At the end of October, the ABC Company needed to make accrual adjustments to the accounts, using the following information: Depreciation for the month is £50 An inventory count on October 31 revealed that 125units were in the company’s warehouse. The cost flow assumption followed for the preparation of statements is FIFO. On September 1, ABC Company issued a 3-month, annual rate 6%, $1,000 Note Payable to Credit Bank. Capital and interest are to be paid at the end of November. Prepare a worksheet showing the October transactions and the October accrual adjustments for the ABC Company. The work sheet is attached below, which is solvevd. But I wonder how to get the lastest amount of inventory, which is 125? Can you please show me the calculation process?

At the end of October, the ABC Company needed to make accrual adjustments to the accounts, using the following information: Depreciation for the month is £50 An inventory count on October 31 revealed that 125units were in the company’s warehouse. The cost flow assumption followed for the preparation of statements is FIFO. On September 1, ABC Company issued a 3-month, annual rate 6%, $1,000 Note Payable to Credit Bank. Capital and interest are to be paid at the end of November. Prepare a worksheet showing the October transactions and the October accrual adjustments for the ABC Company. The work sheet is attached below, which is solvevd. But I wonder how to get the lastest amount of inventory, which is 125? Can you please show me the calculation process?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5EB: Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On...

Related questions

Topic Video

Question

100%

At the end of October, the ABC Company needed to make accrual adjustments to the accounts, using the following information:

Depreciation for the month is £50- An inventory count on October 31 revealed that 125units were in the company’s warehouse. The cost flow assumption followed for the preparation of statements is FIFO.

- On September 1, ABC Company issued a 3-month, annual rate 6%, $1,000 Note Payable to Credit Bank. Capital and interest are to be paid at the end of November.

- Prepare a worksheet showing the October transactions and the October accrual adjustments for the ABC Company.

The work sheet is attached below, which is solvevd. But I wonder how to get the lastest amount of inventory, which is 125?

Can you please show me the calculation process?

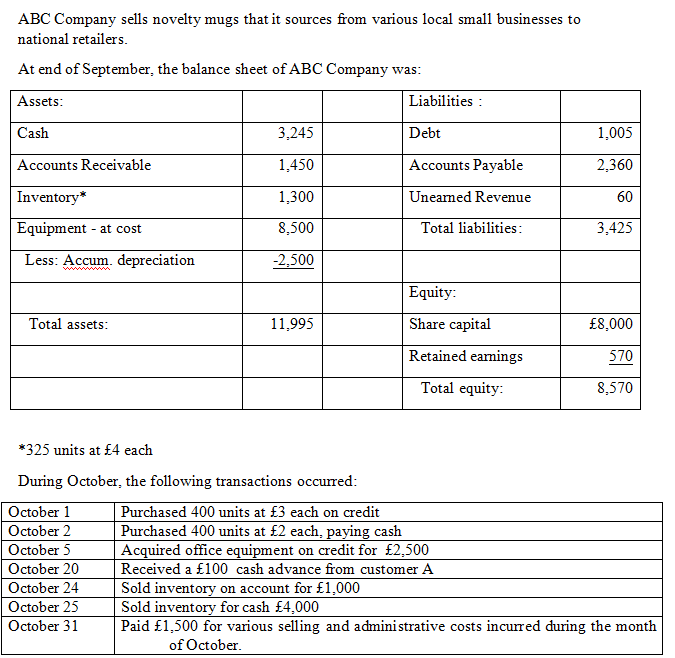

Transcribed Image Text:ABC Company sells novelty mugs that it sources from various local small businesses to

national retailers.

At end of September, the balance sheet of ABC Company was:

Assets:

Liabilities :

Cash

3,245

Debt

1,005

Accounts Receivable

1,450

Accounts Payable

2,360

Inventory*

1,300

Uneamed Revenue

60

Equipment - at cost

8,500

Total liabilities:

3,425

Less: Accum. depreciation

-2,500

Equity:

Total assets:

11,995

Share capital

£8,000

Retained eamings

570

Total equity:

8,570

*325 units at £4 each

During October, the following transactions occurred:

Purchased 400 units at £3 each on credit

Purchased 400 units at £2 each, paying cash

Acquired office equipment on credit for £2,500

October 1

October 2

October 5

October 20

Received a £100 cash advance from customer A

October 24

Sold inventory on account for £1,000

Sold inventory for cash £4,000

Paid £1,500 for various selling and administrative costs incurred during the month

October 25

October 31

of October.

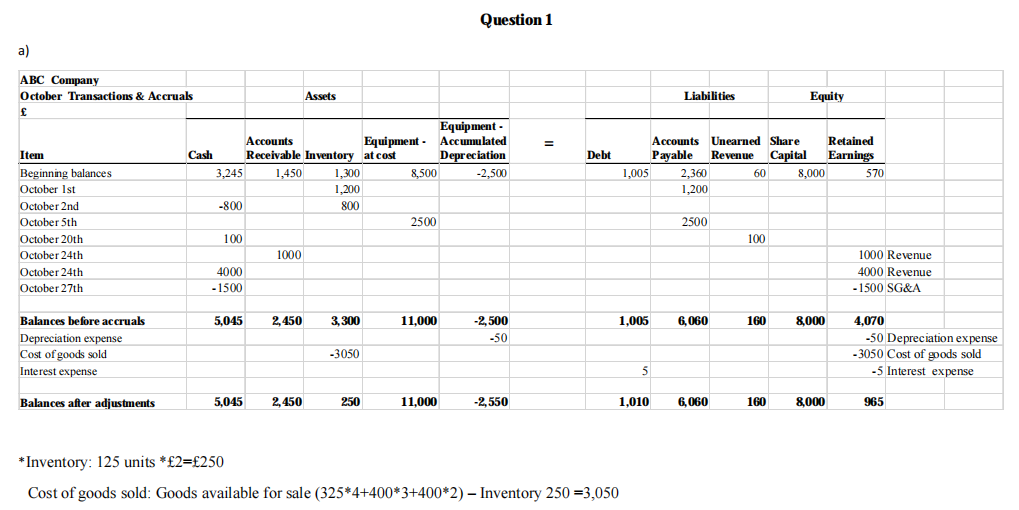

Transcribed Image Text:Question 1

a)

АВС Соmрanу

October Transactions & Accruals

Assets

Liabilities

Equity

Equipment -

Equipment - Accumulated

Depreciation

Аcсounts

Accounts Unearned Share

Retained

Revenue Capital

Earnings

Item

Beginning balances

Cash

Receivable Inventory at cost

Debt

Payable

1,300

1,200

3,245

1,450

8,500

-2,500

1,005

2,360

60

8,000

570

October 1st

1,200

October 2nd

-800

800

October 5th

2500

2500

October 20th

100

100

October 24th

1000

1000 Revenue

October 24th

4000

4000 Revenue

October 27th

-1500

-1500 SG&A

Balances before accruals

5,045

2,450

3,300

11,000

-2,500

1,005

6,060

160

8,000

4,070

-50 Depreciation expense

-3050 Cost of goods sold

Depreciation expense

-50

Cost of goods sold

-3050

Interest expense

-5 Interest expense

Balances after adjustments

5,045

2,450

11,000

250

-2,550

1,010

6,060

160

8,000

965

* Inventory: 125 units *£2=£250

Cost of goods sold: Goods available for sale (325*4+400*3+400*2) – Inventory 250 =3,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub