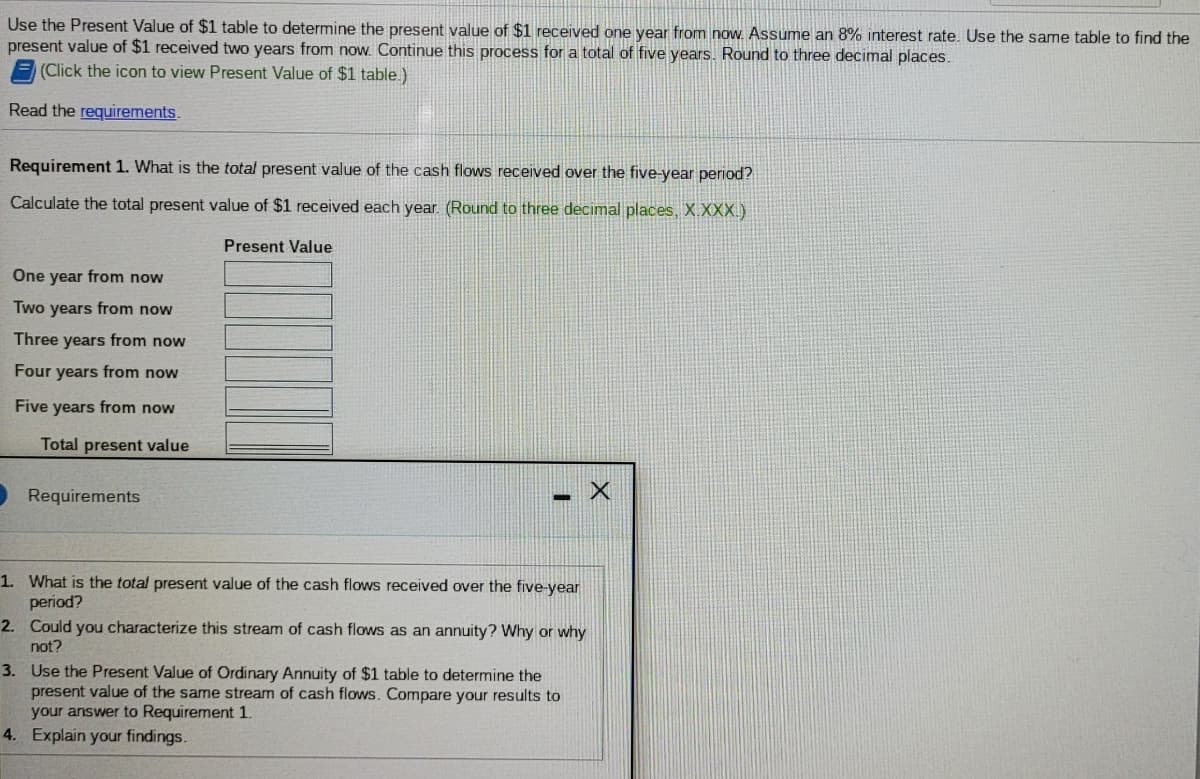

Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume an 8% interest rate. Use the same table to find the present value of $1 received two years from now. Continue this process for a total of five years. Round to three decimal places. (Click the icon to view Present Value of $1 table.) Read the requirements Requirement 1. What is the total present value of the cash flows received over the five-year period? Calculate the total present value of $1 received each year. (Round to three decimal places, X.XXX.) Present Value One year from now Two years from now Three years from now Four years from now Five years from now Total present value O Requirements 1 What is the total present value of the cash flows received over the five-year period? 2. Could you characterize this stream of cash flows as an annuity? Why or why not? 3. Use the Present Value of Ordinary Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer to Requirement 1. 4. Explain your findings.

Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume an 8% interest rate. Use the same table to find the present value of $1 received two years from now. Continue this process for a total of five years. Round to three decimal places. (Click the icon to view Present Value of $1 table.) Read the requirements Requirement 1. What is the total present value of the cash flows received over the five-year period? Calculate the total present value of $1 received each year. (Round to three decimal places, X.XXX.) Present Value One year from now Two years from now Three years from now Four years from now Five years from now Total present value O Requirements 1 What is the total present value of the cash flows received over the five-year period? 2. Could you characterize this stream of cash flows as an annuity? Why or why not? 3. Use the Present Value of Ordinary Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer to Requirement 1. 4. Explain your findings.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume an 8% interest rate. Use the same table to find the

present value of $1 received two years from now. Continue this process for a total of five years. Round to three decimal places.

(Click the icon to view Present Value of $1 table.)

Read the requirements.

Requirement 1. What is the total present value of the cash flows received over the five-year period?

Calculate the total present value of $1 received each year (Round to three decimal places, X.XXX.)

Present Value

One year from now

Two years from now

Three years from now

Four years from now

Five years from now

Total present value

Requirements

1. What is the total present value of the cash flows received over the five-year

period?

2. Could you characterize this stream of cash flows as an annuity? Why or why

not?

3. Use the Present Value of Ordinary Annuity of $1 table to determine the

present value of the same stream of cash flows. Compare your results to

your answer to Requirement 1.

4. Explain your findings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT