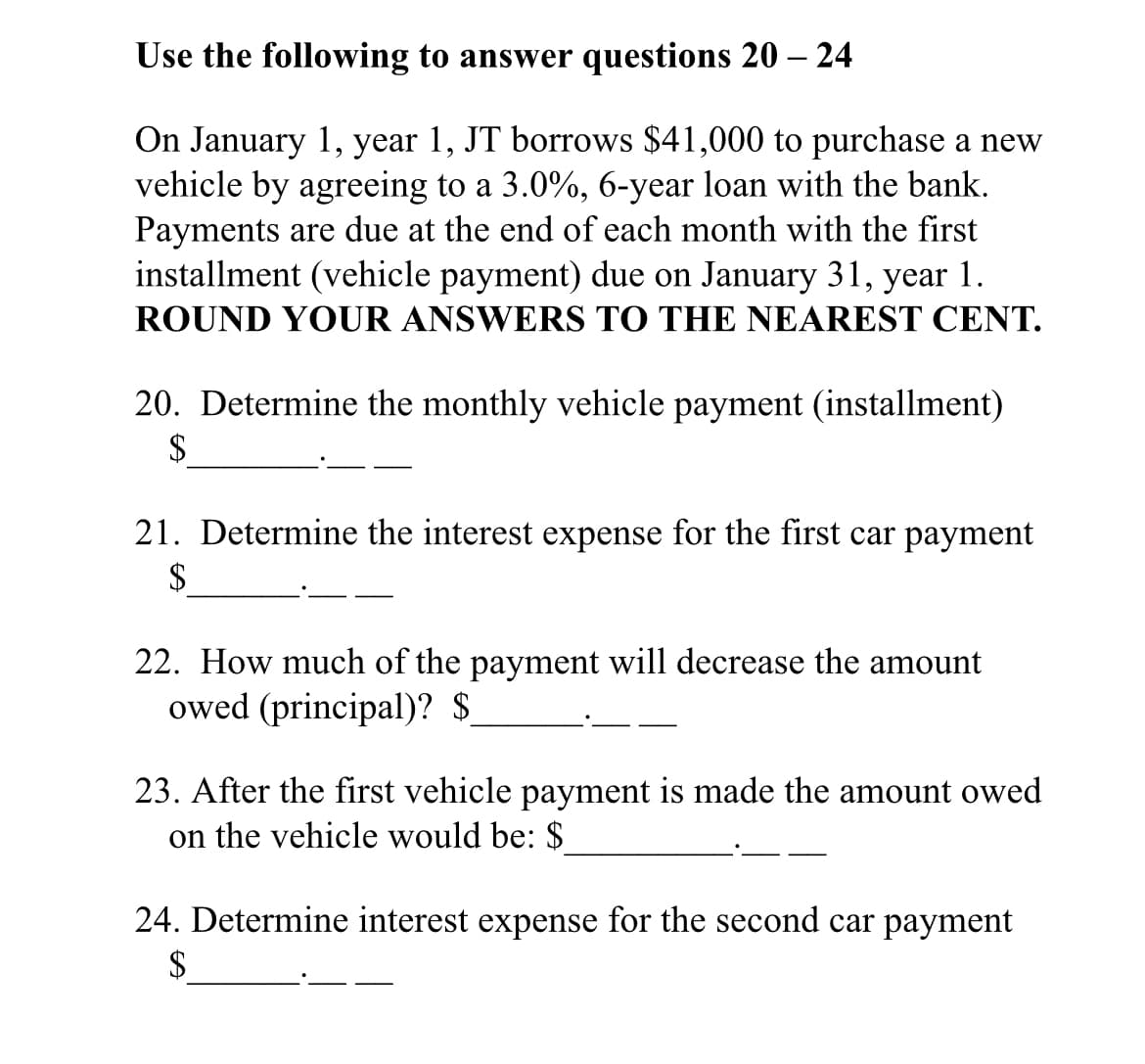

Use the following to answer questions 20 – 24 On January 1, year 1, JT borrows $41,000 to purchase a new vehicle by agreeing to a 3.0%, 6-year loan with the bank. Payments are due at the end of each month with the first installment (vehicle payment) due on January 31, year 1. ROUND YOUR ANSWERS TO THE NEAREST CENT. 20. Determine the monthly vehicle payment (installment)

Use the following to answer questions 20 – 24 On January 1, year 1, JT borrows $41,000 to purchase a new vehicle by agreeing to a 3.0%, 6-year loan with the bank. Payments are due at the end of each month with the first installment (vehicle payment) due on January 31, year 1. ROUND YOUR ANSWERS TO THE NEAREST CENT. 20. Determine the monthly vehicle payment (installment)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 85E: ExerciseInstallment Notes ABC bank loans $250,000 to Yossarian to purchase a new home. Yossarian...

Related questions

Question

Transcribed Image Text:Use the following to answer questions 20 – 24

On January 1, year 1, JT borrows $41,000 to purchase a new

vehicle by agreeing to a 3.0%, 6-year loan with the bank.

Payments are due at the end of each month with the first

installment (vehicle payment) due on January 31, year 1.

ROUND YOUR ANSWERS TO THE NEAREST CENT.

20. Determine the monthly vehicle payment (installment)

$

21. Determine the interest expense for the first car payment

$

22. How much of the payment will decrease the amount

owed (principal)? $

23. After the first vehicle payment is made the amount owed

on the vehicle would be: $

24. Determine interest expense for the second car payment

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning