Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

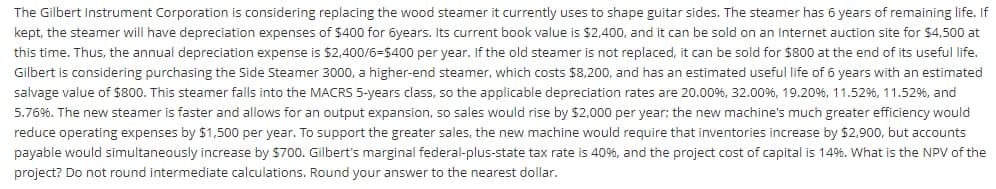

The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $400 for years. Its current book value is $2.400, and it can be sold on an Internet auction site for 54,500 at this time. Thus, the annual depreciation expense is $2.400/6=5400 per year. If the old steamer is not replaced, it can be sold for $800 at the end of its useful ife. Gilbert is considering purchasing the Side Steamer 3000, 3 higher-end steamer, which costs §8,200, and has an estimated useful Iife of 6 years with an estimated salvage value of $800. This steamer falls into the MACRS 5-years class, 50 the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year: the new machine's much greater efficiency would reduce operating expenses by §1,500 per year. To support the greater sales, the new machine would require that inventories increase by $2.900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and the project cost of capitalis 14%. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar.

Transcribed Image Text:The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If

kept, the steamer will have depreciation expenses of $400 for 6years. Its current book value is $2,400, and it can be sold on an Internet auction site for $4,500 at

this time. Thus, the annual depreciation expense is $2,400/6=$400 per year. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life.

Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $8,200, and has an estimated useful life of 6 years with an estimated

salvage value of $800. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and

5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would

reduce operating expenses by $1,500 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts

payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and the project cost of capital is 14%. What is the NPV of the

project? Do not round intermediate calculations. Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning