This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed. Requirements: Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction. Determine and record the federal income taxes for each employee. Determine and record the state income taxes for each employee. Determine and record the city income taxes for the city of Pittsburgh. Total each input column. Below lists each employee's assigned Time Card No., Filing Status, and Withholding Allowances. This information is necessary when determining the amount of tax to withhold. Time Card No. Employee Name Filing Status No. of Withholding Allowances 11 Fran M. Carson S N/A 12 William A. Wilson S N/A 13 Harry T. Utley MFJ N/A 21 Lawrence R. Fife MFJ N/A 22 Lucy K. Smith S N/A 31 Gretchen R. Fay MFJ N/A 32 Glenda B. Robey MFJ N/A 33 Thomas K. Schork S N/A 51 Barbara T. Hardy MFJ N/A 99 Carson C. Kipley MFJ N/A

This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed. Requirements: Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction. Determine and record the federal income taxes for each employee. Determine and record the state income taxes for each employee. Determine and record the city income taxes for the city of Pittsburgh. Total each input column. Below lists each employee's assigned Time Card No., Filing Status, and Withholding Allowances. This information is necessary when determining the amount of tax to withhold. Time Card No. Employee Name Filing Status No. of Withholding Allowances 11 Fran M. Carson S N/A 12 William A. Wilson S N/A 13 Harry T. Utley MFJ N/A 21 Lawrence R. Fife MFJ N/A 22 Lucy K. Smith S N/A 31 Gretchen R. Fay MFJ N/A 32 Glenda B. Robey MFJ N/A 33 Thomas K. Schork S N/A 51 Barbara T. Hardy MFJ N/A 99 Carson C. Kipley MFJ N/A

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter10: Payroll Register (pr)

Section: Chapter Questions

Problem 6R: In the space provided below, prepare the journal entry to record the November payroll for all...

Related questions

Question

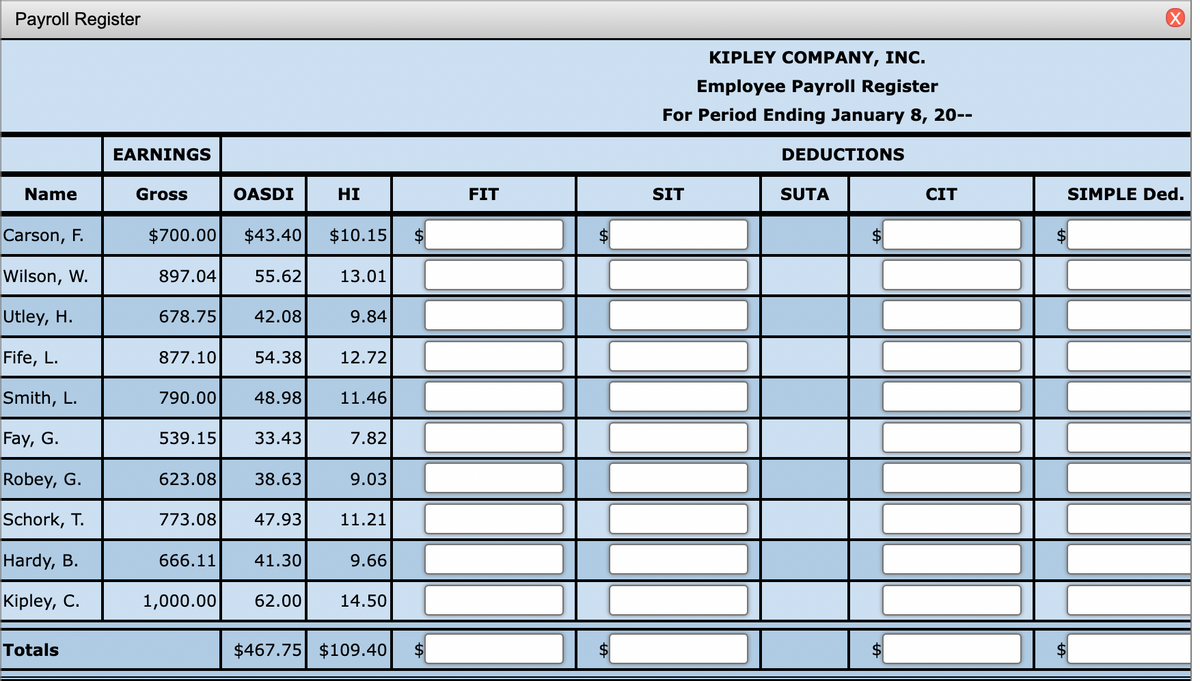

This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed.

Requirements:

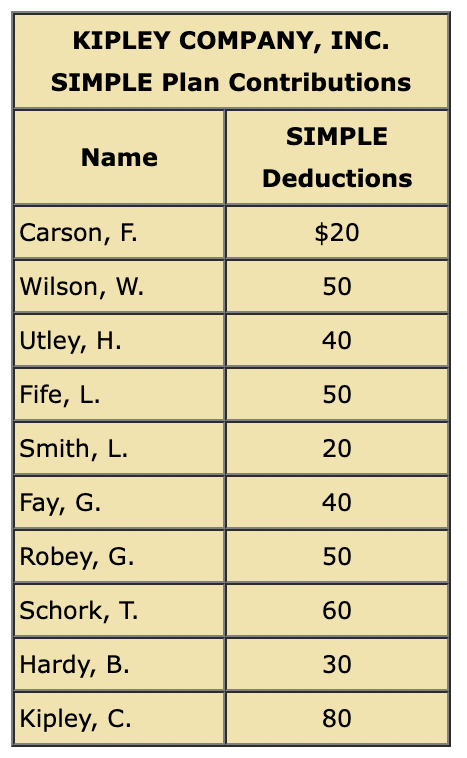

- Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction.

- Determine and record the federal income taxes for each employee.

- Determine and record the state income taxes for each employee.

- Determine and record the city income taxes for the city of Pittsburgh.

- Total each input column.

Below lists each employee's assigned Time Card No., Filing Status, and Withholding Allowances. This information is necessary when determining the amount of tax to withhold.

Time Card No. |

Employee Name |

Filing Status |

No. of Withholding Allowances |

|---|---|---|---|

| 11 | Fran M. Carson | S | N/A |

| 12 | William A. Wilson | S | N/A |

| 13 | Harry T. Utley | MFJ | N/A |

| 21 | Lawrence R. Fife | MFJ | N/A |

| 22 | Lucy K. Smith | S | N/A |

| 31 | Gretchen R. Fay | MFJ | N/A |

| 32 | Glenda B. Robey | MFJ | N/A |

| 33 | Thomas K. Schork | S | N/A |

| 51 | Barbara T. Hardy | MFJ | N/A |

| 99 | Carson C. Kipley | MFJ | N/A |

Transcribed Image Text:Payroll Register

KIPLEY COMPANY, INC.

Employee Payroll Register

For Period Ending January 8, 20--

EARNINGS

DEDUCTIONS

Name

Gross

OASDI

HI

FIT

SIT

SUTA

CIT

SIMPLE Ded.

Carson, F.

$700.00

$43.40

$10.15

$

Wilson, W.

897.04

55.62

13.01

Utley, H.

678.75

42.08

9.84

Fife, L.

877.10

54.38

12.72

Smith, L.

790.00

48.98

11.46

Fay, G.

539.15

33.43

7.82

Robey, G.

623.08

38.63

9.03

Schork, T.

773.08

47.93

11.21

Hardy, B.

666.11

41.30

9.66

Kipley, C.

1,000.00

62.00

14.50

Totals

$467.75 $109.40

$

Transcribed Image Text:KIPLEY COMPANY, INC.

SIMPLE Plan Contributions

SIMPLΕ

Name

Deductions

Carson, F.

$20

Wilson, W.

50

Utley, H.

40

Fife, L.

50

Smith, L.

20

Fay, G.

40

Robey, G.

50

Schork, T.

60

Hardy, B.

30

Kipley, C.

80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning