017 was overstated by 80,000. Inventory on December 31, 2017

was overstated by 120,000. Taxes of 60,000 for the fourth quarter of 2017 were paid on January 20,

2018 and charged as expense of 2018.

On December 5, 2017 a cash advance of 90,000 by a customer was received for goods to be

delivered in January 2018. The amount of 90,000 was credited to sales. The gross profit on sales is

40%. Net income for the year before any adjustments is 1,550,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning