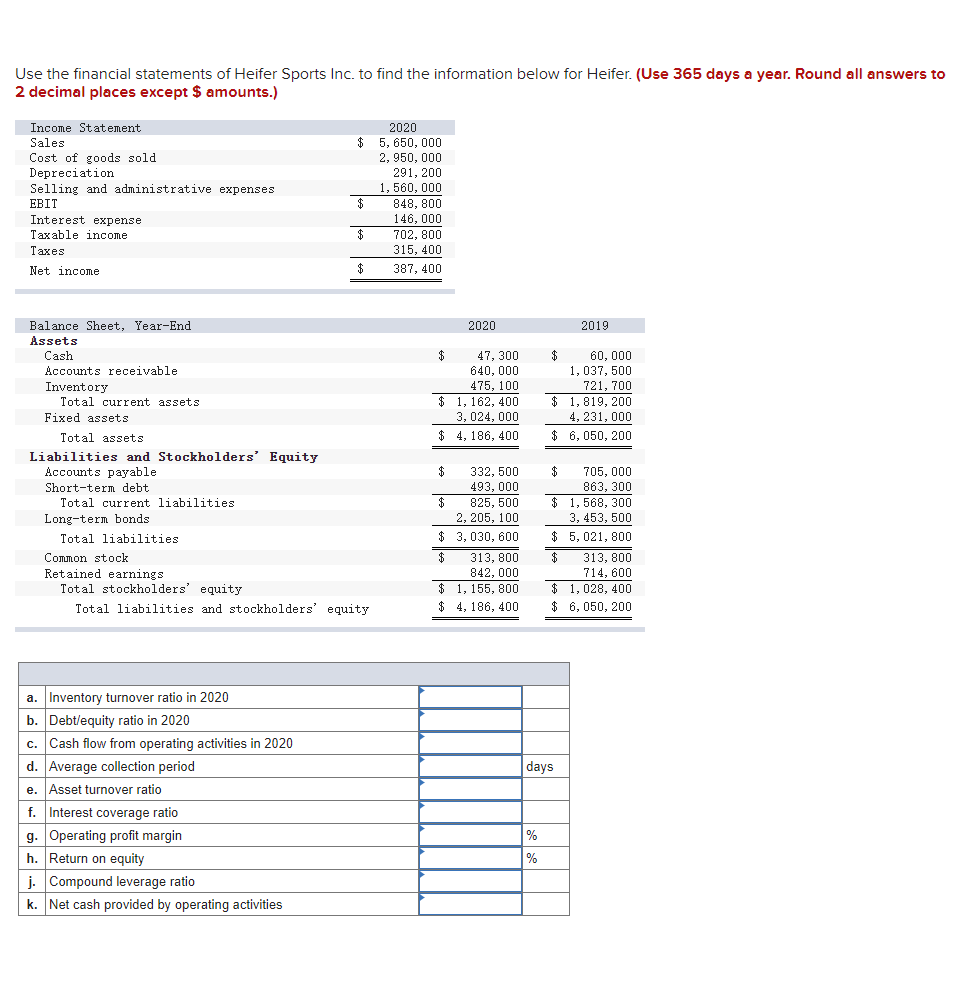

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 day 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses. EBIT Interest expense Taxable income Taxes Net income Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets. Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities. Long-term bonds Total liabilities 2020 $ 5,650,000 2,950,000 291, 200 1,560, 000 848, 800 146,000 702, 800 315, 400 $ 387, 400 a. Inventory turnover ratio in 2020 b. Debt/equity ratio in 2020 c. Cash flow from operating activities in 2020 $ $ Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity. $ 47, 300 640,000 475, 100 $1,162, 400 3, 024, 000 $4, 186, 400 $ $ $ 2020 3,030, 600 313, 800 842, 000 1,155, 800 $ $ 4,186, 400 $ 332, 500 493, 000 825, 500 2, 205, 100 2019 60, 000 1,037, 500 721, 700 $ 1,819, 200 4, 231,000 $ 6,050, 200 $ 705, 000 863, 300 $ 1,568, 300 3,453, 500 $ 5,021,800 $ 313, 800 714, 600 $1,028, 400 $ 6,050, 200

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 day 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses. EBIT Interest expense Taxable income Taxes Net income Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets. Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities. Long-term bonds Total liabilities 2020 $ 5,650,000 2,950,000 291, 200 1,560, 000 848, 800 146,000 702, 800 315, 400 $ 387, 400 a. Inventory turnover ratio in 2020 b. Debt/equity ratio in 2020 c. Cash flow from operating activities in 2020 $ $ Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity. $ 47, 300 640,000 475, 100 $1,162, 400 3, 024, 000 $4, 186, 400 $ $ $ 2020 3,030, 600 313, 800 842, 000 1,155, 800 $ $ 4,186, 400 $ 332, 500 493, 000 825, 500 2, 205, 100 2019 60, 000 1,037, 500 721, 700 $ 1,819, 200 4, 231,000 $ 6,050, 200 $ 705, 000 863, 300 $ 1,568, 300 3,453, 500 $ 5,021,800 $ 313, 800 714, 600 $1,028, 400 $ 6,050, 200

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

9

Transcribed Image Text:Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to

2 decimal places except $ amounts.)

Income Statement

Sales

Cost of goods sold

Depreciation

Selling and administrative expenses

EBIT

Interest expense

Taxable income

Taxes

Net income

Balance Sheet, Year-End

Assets

Cash

Accounts receivable

Inventory

Total current assets

Fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short-term debt.

Total current liabilities

Long-term bonds

Total liabilities

a. Inventory turnover ratio in 2020

b. Debt/equity ratio in 2020

c. Cash flow from operating activities in 2020

d. Average collection period

e. Asset turnover ratio

f. Interest coverage ratio

g. Operating profit margin

h. Return on equity

2020

$ 5,650,000

2,950,000

291, 200

1, 560, 000

848, 800

146,000

Common stock

Retained earnings.

Total stockholders' equity

Total liabilities and stockholders' equity

j. Compound leverage ratio

k. Net cash provided by operating activities

$

702, 800

315, 400

387, 400

$

47, 300

640,000

475, 100

$1, 162, 400

3, 024, 000

4, 186, 400

2020

$

332, 500

493, 000

825, 500

2,205, 100

$ 3,030, 600

313, 800

842, 000

$1,155, 800

$4, 186, 400

$

%

%

60, 000

1,037, 500

721, 700

$1,819, 200

4, 231, 000

$6,050, 200

2019

days

705, 000

863, 300

$ 1,568, 300

3, 453, 500

$ 5,021, 800

$ 313, 800

714, 600

$ 1,028, 400

$6,050, 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning