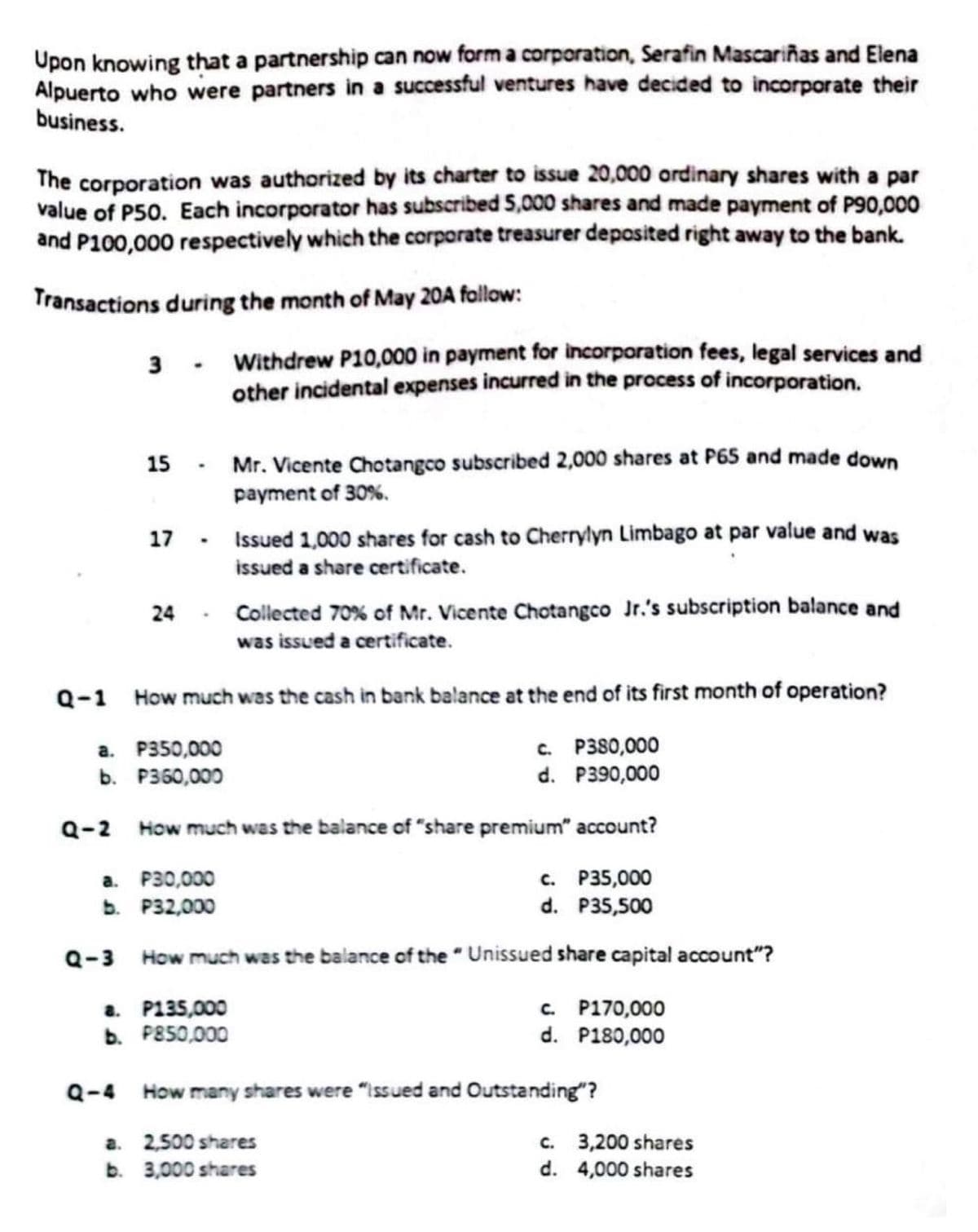

Upon knowing that a partnership can now form a corporation, Serafin Mascariñas and Elena Alpuerto who were partners in a successful ventures have decided to incorporate their business. The corporation was authorized by its charter to issue 20,000 ordinary shares with a par value of P50. Each incorporator has subscribed 5,000 shares and made payment of P90,000 and P100,000 respectively which the corporate treasurer deposited right away to the bank. Transactions during the month of May 20A follow: 3 - Withdrew P10,000 in payment for incorporation fees, legal services and other incidental expenses incurred in the process of incorporation.

Upon knowing that a partnership can now form a corporation, Serafin Mascariñas and Elena Alpuerto who were partners in a successful ventures have decided to incorporate their business. The corporation was authorized by its charter to issue 20,000 ordinary shares with a par value of P50. Each incorporator has subscribed 5,000 shares and made payment of P90,000 and P100,000 respectively which the corporate treasurer deposited right away to the bank. Transactions during the month of May 20A follow: 3 - Withdrew P10,000 in payment for incorporation fees, legal services and other incidental expenses incurred in the process of incorporation.

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 53P

Related questions

Question

100%

please answer thanks.

Transcribed Image Text:Upon knowing that a partnership can now form a corporation, Serafin Mascariñas and Elena

Alpuerto who were partners in a successful ventures have decided to incorporate their

business.

The corporation was authorized by its charter to issue 20,000 ordinary shares with a par

value of P50. Each incorporator has subscribed 5,000 shares and made payment of P90,000

and P100,000 respectively which the corporate treasurer deposited right away to the bank.

Transactions during the month of May 20A follow:

3 - Withdrew P10,000 in payment for incorporation fees, legal services and

other incidental expenses incurred in the process of incorporation.

15

17

.

P350,000

a.

b. P360,000

Q-4

24- Collected 70% of Mr. Vicente Chotangco Jr.'s subscription balance and

was issued a certificate.

Q-1 How much was the cash in bank balance at the end of its first month of operation?

c. P380,000

d. P390,000

Q-2 How much was the balance of "share premium" account?

a. P30,000

b. P32,000

Mr. Vicente Chotangco subscribed 2,000 shares at P65 and made down

payment of 30%.

Issued 1,000 shares for cash to Cherrylyn Limbago at par value and was

issued a share certificate.

c. P35,000

d. P35,500

Q-3 How much was the balance of the "Unissued share capital account"?

a. P135,000

b. P850,000

c. P170,000

d. P180,000

How many shares were "Issued and Outstanding"?

2,500 shares

a.

b. 3,000 shares

c.

3,200 shares

d. 4,000 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you