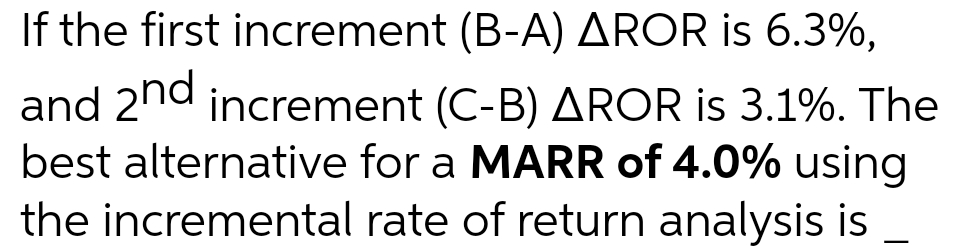

If the first increment (B-A) AROR is 6.3%, and 2hd increment (C-B) AROR is 3.1%. The best alternative for a MARR of 4.0% using the incremental rate of return analysis is

Q: The investor’s required rate of return is 15 percent. • The expected level of earnings at the end of...

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first t...

Q: Mr. Larsen's will directed that $209,000 be invested to establish a perpetuity making payments at th...

A: Investment amount = $209000 Let the monthly payment = M r = 6% per annum = 0.5% per month Investment...

Q: a. Discuss two technical points that can affect short selling. b. Do your own research on ASX. What ...

A: a) Short selling occurs when an investor borrows a security and sells it on the open market with the...

Q: Flyers plc operates public transport services in major cities in the United Kingdom (UK). The compan...

A: Concept Payback method evaluates how long it will take to recover initial investment. Pay back perio...

Q: PROBLEM 3: A P2 000 loan was originally made at 8% simple interest for 4 years . At the end of this ...

A: Loan (L) = P 2000 Simple interest rate for 4 years (r) = 8% Interest rate for 3 more years (6 semian...

Q: vo categories of cash flows: single cash flows, referred to as "lump sum:

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts fo...

Q: Simtek currently pays a $3.5 dividend (D0) per share. Next year’s dividend is expected to be $4 per ...

A: Stock price is defined as the maximum price that an investor is ready to pay for a stock. It is calc...

Q: Forward Dividend Price 1T Target Est $75.20 $0.80 $87.76 Given the information in the table, ift he ...

A: Given Price of stock = $75.20 Forward dividend = $0.80 1T Target Est = $87.76 Required Return = 5.5%

Q: Emily Dao, 27, just received a promotion at work that increased her annual salary to $37,000. She is...

A: Since you have posted a multiple question, therefore, we will be solving the first question only as ...

Q: f you were asked to describe the terms of the Federal Reserve's Board of Governors, how would you ex...

A: Board of Governors The Board of Governors are also known as the Federal Reserve Board. They are the ...

Q: Mr. Jackson is faced with a scenario and as a final year banking and finance student; you are requir...

A: Investing or borrowing a sum of money for a period of less than one year is known as short-term fina...

Q: Explain 1-2 sentences Financial Risk Interest Rates Volatility Foreign Currency Liquidity Derivati...

A: Financial risk is a type of risk that can lead to the loss of stakeholder capital. For the governmen...

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts f...

Q: dns ieui sə: Efficient Market Hypothesis (EMH) * True O False

A: Efficient market hypothesis is one of the basic theories which explain the market and dynamics in th...

Q: A credit card company offers an annual 2% cash-back rebate on all gasoline purchases. If a family sp...

A: Solution:- Rebate means the discount or cash back offered by the company to its seller.

Q: 24. Namak Co. has an ROE=20%, TATO = 2.5, Equity multiplier of 3, and sales =$30,000. Calculate the ...

A: Sales = $30,000 TATO = 2.50 Equity multiplier = 3 Equity = (Sales/TATO)/Equity multiplier ...

Q: Silver Inc. will be registering with SEC. Its incorporators was able to gather the following cost of...

A: The minimum rate of return a company will seek while investing in a project is the weighted average ...

Q: to deposits of $80 a month for 18 years, then they are offering a guaranteed rate of 4.5% interest c...

A: Future Value of Annuity: It is the future worth of the present annuity stream cash flows. It is com...

Q: ds per share and market value per share was recently at P32 and P240 respectively. If dividends grow...

A: Price of shares increases with time and grow at the rate of growth in dividend. That can be found ou...

Q: Find r: You have $2,000 in a money market account. If you make no deposits to or withdrawals from th...

A: a) Amount in the account initially (P) = $2000 Future value (F) = $10000 n = 10 years r = Interest r...

Q: 3. Although Mutual funds and Hedge funds are traded on exchanges regulated, they are not

A: Both hedge funds and mutual funds are made of pooled funds and have portfolios that need to be manag...

Q: Analyse the Assets-to-equity ratio of 1.87 in 2019 and 1.67 in 2020

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve ...

Q: A bond has a $1000 par value, 12 years to maturity, a 5% annual coupon and currently sells for $900....

A: Par value (F) = $1000 Years to maturity (n) = 12 years Coupon (C) = 5% of $1000 = $50 Let r = YTM

Q: Last year, Joan purchased a $1,000 face value corporate bond with an 9% annual coupon rate and a 10-...

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only o...

Q: The following statements relate to long-term financing. Which is true? a. The risk on any type of e...

A: Long term financing Long term financing is a financing that has the maturity more than a year.

Q: ) The time is progressed by using the event count method.

A: Event count method is the process of measure the no. Of discrete events over period of time.

Q: Marion's grandfather's will established a trust that will pay her $1,800 every three months for 12 y...

A: A cashflow of a certain amount today is more valuable than the same cashflow after some years. This ...

Q: The company has a target return on capital of 15% and a corporate tax rate is 40%. You are required ...

A: Net present value method is a method of appraising potential investment projects. In this method, th...

Q: The Board of Directors were worried over the dwindling financial performance and precarious financia...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first ...

Q: You just received an inheritance of $123,456. How long would you need to leave it in an RRSP earning...

A: Here, Inheritance Amount is $123,456 Monthly Payment for 20 years is $800 Interest Rate is 2.5% Comp...

Q: Fiscal year is January-December. All values PHP Millions. 2020 2019 Cash & Short Term...

A: Working capital is defined as the difference between the current assets of the company like - unpaid...

Q: Year Cash Flows 0 -29,700 1 11,900 2 14,600 3 16,500 4 13,600 5 -10,100 The company uses an interest...

A: MIRR is used in capital budgeting for determining the cost and profitability of a company's future p...

Q: Jose acquired a loan in the amount of 2 million pesos from Pedro. According to their agreement, Jose...

A: Loan is referred as the lending of the funds through one or more individuals, entities, or the organ...

Q: = sinking fund formula, calculate the

A: Payment per month refers to the amount which a borrower should at the end of each month or period to...

Q: We are considering the purchase of a $760,000 computed based inventory management system. It is in c...

A: Given in this question , Purchase = $760,000 CCA rate = 30 % Tax rate = 28%. The required return =1...

Q: Quantitative Problem 2: You and your wife are making plans for retirement. You plan on living 25 yea...

A: While calculating, the amount required in the retirement account, we are required to calculate the f...

Q: Ten years ago, Video Toys began manufacturing and selling coin-operated arcade games. Dividends are ...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: 4. Capital Markets are the financial markets for stocks and for intermediate or long-term debt (one ...

A: Solution:- There are two types of financial markets:- 1. Money Market 2. Capital Market

Q: Undeclared dividends (in arrears) to cumulative preferred stockholders must be filed to. in the note...

A: Solution:- As we know, the preferred shares are paid dividend prior to common shares. There is a typ...

Q: firm considering the installation of an automatic data processing unit to handle some of its account...

A: The equipment can be purchased by cash payment but may be leased also by payment of lease which give...

Q: Lauren plans to deposit $5000 into a bank account at the beginning of next month and $200/month into...

A: Future value is the amount accumulated on the deposit made along with interest earned on the deposit...

Q: Isabella purchased $20,000 worth of 26-week T-Bills for $19,700. What will be the rate of return on ...

A: Initial investment (P) =$19,700 Maturity value(S)=$20,000 since maturity period is 26 week= 26*7=182...

Q: 3. Consider an EOY geometric gradient, which lasts for eight years, whose initial value at EOY one i...

A: A cash flow series is a series in which the cash flows in and out at certain period of time. However...

Q: What are the annual payments necessary to pay a $100,000, 12-year loan if the loan rate is 8 %?

A: Solution:- When an amount is borrowed, it can be either repaid as a lump sum payment or in installme...

Q: Compute the unlevered beta corrected for cash for each firm. B. Using the unlevered beta corrected ...

A: Unlevered beta It is the value of firm's beta without getting the impact of debt while levered beta...

Q: On December 31, 2020, Dow Steel Corporation had 740,000 shares of common stock and 314,000 shares of...

A: Dow's basic earnings per share Dow's diluted earnings per share

Q: If an individual stock's beta is higher than 1, that stock is riskier than the market

A: If individual stocks beta greater than 1 has risker than market and more volatile. CAPM cost of equ...

Q: Combine the different component costs to determine the firm’s WACC.

A: WACC is the organization cost of capital in which each component (debt and equity) is considered on...

Q: 1. An investor deposits P10,000.00 at the end of each year in an account which gives a nominal annua...

A: Annual deposit (A) = P 10000 Accumulated value = X n = 10 years r = 5% continuously compounded

Q: EMC Corporation's current free cash flow of $370,000 and is expected to grow at a constant rate of 6...

A: Value of operations = FCF*(1+g)/(k-g) Where FCF = Free cash flow current g = growth rate k = Cost ...

Please answer fast

Step by step

Solved in 2 steps

- Consider the following analysis of two alternatives, X & Y: YR X Y 0 -200 -1000 1 30 250 2 30 250 3 30 250 4 30 250 5 100 400 The MARR is 10%. Calculate the incremental rate of return in percent to the nearest 0.1 percent. Please explain each stepIf the risk-free rate is 4.8 percent and the risk premium is 6.8 percent, what is the required return? (Round your answer to 1 decimal place.) Required Return: ___.__%Suppose the average return on Asset A is 6.6 percent and the standard deviation is 8.6 percent and the average return and standard deviation on Asset B are 3.8 percent and 3.2 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.25 percent. How likely is it that such a low return will recur at some point in the future? (Do…

- uppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…K2. If the 1% percentile of an annual return distribution is -2%, the risk free rate is 2% and the mean return is 4%, then A) The absolute 99% annual VaR is 2% B) The relative 99% annual VaR from the risk free rate is 4% C) The relative 99% annual VaR from the mean is 6% D) All of the aboveSuppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.2 percent and the standard deviation was 10.6 percent. a. What is the probability that your return on this asset will be less than –9.7 percent in a given year? Use the NORMDIST function in Excel® to answer this question. b. What range of returns would you expect to see 95 percent of the time? c. What range of returns would you expect to see 99 percent of the time?

- Suppose the beta of PetrolCom is 0.75, the risk - free rate is 3 percent, and the market risk premium is II percent. Calculate the expected rate of return on PertrolCom.Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3. What is the 5-day 99% VaR for the portfolio?Asset P has a beta of 0.9. The risk-free rate of return is 8 percent, while the return on the market portfolio of assets is 14 percent. The asset's required rate of return is

- A project that has a positive net present value discounted at a rate of 15% would have an internal rate of return (IRR) of a. 0% b. 10% c. less than 15% d. more than 15%If the risk free rate is 3.6 percent and the risk premium is 4.6 percent what is the required return?Suppose you have a project that has a 0.4 chance of tripling your investment in a year and a 0.6 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) What is the standard deviation?