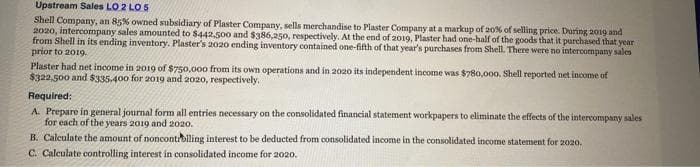

Upstream Sales LO 2 LO 5 Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. During 2019 and 2020, intercompany sales amounted to $442,500 and $386,250, respectively. At the end of 2019, Plaster had one-half of the goods that it purchased that year from Shell in its ending inventory. Plaster's 2020 ending inventory contained one-fifth of that year's purchases from Shell. There were no intercompany sales prior to 2019. Plaster had net income in 2019 of $750,000 from its own operations and in 2020 its independent income was $780,000. Shell reported net income of $322,500 and $335.400 for 2019 and 2020, respectively. Required: A. Prepare in general journal form all entries necessary on the consolidated financial statement workpapers to eliminate the effects of the intercompany sales for each of the years 2019 and 2020. B. Calculate the amount of noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2020. C. Calculate controlling interest in consolidated income for 2020.

Upstream Sales LO 2 LO 5 Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. During 2019 and 2020, intercompany sales amounted to $442,500 and $386,250, respectively. At the end of 2019, Plaster had one-half of the goods that it purchased that year from Shell in its ending inventory. Plaster's 2020 ending inventory contained one-fifth of that year's purchases from Shell. There were no intercompany sales prior to 2019. Plaster had net income in 2019 of $750,000 from its own operations and in 2020 its independent income was $780,000. Shell reported net income of $322,500 and $335.400 for 2019 and 2020, respectively. Required: A. Prepare in general journal form all entries necessary on the consolidated financial statement workpapers to eliminate the effects of the intercompany sales for each of the years 2019 and 2020. B. Calculate the amount of noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2020. C. Calculate controlling interest in consolidated income for 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9P: LIFO Liquidation Profit Hammond Company adopted LIFO when it was formed on January 1, 2017. Since...

Related questions

Question

Transcribed Image Text:Upstream Sales LO 2 LO 5

Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. During 2019 and

2020, intercompany sales amounted to $442,500 and $386,250, respectively. At the end of 2019, Plaster had one-half of the goods that it purchased that year

from Shell in its ending inventory. Plaster's 2020 ending inventory contained one-fifth of that year's purchases from Shell. There were no intercompany sales

prior to 2019.

Plaster had net income in 2019 of $750,000 from its own operations and in 2020 its independent income was $780,000. Shell reported net income of

$322,500 and $335.400 for 2019 and 2020, respectively.

Required:

A. Prepare in general journal form all entries necessary on the consolidated financial statement workpapers to eliminate the effects of the intercompany sales

for each of the years 2019 and 2020.

B. Calculate the amount of noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2020.

C. Calculate controlling interest in consolidated income for 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning