uppose that in January 2006, Kenneth Cole Productions had sales of $535 million, EBITDA of $56.5 million, excess cash of $105 million, $3.8 million of debt, and 22 million shares outstanding. Use the multiples approach estimate KCP's value based on the following data om comparable firms: E Using the average enterprise value to sales multiple in the table above, estimate KCP's share price. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above. Using the average enterprise value to EBITDA multiple in the table above, estimate KCP's share price. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

uppose that in January 2006, Kenneth Cole Productions had sales of $535 million, EBITDA of $56.5 million, excess cash of $105 million, $3.8 million of debt, and 22 million shares outstanding. Use the multiples approach estimate KCP's value based on the following data om comparable firms: E Using the average enterprise value to sales multiple in the table above, estimate KCP's share price. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above. Using the average enterprise value to EBITDA multiple in the table above, estimate KCP's share price. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 2MAD: Analyze and compare Bank of America and Wells Fargo Bank of America Corporation (BAC) and Wells...

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

Help me and i dont need handwritten i want in text only

Transcribed Image Text:Suppose that in January 2006, Kenneth Cole Productions had sales of $535 million, EBITDA of $56.5 million, excess cash of $105 million, $3.8 million of debt, and 22 million shares outstanding. Use the multiples approach to estimate KCP's value based on the following data

from comparable firms:

a. Using the average enterprise value to sales multiple in the table above, estimate KCP's share price.

b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above.

c. Using the average enterprise value to EBITDA multiple in the table above, estimate KCP's share price.

d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

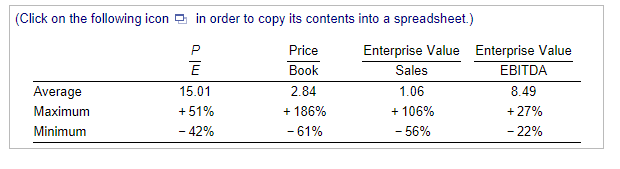

Transcribed Image Text:(Click on the following icon in order to copy its contents into a spreadsheet.)

P

Price

Ē

Book

15.01

+ 51%

- 42%

Average

Maximum

Minimum

2.84

+ 186%

- 61%

Enterprise Value Enterprise Value

EBITDA

Sales

1.06

8.49

+ 106%

+ 27%

- 56%

- 22%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College