Using Table 6–13, create a pro forma balance sheet using the percentage of sales method. If net income next year is $50,000, answer the following: How much did the owners take out of the business? What is the profit margin for next year?

Using Table 6–13, create a pro forma balance sheet using the percentage of sales method. If net income next year is $50,000, answer the following: How much did the owners take out of the business? What is the profit margin for next year?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.9BE

Related questions

Question

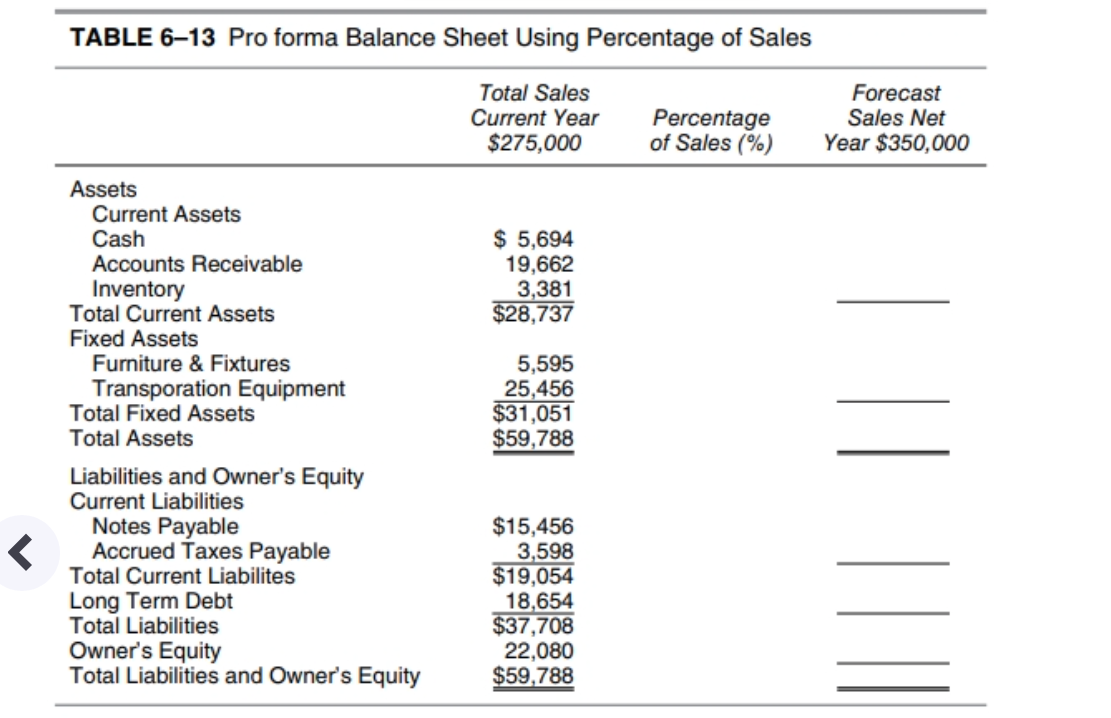

Using Table 6–13, create a pro forma balance sheet using the percentage of sales method. If net income next year is $50,000, answer the following:

- How much did the owners take out of the business?

- What is the profit margin for next year?

Transcribed Image Text:TABLE 6–13 Pro forma Balance Sheet Using Percentage of Sales

Total Sales

Current Year

$275,000

Percentage

of Sales (%)

Forecast

Sales Net

Year $350,000

Assets

Current Assets

Cash

Accounts Receivable

Inventory

Total Current Assets

Fixed Assets

Furniture & Fixtures

$ 5,694

19,662

3,381

$28,737

5,595

25,456

$31,051

$59,788

Transporation Equipment

Total Fixed Assets

Total Assets

Liabilities and Owner's Equity

Current Liabilities

Notes Payable

Accrued Taxes Payable

Total Current Liabilites

Long Term Debt

Total Liabilities

Owner's Equity

Total Liabilities and Owner's Equity

$15,456

3,598

$19,054

18,654

$37,708

22,080

$59,788

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning