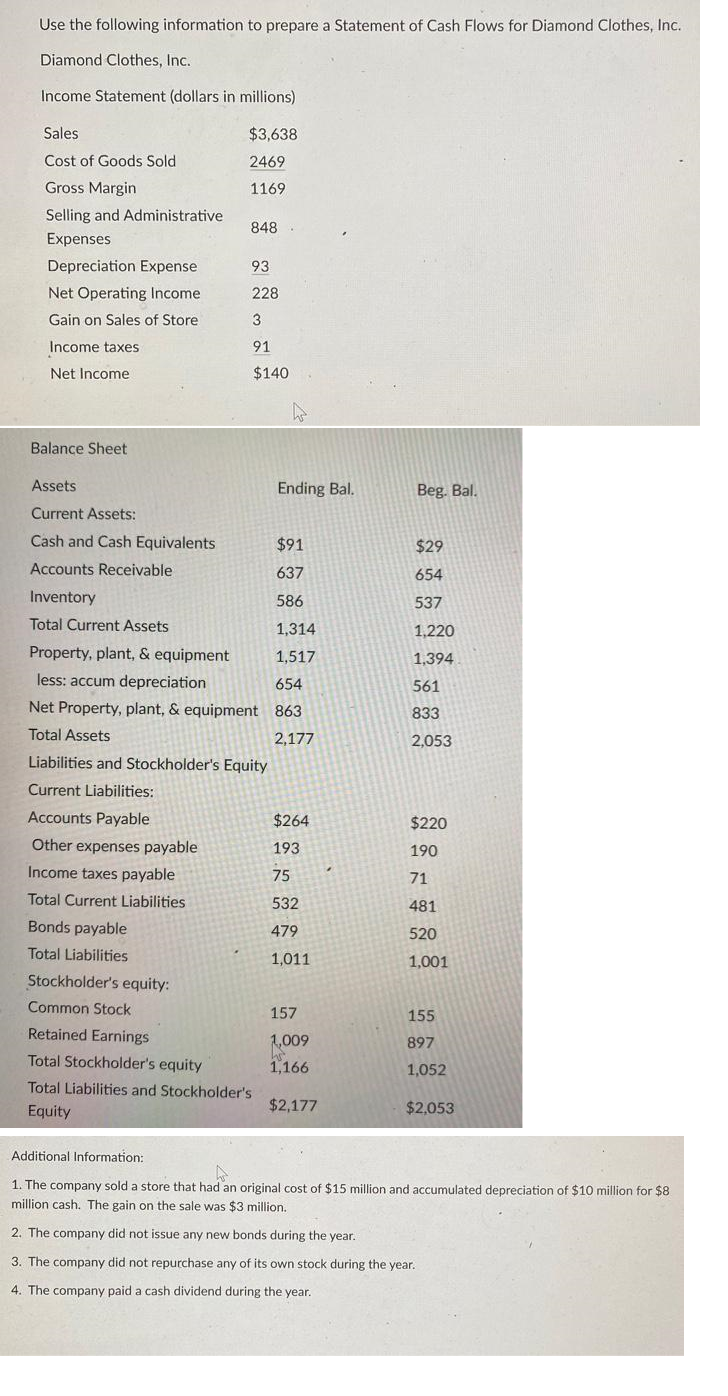

Use the following information to prepare a Statement of Cash Flows for Diamond Clothes, Inc. Diamond Clothes, Inc. Income Statement (dollars in millions)

Use the following information to prepare a Statement of Cash Flows for Diamond Clothes, Inc. Diamond Clothes, Inc. Income Statement (dollars in millions)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter16: Statement Of Cash Flows: Another Look

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Use the following information to prepare a Statement of Cash Flows for Diamond Clothes, Inc.

Diamond Clothes, Inc.

Income Statement (dollars in millions)

Sales

$3,638

Cost of Goods Sold

2469

Gross Margin

1169

Selling and Administrative

848

Expenses

Depreciation Expense

93

Net Operating Income

228

Gain on Sales of Store

3

Income taxes

91

Net Income

$140

Balance Sheet

Assets

Ending Bal.

Beg. Bal.

Current Assets:

Cash and Cash Equivalents

$91

$29

Accounts Receivable

637

654

Inventory

586

537

Total Current Assets

1,314

1,220

Property, plant, & equipment

1,517

1,394

less: accum depreciation

654

561

Net Property, plant, & equipment 863

833

Total Assets

2,177

2,053

Liabilities and Stockholder's Equity

Current Liabilities:

Accounts Payable

$264

$220

Other expenses payable

193

190

Income taxes payable

75

71

Total Current Liabilities

532

481

Bonds payable

479

520

Total Liabilities

1,011

1,001

Stockholder's equity:

Common Stock

157

155

Retained Earnings

1,009

1,166

897

Total Stockholder's equity

1,052

Total Liabilities and Stockholder's

Equity

$2,177

$2,053

Additional Information:

1. The company sold a store that had an original cost of $15 million and accumulated depreciation of $10 million for $8

million cash. The gain on the sale was $3 million.

2. The company did not issue any new bonds during the year.

3. The company did not repurchase any of its own stock during the year.

4. The company paid a cash dividend during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College