uppose tne Onited States decides to reduce export agricuiturai products, but it dde government spending. nitially, a reduction in export subsidies decreases net exports at any given real exchange rate, causing the demand for dollars in the foreign exchange market to decrease. This leads to a decrease in the real exchange rate, which, in turn, decreases imports to negate any decrease in exports, leaving the equilibrium quantity of net exports and the trade deficit unchanged at this point. However, the reduction in expenditure on export subsidies v the fiscal deficit, thereby public saving. On the following graph, indicate the effect this has on the U.S. market for loanable funds. Supply Demand Supply Demand Quantity of Loanable Funds Real Interest Rate

uppose tne Onited States decides to reduce export agricuiturai products, but it dde government spending. nitially, a reduction in export subsidies decreases net exports at any given real exchange rate, causing the demand for dollars in the foreign exchange market to decrease. This leads to a decrease in the real exchange rate, which, in turn, decreases imports to negate any decrease in exports, leaving the equilibrium quantity of net exports and the trade deficit unchanged at this point. However, the reduction in expenditure on export subsidies v the fiscal deficit, thereby public saving. On the following graph, indicate the effect this has on the U.S. market for loanable funds. Supply Demand Supply Demand Quantity of Loanable Funds Real Interest Rate

Chapter4: The Aggregate Economy

Section: Chapter Questions

Problem 5E

Related questions

Question

This is the second part of the previous question I asked, I either get most right or wrong

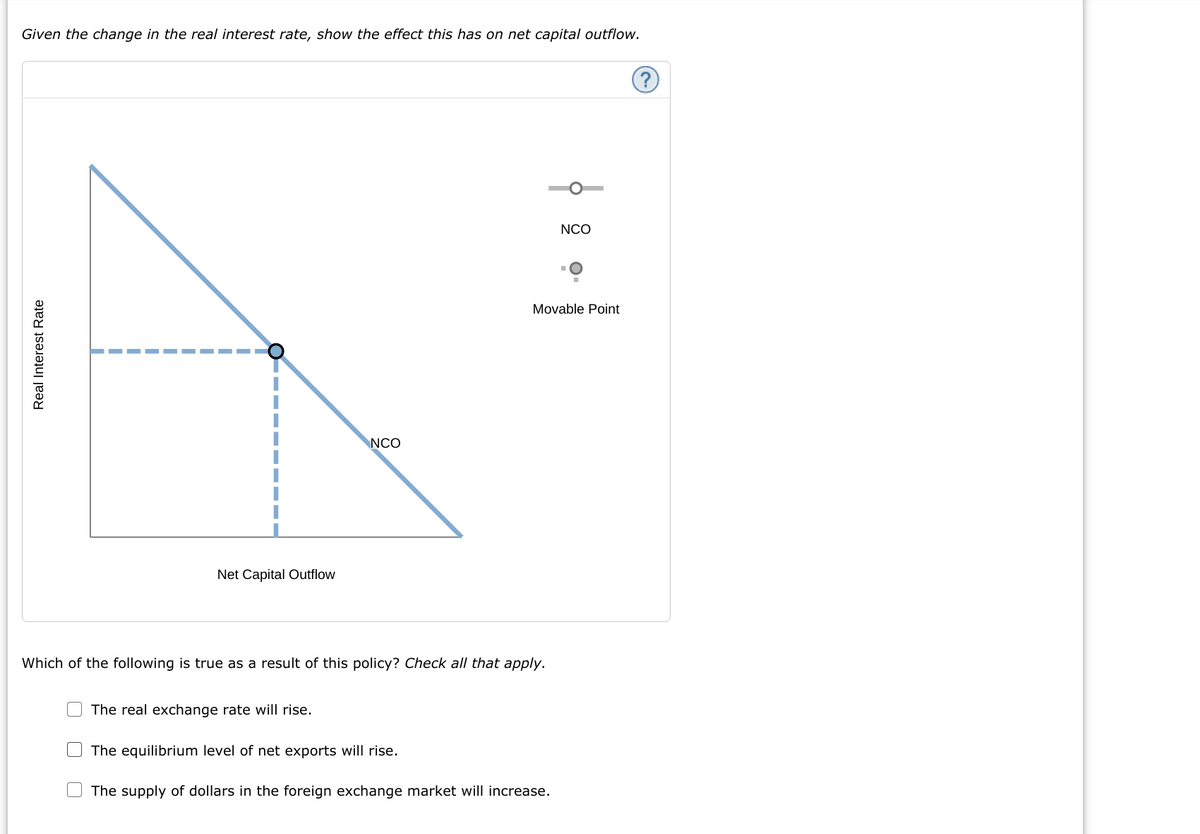

Transcribed Image Text:Given the change in the real interest rate, show the effect this has on net capital outflow.

NCO

Movable Point

NCO

Net Capital Outflow

Which of the following is true as a result of this policy? Check all that apply.

The real exchange rate will rise.

The equilibrium level of net exports will rise.

The supply of dollars in the foreign exchange market will increase.

Real Interest Rate

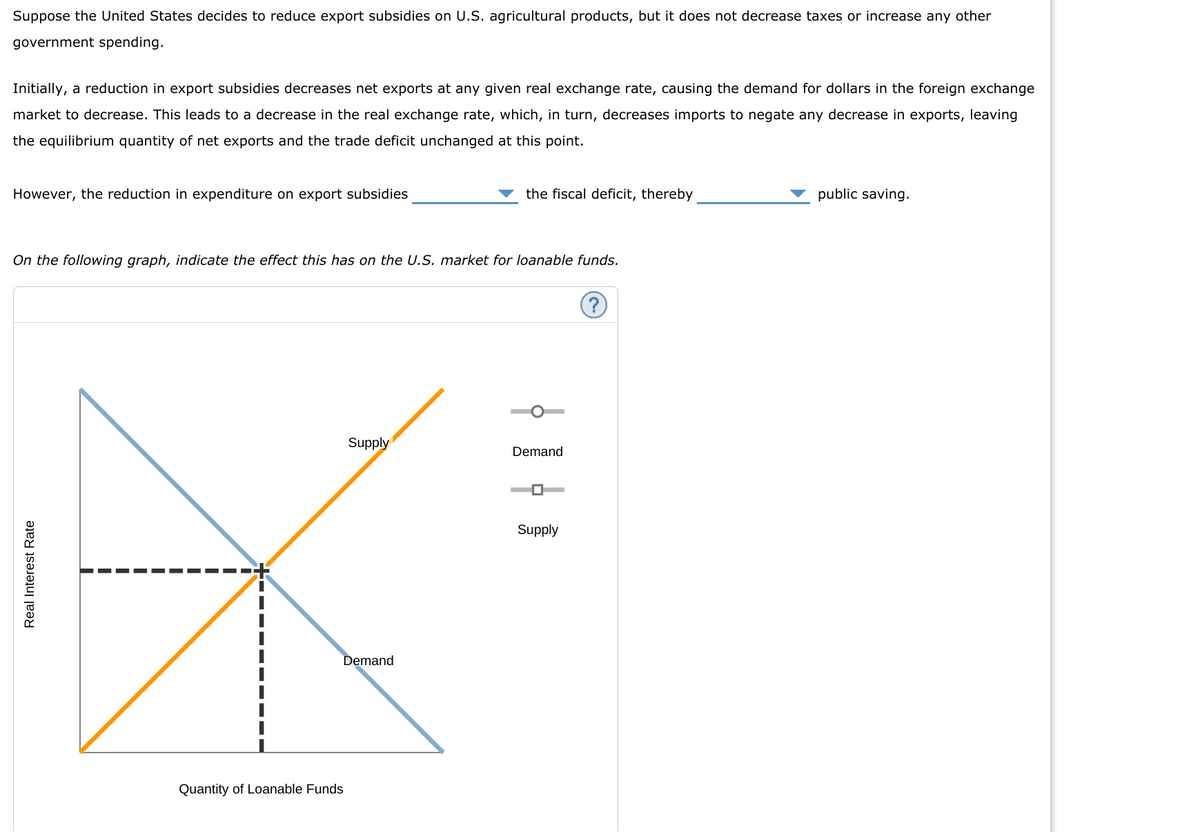

Transcribed Image Text:Suppose the United States decides to reduce export subsidies on U.S. agricultural products, but it does not decrease taxes or increase any other

government spending.

Initially, a reduction in export subsidies decreases net exports at any given real exchange rate, causing the demand for dollars in the foreign exchange

market to decrease. This leads to a decrease in the real exchange rate, which, in turn, decreases imports to negate any decrease in exports, leaving

the equilibrium quantity of net exports and the trade deficit unchanged at this point.

However, the reduction in expenditure on export subsidies

the fiscal deficit, thereby

public saving.

On the following graph, indicate the effect this has on the U.S. market for loanable funds.

Supply

Demand

Supply

Demand

Quantity of Loanable Funds

Real Interest Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you