use. In July of 2016, the house was struck $120,000 for his personal belongings. His

use. In July of 2016, the house was struck $120,000 for his personal belongings. His

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 44P

Related questions

Question

i need the answer quickly

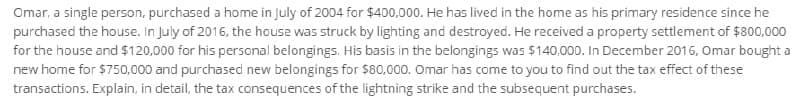

Transcribed Image Text:Omar, a single person, purchased a home in July of 2004 for $400,000. He has lived in the home as his primary residence since he

purchased the house. In July of 2016, the house was struck by lighting and destroyed. He received a property settlement of $800,000

for the house and $120,000 for his personal belongings. His basis in the belongings was $140,000. In December 2016, Omar bought a

new home for $750,000 and purchased new belongings for $80,000. Omar has come to you to find out the tax effect of these

transactions. Explain, in detail, the tax consequences of the lightning strike and the subsequent purchases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT