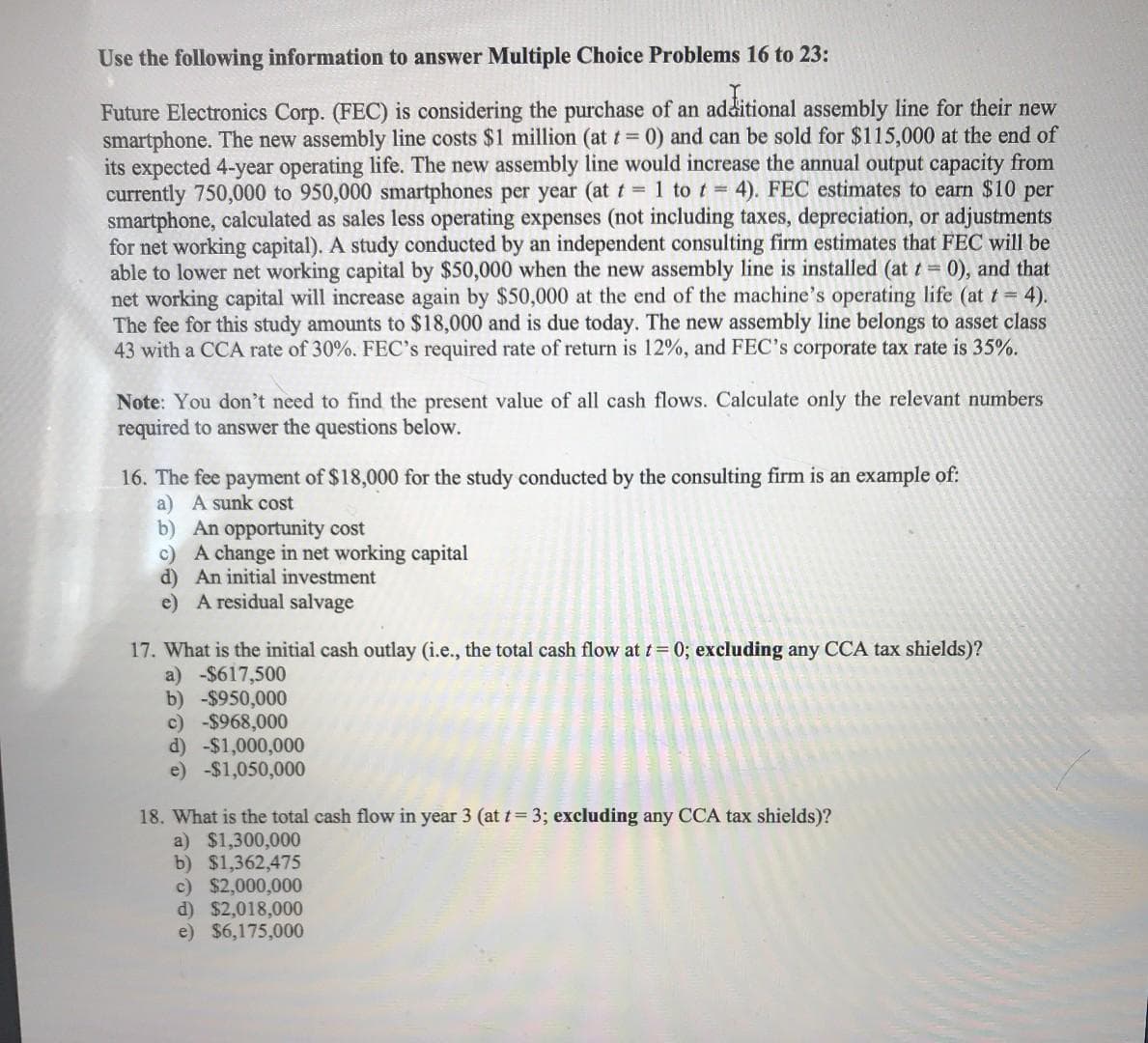

Use the following information to answer Multiple Choice Problems 16 to 23: Future Electronics Corp. (FEC) is considering the purchase of an additional assembly line for their new smartphone. The new assembly line costs $1 million (at t 0) and can be sold for $115,000 at the end of its expected 4-year operating life. The new assembly line would increase the annual output capacity from currently 750,000 to 950,000 smartphones per year (at t 1 to t 4). FEC estimates to earn $10 per smartphone, calculated as sales less operating expenses (not including taxes, depreciation, or adjustments for net working capital). A study conducted by an independent consulting firm estimates that FEC will be able to lower net working capital by $50,000 when the new assembly line is installed (at t 0), and that net working capital will increase again by $50,000 at the end of the machine's operating life (at t 4). The fee for this study amounts to $18,000 and is due today. The new assembly line belongs to asset class 43 with a CCA rate of 30%. FEC's required rate of return is 12%, and FEC's corporate tax rate is 35%. Note: You don't need to find the present value of all cash flows. Calculate only the relevant numbers required to answer the questions below. 16. The fee payment of $18,000 for the study conducted by the consulting firm is an example of: a) A sunk cost b) An opportunity cost c) A change in net working capital d) An initial investment e) A residual salvage 17. What is the initial cash outlay (i.e., the total cash flow at t= 0; excluding any CCA tax shields)? a) -$617,500 b) -$950,000 c) -$968,000 d) -$1,000,000 e) -$1,050,000 18. What is the total cash flow in year 3 (at t= 3; excluding any CCA tax shields)? a) $1,300,000 b) $1,362,475 c) $2,000,000 d) $2,018,000 e) $6,175,000

Use the following information to answer Multiple Choice Problems 16 to 23: Future Electronics Corp. (FEC) is considering the purchase of an additional assembly line for their new smartphone. The new assembly line costs $1 million (at t 0) and can be sold for $115,000 at the end of its expected 4-year operating life. The new assembly line would increase the annual output capacity from currently 750,000 to 950,000 smartphones per year (at t 1 to t 4). FEC estimates to earn $10 per smartphone, calculated as sales less operating expenses (not including taxes, depreciation, or adjustments for net working capital). A study conducted by an independent consulting firm estimates that FEC will be able to lower net working capital by $50,000 when the new assembly line is installed (at t 0), and that net working capital will increase again by $50,000 at the end of the machine's operating life (at t 4). The fee for this study amounts to $18,000 and is due today. The new assembly line belongs to asset class 43 with a CCA rate of 30%. FEC's required rate of return is 12%, and FEC's corporate tax rate is 35%. Note: You don't need to find the present value of all cash flows. Calculate only the relevant numbers required to answer the questions below. 16. The fee payment of $18,000 for the study conducted by the consulting firm is an example of: a) A sunk cost b) An opportunity cost c) A change in net working capital d) An initial investment e) A residual salvage 17. What is the initial cash outlay (i.e., the total cash flow at t= 0; excluding any CCA tax shields)? a) -$617,500 b) -$950,000 c) -$968,000 d) -$1,000,000 e) -$1,050,000 18. What is the total cash flow in year 3 (at t= 3; excluding any CCA tax shields)? a) $1,300,000 b) $1,362,475 c) $2,000,000 d) $2,018,000 e) $6,175,000

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

.

Transcribed Image Text:Use the following information to answer Multiple Choice Problems 16 to 23:

Future Electronics Corp. (FEC) is considering the purchase of an additional assembly line for their new

smartphone. The new assembly line costs $1 million (at t 0) and can be sold for $115,000 at the end of

its expected 4-year operating life. The new assembly line would increase the annual output capacity from

currently 750,000 to 950,000 smartphones per year (at t 1 tot = 4). FEC estimates to earn $10 per

smartphone, calculated as sales less operating expenses (not including taxes, depreciation, or adjustments

for net working capital). A study conducted by an independent consulting firm estimates that FEC will be

able to lower net working capital by $50,000 when the new assembly line is installed (at t= 0), and that

net working capital will increase again by $50,000 at the end of the machine's operating life (at t = 4).

The fee for this study amounts to $18,000 and is due today. The new assembly line belongs to asset class

43 with a CCA rate of 30%. FEC's required rate of return is 12%, and FEC's corporate tax rate is 35%.

Note: You don't need to find the present value of all cash flows. Calculate only the relevant numbers

required to answer the questions below.

16. The fee payment of $18,000 for the study conducted by the consulting firm is an example of:

a) A sunk cost

b) An opportunity cost

c) A change in net working capital

d) An initial investment

e) A residual salvage

17. What is the initial cash outlay (i.e., the total cash flow at t= 0; excluding any CCA tax shields)?

a) -$617,500

b) -$950,000

c) -$968,000

d) -$1,000,000

e) -$1,050,000

18. What is the total cash flow in year 3 (at t= 3; excluding any CCA tax shields)?

a) $1,300,000

b) $1,362,475

c) $2,000,000

d) $2,018,000

e) $6,175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning