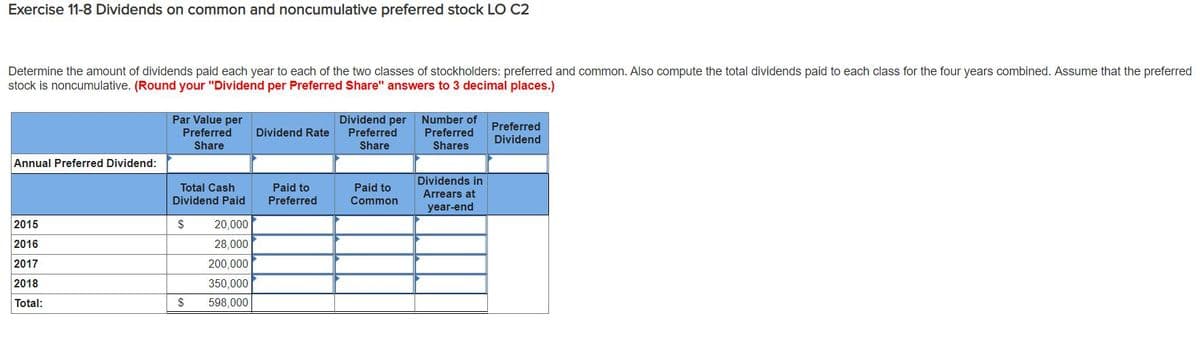

Use the following information for the Exercises below. [The following information applies to the questions displayed below.] York's outstanding stock consists of 80,000 shares of 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: 2015 total cash dividends $ 20,000 2016 total cash dividends 28,000 200,000 350,000 2017 total cash dividends 2018 total cash dividends References Section Break Use the following information for the Exercises below. Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Dividend per Preferred Par Value per Number of Preferred Preferred Dividend Rate Preferred Dividend Share Share Shares Annual Preferred Dividend: Dividends in Paid to Preferred Total Cash Paid to Arrears at Dividend Paid Common year-end 2015 $ 20,000 2016 28,000 2017 200,000 2018 350,000 Total: 598,000

Use the following information for the Exercises below. [The following information applies to the questions displayed below.] York's outstanding stock consists of 80,000 shares of 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: 2015 total cash dividends $ 20,000 2016 total cash dividends 28,000 200,000 350,000 2017 total cash dividends 2018 total cash dividends References Section Break Use the following information for the Exercises below. Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Dividend per Preferred Par Value per Number of Preferred Preferred Dividend Rate Preferred Dividend Share Share Shares Annual Preferred Dividend: Dividends in Paid to Preferred Total Cash Paid to Arrears at Dividend Paid Common year-end 2015 $ 20,000 2016 28,000 2017 200,000 2018 350,000 Total: 598,000

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 4R: The following selected transactions and events occurred during 2013: a. Issued 200 shares of...

Related questions

Question

100%

![Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

York's outstanding stock consists of 80,000 shares of 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid

the following total cash dividends:

2015 total cash dividends

$ 20,000

2016 total cash dividends

28,000

200,000

350,000

2017 total cash dividends

2018 total cash dividends

References

Section Break

Use the following information for the Exercises

below.

Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred

stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F2f59d35f-0bff-4740-b78a-029b58731eac%2Fe8acf212-b980-4df9-94b3-475d430082bd%2F9ilg57i_processed.png&w=3840&q=75)

Transcribed Image Text:Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

York's outstanding stock consists of 80,000 shares of 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid

the following total cash dividends:

2015 total cash dividends

$ 20,000

2016 total cash dividends

28,000

200,000

350,000

2017 total cash dividends

2018 total cash dividends

References

Section Break

Use the following information for the Exercises

below.

Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred

stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.)

Transcribed Image Text:Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred

stock is noncumulative. (Round your "Dividend per Preferred Share" answers to 3 decimal places.)

Dividend per

Preferred

Par Value per

Number of

Preferred

Preferred

Dividend Rate

Preferred

Dividend

Share

Share

Shares

Annual Preferred Dividend:

Dividends in

Paid to

Preferred

Total Cash

Paid to

Arrears at

Dividend Paid

Common

year-end

2015

$

20,000

2016

28,000

2017

200,000

2018

350,000

Total:

598,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,