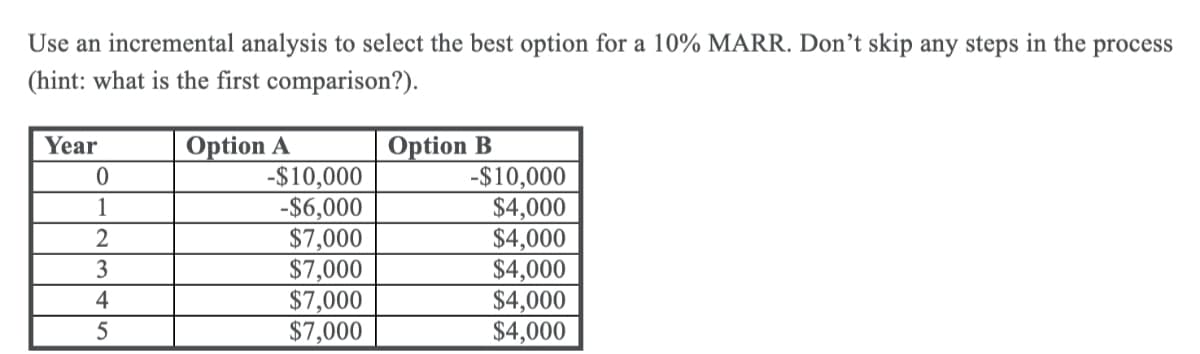

Use an incremental analysis to select the best option for a 10% MARR. Don’t skip any steps in the (hint: what is the first comparison?). process

Q: If the MARR is 10% per year, use the present worth (PW) analysis (using the LCM approach) to…

A: The concept of annual cost is used in capital budgeting when the company wants to incur any capital…

Q: If the minimum attractive rate of return is 7%, which alternative should be selected assuming…

A: The alternative with the highest NPV should be selected. NPV is the present value of benefits less…

Q: Use the following alternatives to develop an incremental analysis choice table and answer the…

A: Internal rate of return: It is the rate where the net present value of a project becomes zero and…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High 90 Low…

A:

Q: Profitability index. Given the discount rate and the future cash flow of each project listed in the…

A: Profitability Index = Present value of Cashflows/ Initial investment

Q: pmts per yr 100 par term 3 coupon 6.00% current price $ 97.00 YIELD 6.00% time value discount factor…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: When evaluating the following project, if the required return is 10 percent, what is its NPV? Year…

A: Capital budgeting: Capital budgeting is a financial technique that is used to evaluate long-term and…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: The statistical technique based on tradeoff quantification among alternative categorization…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: Under Maximin criteria, we have to choose the maximum of minimums value of available alternative.

Q: Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parentheses…

A: NPV = Cash Inflows - Cash outflows = (Annual cash inflows * cumulative PV @ 12% for 7 years) - Cost…

Q: For the following table, assume a MARR of 15% per year and a useful life for each alternative of…

A: We need to calculate the PW for the last option W → X and determine which alternative to choose.…

Q: If the discount rate is 8 percent, then the projects NPV is $. (Round to the nearest dollar.)

A: Net present value (NPV) of an investment refers to the variance between the initial investment or…

Q: Consider the publie project at the end of the handout on "TVM and Cost-Beneft Analysis," which we…

A: NPV is the difference between Present Value of cash Inflows and Initial Investment. NPV will be…

Q: Hi, I am really having some troubles solving these questions, so any kir of help would be highly…

A: The expeted return is calculated with the help of following formula Expected Return = Return x…

Q: Over the past 3 years an investment returned 0.15, -0.1, and 0.06. What is the variance of returns?…

A: Introduction:- The commitment of an asset to improve in value over time is referred to as…

Q: A firm is considering the following alternatives, each with a five year life. What is the IRR of the…

A: IRR is the rate of return a project generates through its lifetime expressed in annual terms. It is…

Q: Compare two alternatives using i = 10% Alternative X Alternative Y First cost, $ M&O costs, $/year…

A: The projects can be evaluated based on various capital budgeting techniques. However, the decision…

Q: a. Calculate the NPV at the following discount rates for this investment: 0%, 5%, 10%, 20%, 30%,…

A:

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: Maximin criteria is selecting maximum value out of the minimum values of alternatives available.

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low 95…

A: Under Baye's decision rule, Expected payoff under each alternative = (Probability of high *Payoff…

Q: The three-month call with X1=$94 is priced at $8. The three-month call with X2=$114 is priced at $2.…

A: Bullish Call Strategy means Buying a call at a lower Strike Price and Selling the call at higher…

Q: Evaluate the following alternatives through the VPN, VAUE and IRR of the best option. To evaluate…

A: Alternative investments comprises of private equity, futures trading, hedge funds, commodities and…

Q: a. What is the net present value of the project? (Negative amount should be indicated by a minus…

A: Net Present Value: It is a method used in capital budgeting to determine the absolute profitability…

Q: You form a long straddle by buying a call with a premium of C = $8, and buying a put with a premium…

A: Put-Call Parity formula states that the return from holding a short put and a long call option for a…

Q: A fırm is considering the following alternatives, each with a five year life. What is the IRR of the…

A: The Internal rate of return is a capital budgeting metric which is used to measure the return on…

Q: . What is the expected cash payoff? (Round your answer to the nearest whole dollar amount.) a-2.…

A: Information Probability: Probability Payoff Net Profit 0.30 $600 $400 0.60 200 0 0.10 0…

Q: If the MARR=I5%, which option would be selected? On the same excel spreadsheet use excel functions…

A: Present worth is calculated by sum of present value of cash flows. It is calculated by NPV function…

Q: If the discount rate is 6 percent, then the project's NPV is $ (Round to the nearest dollar.)

A: Net Present Value (NPV): It represents the investment's profitability in dollar amounts. It is…

Q: Check my Required information a. What is the net present value of the project? (Negative amount…

A: NPV is capital budgeting technique used to evaluate performance of projects. It is arrived at by…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A:

Q: For the following table, assume a MARR of 15% per year and a useful life for each alternative of…

A: PW is the current worth of cash flows that are expected to occur in the future.

Q: using the incremental rate of return analysis, if M

A: Incremental IRR analysis is a technique used in capital budgeting to analyze different investment…

Q: Evaluate the success of the project. Assume a discount rate of 12%. (If the net present value is…

A: Net Present Value :— It Means the summation of all present Value of cash flows. For decision…

Q: If the risk-free rate is 3.80 percent and the risk premium is 2.8 percent, what is the required…

A: RISK PREMIUM = EXPECTED RETUN - RISK FREE RATE SO, REQUIRED RETURN = RISK FREE RATE + RISK PREMIUM…

Q: For the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback…

A: Net present value (NPV) is the value of all the cash flow of the investment (positive and negative)…

Q: You are considering a project that requires a $1000 investment today and returns $550 at the end of…

A: NPV or Net present value of an investment proposal is the difference between the present value of…

Q: Requireu: la. Compute the average rate of return for each investment. If required, round your answer…

A: Present value of money is the value of money measured in today’s terms that is expected to be…

Q: 1) Using the Black and Scholes formula, for each payoff compute the price, delta and probability of…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Your goal is to be able to withdraw $4,800 for each of the next seven years beginning one year from…

A: Amount need to be invested today = Annual amount withdrawal x Present value factor (12%, 7 years)

Q: A game of chance offers the following odds and payoffs. Each play of the game costs $200, so the net…

A: Formulas:

Q: Assume the corporate discount rate is 10 percent, please offer your recommendations by ranking the…

A: 1) Net Present Value=Sum of the present value of cash inflows-Present value of cash outflows Project…

Q: If the first increment (B-A) AROR is 6.3%, and 2hd increment (C-B) AROR is 3.1%. The best…

A: Incremental rate of return Analysis It is the analysis of financial return to investor where…

Q: Complete the following analysis of cost alternatives and select the preferred alternative. The study…

A: While evaluating the right investments, certain projects are evaluated and on the basis of that…

Q: Consider these mutually exclusive alternatives. MARR = 8% per year, so all the alternatives are…

A: IRR is the internal rate of return which is the actual return received from an investment or a…

Q: For each of the following option positions state the risk profile, draw the profit and loss area and…

A: Options are derivative financial instruments dependent on the value of underlying securities like…

Q: You are evaluating a project that costs $69,000 today. The project has an inflow of $148,000 in one…

A: Net Present Value(NPV) is excess of PV of inflows over PV of outflows related to proposal whereas…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- How much would you invest today in order to receive $30,000 in each of the following independent scenarios: 10 years at 9% 8 years at 12% 14 years at 15% 24 years at 10% Use the appropriate EXCEL spreadsheet in the Chapter11 TVOM Examples.xlsx downloadto complete the following table: Present Value (PV) Rate Time (Years) Future Value (FV) A 9% 10 $30,000.00 B 12% 8 $30,000.00 C 15% 14 $30,000.00 D 10% 24 $30,000.00 PLEASE NOTE: All dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Use the present value of $1 table in the Appendix B PV FV Tables downloadand verify that your answers above are correct: Future Value (FV) Rate Time (Years) FV Factor (from Table) Present Value (PV) A $30,000.00 9% 10 B $30,000.00 12% 8 C $30,000.00 15% 14 D $30,000.00 10% 24 PLEASE NOTE: All PV Factors will be rounded to three decimal places (i.e. 1.234). All dollar amounts will be with "$" and…A firm evaluates all of its projects by applying the IRR rule. If the required return is 18 percent, will the firm accept the following project?CF0 = -$30,000CO1 = $20,000C02 = $14,000C03 = $11,000 yes or noCongratulations. You have just won first prize in a quantitative competition. You have the following choices to receive your winnings: Option I: Receive $3,000,000 immediately. Option II: Receive five $1,000,000 payments paid every other year beginning in year T=2. For example, you receive a $1 million dollars payment in year T=2, T=4, T=6, T=8, and T=10. a. What is the present value of each option if R=0.06? Which option would you choose? b. What is the present value of each option if R=0.12? Which option would you choose? c. What interest rate R will make the present value of both options equal? Hint: use Excel’s Data – What If - Goal Seek analysis Show what you do to se up goal seek for c

- Congratulations. You have just won first prize in a quantitative competition. You have the following choices to receive your winnings: Option I: Receive $3,000,000 immediately. Option II: Receive five $1,000,000 payments paid every other year beginning in year T=2. For example, you receive a $1 million dollars payment in year T=2, T=4, T=6, T=8, and T=10. a. What is the present value of each option if R=0.06? Which option would you choose? b. What is the present value of each option if R=0.12? Which option would you choose? c. What interest rate R will make the present value of both options equal? Hint: use Excel's Data - What If - Goal Seek analysis Show what you do to se up goal seek for c Also take snap shots from excel and how did you get the answers, please show work for c!!!Congratulations. You have just won first prize in a quantitative competition. You have the following choices to receive your winnings: Option I: Receive $3,000,000 immediately. Option II: Receive five $1,000,000 payments paid every other year beginning in year T=2. For example, you receive a $1 million dollars payment in year T=2, T=4, T=6, T=8, and T=10. a. What is the present value of each option if R=0.06? Which option would you choose? b. What is the present value of each option if R=0.12? Which option would you choose? c. What interest rate R will make the present value of both options equal? Hint: use Excel’s Data – What If - Goal Seek analysis.Lipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Then decide which product should be selected and why ?

- Direction: Solve what is being asked and show your complete and neat solution. (ROUND OF PV FACTORS TO 4 DECIMAL PLACES, ROUND OF FINAL ANSWER TO TWO DECIMAL PLACES. IN MCQs CHOOSE THE BEST ANSWER) 4.) You have the opportunity to buy a perpetuity that pays P1,000 annually. Your required rate of return on this investment is 15 percent. You should be essentially indifferent to buying or not buying the investment if it were offered at a price of?NOTE:-I request you dnt use excel to solve.and solution is typed or on white paper only. Q)You have 30,000 to invest and want the greatest yield from your investment after five years. You have two plans to choose from: Plan A- 6.9%compouned monthly or Plan B- 7% compound quarterly (a) Which plan would you take to achieve this? (b) How much will you have at the end of five years?Lipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%

- Complete the following analysis of cost alternatives and select the preferred alternative. The study period is 10 years and the MARR=15%per year. "Do Nothing" is not an option. A B C D Capital investment $15,000 $15,900 $13,500 $18,000 Annual costs 240 310 450 90 Market value at EOY 10 900 1,250 1,750 2,000 FW (15%) −$64,656 −$69,369 ??? −$72,647 The FW of the alternative C is ... nothing.(Round to the nearest dollar.) Select the preferred alternative. Choose the correct answer below. A. Alternative D B. Alternative B C. Alternative C D. Alternative A2. Your firm is considering the following 3 mutually exclusive alternatives. Interest rate is10%. A B CInitial Cost $35,000.00 $21,000.00 $42,000.00Annual Benefit $4,200.00 $3,300.00 $5,000.00Salvage value 0 $1,000 $1500Project life Forever 20 year 50 a. Calculate the Benefit-Cost ratio of each projectb. Which of the 3 alternatives should be selected using B/C ratio analysis (show yourwork)?An investment offers the following: a series of $1000 annual payments, starting one year from now, for a total of 12 payments. If your opportunity cost (as an EAR) is 5%, what is the investment worth to you today? Group of answer choices $11,079.20 $9,214.56 $10,103.26 $8,863.25 $10,241.19 Give typing answer with explanation and conclusion