Urgent please help me. Complete Form 940, Employer’s Federal unemployment (FUTA) tax return & Federal Deposit Information worksheet, for Glo-Brite company. Also, complete the Federal Deposit Information Worksheet, using the blank form reproduced. a Total wages for the first three quarters was 142,224.57 FUTA taxable wages for the first three quarters was 65,490.00 b FUTA tax liability by quarter: 1st quarter-204.53 2nd quarter 105.25 3rd quarter 83.16. The first FUTA deposit is now due Additional information Remember this is a annual form. SUTA payments were made in the state of Pennsylvania. Total gross pay 324,142.04 Wages subject to FUTA 73,540.00 Remember A company is not required to deposit FUTA tax until the liability reaches 500.00

Urgent please help me. Complete Form 940, Employer’s Federal unemployment (FUTA) tax return & Federal Deposit Information worksheet, for Glo-Brite company. Also, complete the Federal Deposit Information Worksheet, using the blank form reproduced. a Total wages for the first three quarters was 142,224.57 FUTA taxable wages for the first three quarters was 65,490.00 b FUTA tax liability by quarter: 1st quarter-204.53 2nd quarter 105.25 3rd quarter 83.16. The first FUTA deposit is now due Additional information Remember this is a annual form. SUTA payments were made in the state of Pennsylvania. Total gross pay 324,142.04 Wages subject to FUTA 73,540.00 Remember A company is not required to deposit FUTA tax until the liability reaches 500.00

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 3QY

Related questions

Question

Urgent please help me.

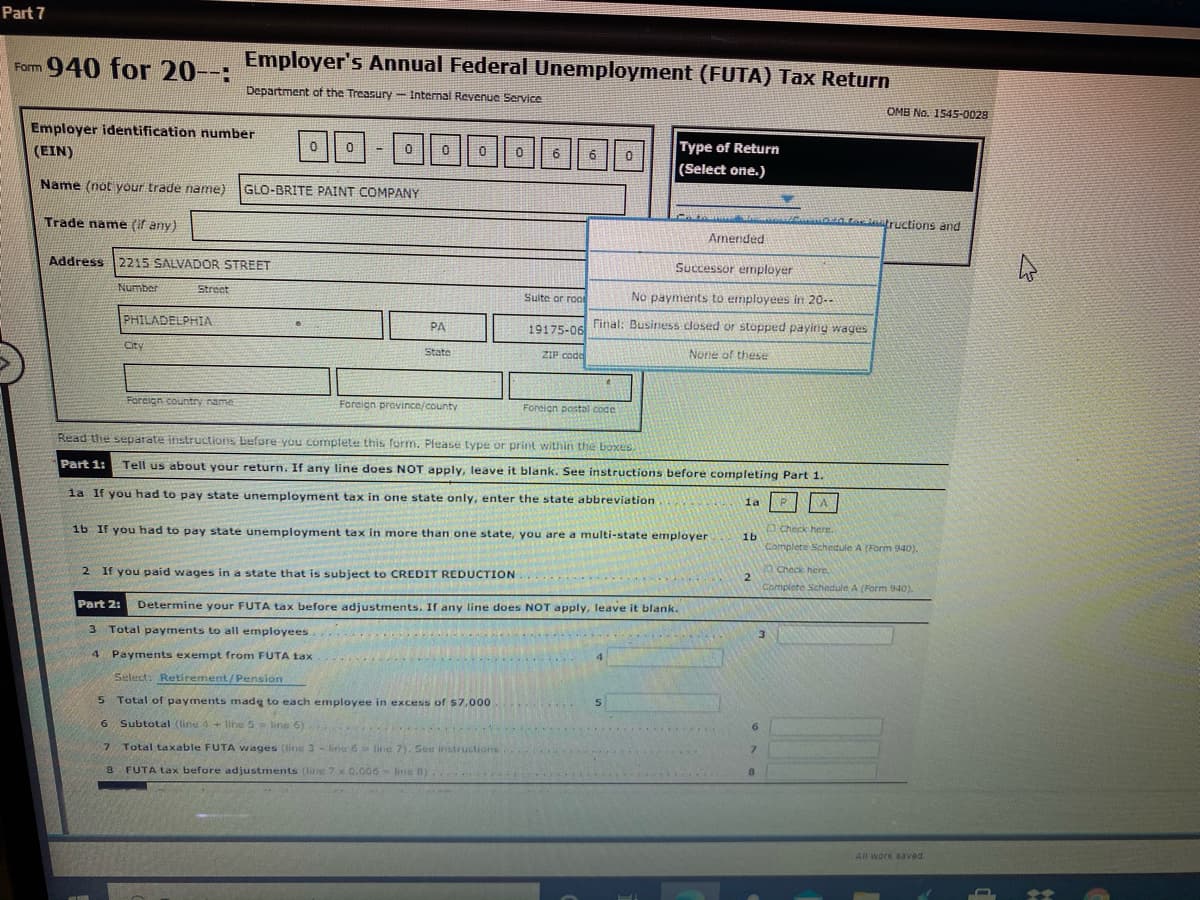

Complete Form 940, Employer’s Federal unemployment (FUTA) tax return & Federal Deposit Information worksheet, for Glo-Brite company. Also, complete the Federal Deposit Information Worksheet, using the blank form reproduced.

a Total wages for the first three quarters was 142,224.57 FUTA taxable wages for the first three quarters was 65,490.00

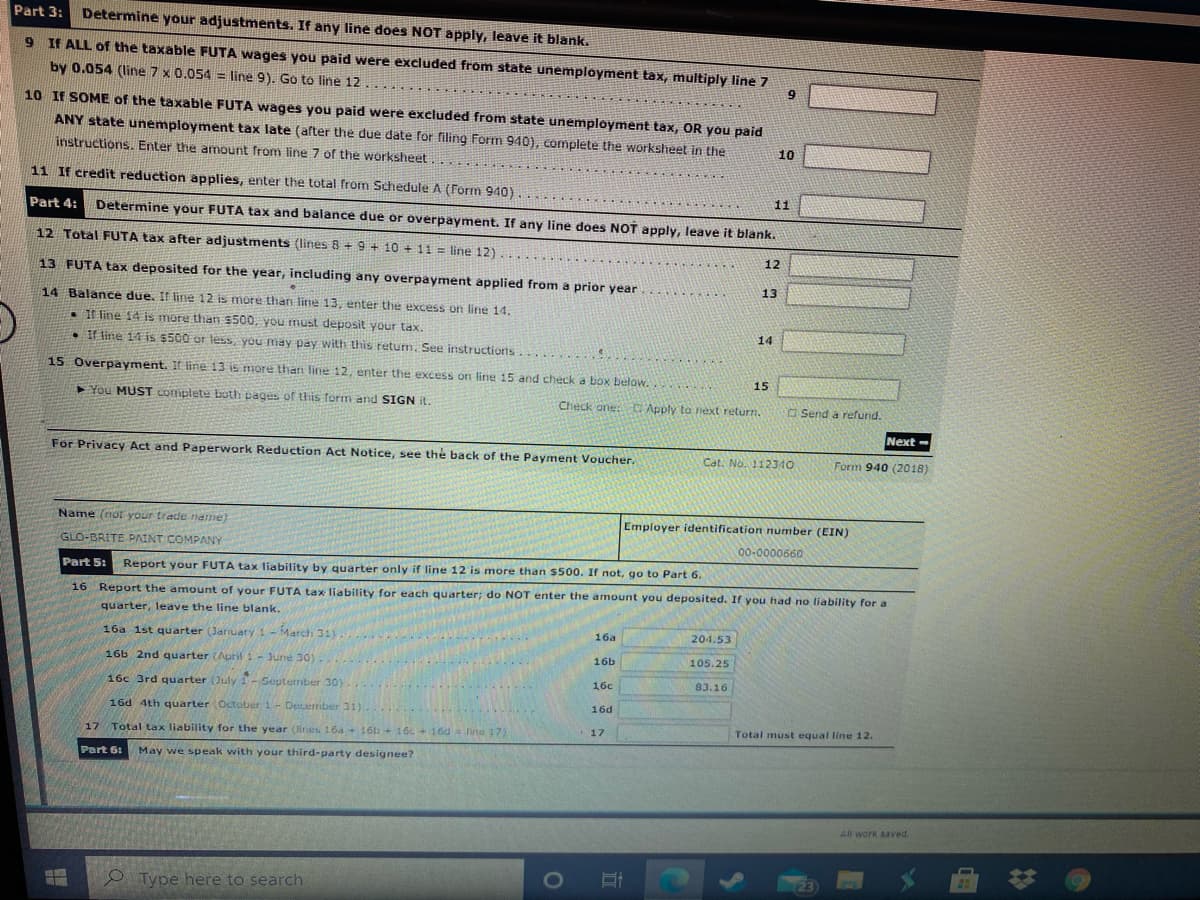

b FUTA tax liability by quarter: 1st quarter-204.53 2nd quarter 105.25 3rd quarter 83.16. The first FUTA deposit is now due

Additional information

Remember this is a annual form.

SUTA payments were made in the state of Pennsylvania.

Total gross pay 324,142.04

Wages subject to FUTA 73,540.00

Remember A company is not required to deposit FUTA tax until the liability reaches 500.00

Transcribed Image Text:Part 3:

Determine your adjustments. If any line does NOT apply, leave it blank.

6.

9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7

by 0.054 (line 7 x 0.054 = line 9). Go to line 12

10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid

ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the

instructions. Enter the amount from line 7 of the worksheet

10

11 If credit reduction applies, enter the total from Schedule A (Form 940)

11

Part 4:

Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank.

12 Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12)

12

13 FUTA tax deposited for the year, including any overpayment applied from a prior year

13

14 Balance due. If line 12 is more than line 13, enter the excess on line 14.

. If line 14 is more than $500, you must deposit your tax.

14

• If line 14 is $500 or less, you may pay with this retum. See instructions

15 Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below.

15

You MUST Complete both pages of this form and SIGN it.

Check one: C Apply to next return.

Send a refund.

Next -

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher.

Cat. No. 112340

Form 940 (2018)

Name (not your trade name)

Employer identification number (EIN)

GLO-BRITE PAINT COMPANY

00-0000660

Part 5:

Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6.

16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a

quarter, leave the line blank.

16a 1st quarter (January 1- March 31)

16a

204.53

16b

105.25

16b 2nd quarter (April 1- June 30)

16c 3rd quarter (July 1- September 30)

16c

83.16

16d

16d 4th quarter (October 1- December 31).

17

Total must equal line 12.

17

Total tax liability for the year (Hnes 16a + 16t + 16c+16d line 17)

Part 6:

May we speak with your third-party designee?

All work aaved.

(23)

O Type here to search

立

Transcribed Image Text:Part 7

Form 940 for 20--:

Employer's Annual Federal Unemployment (FUTA) Tax Return

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0028

Employer identification number

(EIN)

6

Type of Return

6

(Select one.)

Name (not your trade name)

GLO-BRITE PAINT COMPANY

Trade name (if any)

na tas ltructions and

Amended

Address 2215 SALVADOR STREET

Successor employer

Number

Strect

Sulte or roo

No payments to employees in 20--

PHILADELPHIA

19175-06

Final: Business closed or stopped paying wages

PA

City

State

ZIP codd

None of these

Forcign .country name

Foreign province/county

Foreign pastal code

Read the separate instructions before you complete this form. Please type or print within the boxus.

Part 1:

Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1.

la If you had to pay state unemployment tax in one state only, enter the state abbreviation

la

A

1b If you had to pay state unemployment tax in more than one state, you are a multi-state employer

n Check here.

1b

Complete Schedule A (Form 940).

If you paid wages in a state that is subject to CREDIT REDUCTION

10 Check here.

Complete Schedule A (Form 940).

Part 2:

Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank.

3 Total payments to all employees

3.

4 Payments exempt from FUTA tax

Select: Retirement/Pension

5 Total of payments made to each employee in excess of $7,000

6 Subtotal (line 4+ line 5 line 6)

6.

7.

Total taxable FUTA vwages (line3- line 6 line 7). Seu instructions

7.

3 FUTA Lax before adjustments (lie 7 x 0.006 line B)

8.

All work eaved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT